Asset Allocation Bi-Weekly – Secular Trends In Bond Yields (January 30, 2023)

by the Asset Allocation Committee | PDF

[Note: The podcast that accompanies this report will be posted later this week.]

Secular trends in markets are trends that have an extended life. Their length can be different across various markets, but they are usually measured in years and sometimes decades. It is not uncommon for shorter-term trends to occur within the secular trend. But, in a secular bull market, the cyclical trends usually result in “higher highs and higher lows.” From an investing perspective, knowing what kind of secular trend is in place in a market can be quite helpful. The idea of “buying the dip” is rewarded in secular bull markets as downcycles offer buying opportunities. The opposite notion, “selling the rallies,” makes sense in secular downtrends.

What causes secular trends? Usually, it is a set of macroeconomic conditions that foster the trend. These macroeconomic conditions can include growth and inflation trends and are often bolstered by policy. Detecting reversals in secular trends is difficult[1] as history shows that often the underlying factors that supported a secular trend begin to deteriorate well before the market trend changes. Some of this extension of the trend is simple inertia, while other times, even though the underlying factors are weakening, the factors that support a new and different trend are not yet in place. Markets are often driven by narratives,[2] which can then become articles of faith to investors. If these narratives become imbedded, they can make it hard to see when conditions change. Complicating matters is that if a secular trend lasts long enough, a large number of investors may have no experience with any other type of trend. If investors lack personal experience or a foundation in history, the change in trend can be difficult to manage.

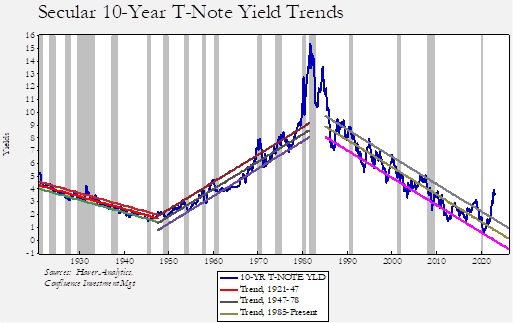

There is increasing evidence, in our opinion, that the secular downtrend in long-duration Treasury yields has ended. The chart provided shows the 10-year T-note yield since 1921. We have regressed time trends through periods when we estimate that a secular trend was in place. The bands around the trend reflect a standard error above and below the estimated trend. Over the past 102 years, we have identified three secular trends. Clearly, these trends are persistent, and when changes do occur, they definitely matter.

Clearly, it is difficult to know in real time when a secular trend has changed. Note that in 1931, there was a pop in yields that would have looked big enough to raise concerns that a secular reversal was underway. However, yields subsequently declined and the downtrend remained in place. Also, when the uptrend developed in the late 1940s, it probably wasn’t obvious that a trend change was in place for at least five years after the low in the former downtrend had occurred. The difficulty that dealers had in selling those T-notes yielding more than 15% in 1981 is legendary. Given the outsized move in yields from 1980-85, we didn’t attempt to calculate a trendline. However, after a spectacular decline in yields from the peak in the autumn of 1981 to the bottom in July 2020, it appears to us that the secular downtrend is probably over.

What changed? In our opinion, the U.S.-led hegemonic system, which began in the early 1980s but was bolstered by the end of the Cold War, has ended. There are multiple causes for the end of this system. Politically, the U.S. voting public has concluded that providing the reserve currency, which requires running persistent current account deficits, is too much of a burden. When President Obama couldn’t pass the Trans-Pacific Partnership (TPP) and the Transatlantic Trade and Investment Partnership (TTIP), it was clear that free trade and open investment, which were critical to keeping inflation under control, were in trouble. These two free trade agreements would have put the U.S. in a dominant position to control global trade. Another factor was growing political instability in the U.S., and although there are multiple facets to that instability, much of it is driven by inequality. Ending globalization and addressing inequality will almost certainly bring with it higher inflation, which will then likely lead to a rise in interest rates.

The great unknown is the pace of that expected rise. Given the long-term nature of secular cycles, there isn’t a large number of “turns” to observe. Even looking at U.K. Consol yields doesn’t offer much insight because interest rate changes were abrupt until 1825 but have tended to be much more gradual since then. We have been expecting the secular downtrend in yields to gradually shift to a steady uptrend, similar to what we saw from the late 1940s into the early 1970s. However, that assumption doesn’t have a strong theoretical underpinning. The notion of gradual shifts in trend is mostly based on Milton Friedman’s theory that investor inflation expectations are built over a lifetime, and thus, when inflation changes accelerate, investor response tends to be slow. In other words, it takes a rather long time for investors to adjust to the new inflation regime.

What worries us about the current environment for long-duration yields is that there is still a rather large cohort of baby boomers who have memories of the 1970s inflation crisis and the consequent bond bear market. It is possible that instead of a slow, steady rise in long-duration interest rates over the next decade or two, we could see a sharp increase. So far, market action seems to favor that outcome. If that is the case, the FOMC and Treasury could come into conflict. A rapid rise in long-duration yields may lead to excessive interest expenses. Although the Treasury could offset that by shortening their borrowing profile, another response could be to force the Federal Reserve to fix interest rates along the Treasury yield curve. This policy was executed during WWII and continued into the early 1950s before the Treasury/Federal Reserve Accord was established in 1951. This accord gave the Fed its independence. This process, called “yield curve control,” would prevent the secular rise in long-duration yields in Treasuries (but not necessarily in other investment-grade products) but could be catastrophic for the dollar.

Due to these risks, we have shortened duration in our fixed income allocations. So far, the long end has behaved rather well, but we think there is an elevated risk of an unexpected outcome. Usually, long-duration fixed income is a good place to be in a recession. That may be the case this time as well, but if we are in the midst of a secular change in yields, the usual rally in long duration may not occur.

[1] For our reflections on inflection points, see Reflections on Inflections, part 1 and part 2.

[2] For a good discussion on narratives and economics, see: Shiller, Robert. (2019). Narrative Economics: How Stories go Viral and Drive Economic Events. Princeton, NJ: Princeton University Press.