Daily Comment (December 20, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Note to readers: the Daily Comment will go on holiday after today’s Comment and will return on January 3, 2022. From all of us at Confluence Investment Management, have a Merry Christmas and a Happy New Year!

Our Comment today opens with a surprising monetary tightening in Japan that has had a significant impact on global markets so far this morning. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the release of a new U.S. spending bill for 2023 that should eliminate the risk of a partial shutdown of the federal government when the current spending authorization runs out at the end of the week.

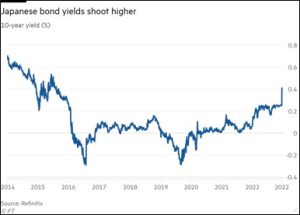

Japan: In its latest policy decision, the Bank of Japan kept its benchmark short-term interest rate unchanged at -0.5%, but then surprised investors with a hawkish change to its yield-curve-control policy. The BOJ said that it would now allow the yield on 10-year government bonds to rise as high as 0.50%, from a limit of 0.25% previously. BOJ Governor Kuroda insisted that the change was aimed only to improve the functioning of Japan’s bond market, but the move is being taken as a sign that the central bank has finally been forced to respond to rising inflation and the weak JPY.

- The decision has driven important moves in several key markets so far this morning:

- Japanese 10-year government bond yields jumped to approximately 0.40% immediately after the decision, pushing up government bond yields in many other countries as well.

- More importantly, the JPY so far this morning has strengthened some 3.1% to 132.59 per dollar, from about 137.00 per dollar before the decision.

- Japanese stock values fell approximately 2.5% on the prospect of a stronger JPY and higher borrowing rates.

- It remains to be seen whether and how aggressively Japanese monetary policy will continue to tighten. Nevertheless, the reactions to today’s BOJ move illustrate how sharply markets can move in response to a sudden unhinging of policy. For example, the market reaction suggests a similar big impact on the dollar if the Federal Reserve were to lift its target inflation rate above the current 2.0%.

China: After abandoning President Xi’s Zero-COVID policy and with a new wave of COVID-19 infections sweeping across the country and disrupting the economy, Chinese state media has taken to describing this “exit wave” as well planned and temporary. A report in the state-run China Daily today promises “normalcy by spring.”

China-Hong Kong: Securities regulators in China and Hong Kong have agreed to expand the scope of their “Stock Connect” program, under which investors can access mainland stock markets through the Hong Kong bourse. Northbound investments can now include stocks that have a market capitalization exceeding about $717 million or that meet certain liquidity criteria. Southbound investments can now include stocks of primary-listed foreign companies that are constituents of Hang Seng composite indices.

- The move will boost the number of mainland stocks eligible for trading via the northbound link to about 2,516, up from the current 1,458.

- Nevertheless, despite other recent signs that the Chinese government wants to ease tensions with the West in order to support its economy, we still believe the long-term geopolitical competition between China and the West will make it riskier and more difficult for U.S. investors to invest in China.

Russia-Ukraine War: Fighting continues along the front lines running from northeastern to southern Ukraine, while yesterday the Russians launched a new swarm of Iranian kamikaze drones against Kyiv. Ukrainian military officials believe that the Russians should only be able to launch three or four more rounds of missiles into Ukraine before they will deplete their available inventory, after which they will need to procure Iranian ballistic missiles, which Ukraine would have trouble defending against. Meanwhile, Russian President Putin traveled to Minsk yesterday but apparently failed to get President Lukashenko’s agreement to deepen Belarus’s participation in the war.

European Union: As we previewed in our Comment yesterday, EU energy ministers agreed to impose a price cap if month-ahead prices remain above €180 per megawatt hour on the bloc’s main trading hub for three consecutive days. Prices must also be at least €35 higher than a reference level for global LNG during the same period. The new rule goes into effect on February 15. One key risk with the policy is that it could prompt shippers to divert natural gas shipments to Asia or other locales where prices may be unregulated and much higher.

United States-European Union: Facing strong pushback from the EU against its new subsidies for U.S.-made green technology, the Biden administration yesterday delayed its proposed rules for new tax incentives related to electric vehicles. Details on the battery-sourcing requirements that electric vehicles must meet in order to qualify for up to $7,500 in tax credit will now be released in March, instead of by the end of this year as earlier planned.

- The delay suggests that the administration is showing some alliance-building sensitivity to EU leaders, who worry that the U.S. subsidies will hurt the EU’s green technology sector. Indeed, German Economy Minister Habeck and French Finance Minister Le Maire today issued a joint paper arguing that the U.S. and EU have a mutual interest in swiftly finding common ground on the controversy.

- All the same, it’s important to remember that the U.S. administration has encouraged the EU to adopt similar subsidies as a way to reduce their economic dependence on China.

United States-Congo-Zambia: Last week, the U.S. signed a memorandum of understanding with the Democratic Republic of Congo and Zambia to provide them with the funding and technical expertise to develop their supply chains for minerals related to electric-vehicle batteries. The move shows how the U.S. is working to reverse its disadvantage in the supply of exotic minerals needed for the electrified economy of the future.

- Importantly, the U.S. move also has important geopolitical considerations. We assess that the Congo is currently a member of the evolving China-led geopolitical bloc, while Zambia is in the “leaning China” bloc.

- The U.S. move illustrates how the U.S. and China are likely to work feverishly to peel countries out of their adversary’s blocs in order to ensure access to critical mineral supplies.

U.S. Fiscal Policy: Earlier today, congressional leaders unveiled an agreed spending bill for the remainder of the 2023 fiscal year. The bill, which must be passed and signed into law by the end of the week to avoid a partial government shutdown, includes $858 billion in military spending, or $45 billion more than President Biden had requested and up about 10% from $782 billion the prior year. It also reportedly includes $773 billion in nondefense discretionary spending, up almost 6% from $730 billion from the prior year.

U.S. Retirement Policy: The spending bill expected to be signed into law in the coming days also includes several important changes to the laws related to retirement savings. For example:

- The bill raises the age at which people are required to start withdrawing money from tax-deferred retirement accounts from 72 today to 73 beginning in 2023 and to 75 in 2033

- It also increases the catch-up contributions older workers are allowed to make to their 401(k)-style retirement accounts. In 2023, people 50 and older will be able to contribute an extra $7,500 a year to these accounts. The bill would also raise the catch-up amount to at least $11,250 a year for people 60 to 63 beginning in 2025.