Daily Comment (February 3, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s Comment begins with our concerns about the market’s dovish interpretation of the remarks from the central banks. Next, we discuss why poor Q4 earnings may not lead to a weak performance in the stock market. We end the report by discussing how rising tensions with Russia and China may lead to increased defense spending in the West.

Mixed Signals: Perceived dovishness from the central banks has lifted risk assets, but more questions still need to be answered to know if the upswing will last.

- A growing number of monetary policymakers have moved away from hawkish rhetoric to favor language with greater flexibility. The three major central banks (Federal Reserve, European Central Bank, and Bank of England) have all offered timid support for automatic rate hikes over the next few meetings. The shift in rhetoric began when Fed Chair Jerome Powell proclaimed in a press conference that the disinflationary process had begun. This dovish sentiment was continued by ECB President Christine Lagarde and BOE Governor Andrew Bailey’s comments that their own subsequent hikes will be data-dependent. Despite each central bank’s acknowledgment that rate hikes are not guaranteed, they all insisted that keeping rates elevated is necessary to fight inflation.

- Relatively low-inflation countries are moving in the opposite direction. The Swiss National Bank and the Bank of Japan are expected to tighten policy this year. The decision to tighten comes as the countries are seeing an uncharacteristic rise in inflation. The Consumer Price Index (CPI) for Switzerland rose 2.7% from the prior year in December, while Japan had a 4.0% increase in the same period. Although their inflation remains below that of their peers, the sharp rise is well above the ten-year inflation experience within these countries. Therefore, some central banks may pause or cut this year, while others will still be hiking rates.

- Economic data can vary depending on the country and the circumstance. Just because inflation falls in one country does not mean that prices are decelerating everywhere. The latest surprise in the Spanish CPI demonstrates how price pressures can pop out of nowhere. The unpredictable changes in data may prevent central banks from halting their hiking cycle. January’s blockbuster 517k payroll number in the U.S. is a perfect example of how an economic surprise may suddenly shift sentiment. As a result, investors should remember that central bankers can be very fickle during times of uncertainty and should be reluctant to buy into dovish talk if they don’t want to be blindsided by unexpected rate hikes.

Risk On, Risk Off: Earnings reports have blunted some of the optimism for equities as firms pointed to headwinds felt toward the end of 2022; however, there is still a bright side.

- Poor results from major tech firms weighed on equities moments before the release of the nonfarm payroll numbers. Apple (AAPL, $150.82), Amazon (AMZN, $112.91), and Alphabet (GOOG, $107.74) reported a slump in sales toward the end of the year. A decline in consumer demand impacted sales for PCs, cell phones, and ads which weighed on investor sentiment. Some of the weak performance can be traced to macroeconomic factors such as the war in Ukraine and China’s Zero-COVID policies. However, much of the pullback in spending may be representative of households preparing for a recession. Amazon’s light-forward guidance also supports the view that firms are worried about a downturn.

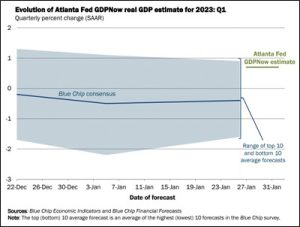

- The disappointing figures from tech companies have mirrored economic data that came out toward the end of the year. Retail sales dropped in the final two months of 2022, and industrial production sank to a nine-month low in December. Additionally, the latest Atlanta GDPNow forecast for Q1 projects a 0.7% annualized increase in economic activity, which is a sharp drop from the 2.9% rise in the final three months of 2022. The combination of earnings reports and government data both suggest that the country may be headed toward a recession sooner than many investors realize.

- That said, this recession will likely be the most telegraphed one in our history. Toward the end of 2022, retail and institutional investors increased their cash holdings to record highs. Total net assets in money market funds rose to $4.818 trillion in the week ending January 4, surpassing the previous peak set in May 2020. As a result, the market could be primed for a strong rally later in the year. Last month, equities got off to their strongest start in over four years. Similar starts have generally been a positive sign for the rest of the year, so we believe this may be a good time to look for new opportunities.

- According to Ned Davis Research, gains in January translate, on average, to about an 8.6% increase for the rest of the year.

Look At the Sky: The U.S. and China’s relations are back on the rocks, while the war in Ukraine enters a new phase.

- A surveillance balloon, suspected to be from China, threatens to undue improvement in diplomatic relations between Washington and Beijing. The spy balloon was spotted in Montana, near an area that is home to several sensitive military sites. Although Beijing claimed to be unaware of the balloon, U.S. experts are confident that it came from China. The incident comes days before U.S. Secretary of State Antony Blinken is scheduled to visit Beijing to help normalize relations between the two countries. As of this writing, the U.S. has not officially canceled the trip; however, the incident could prevent a significant breakthrough as distrust between the two sides remains elevated.

- The discovery of the balloon suggests that any rollback of export controls on semiconductors is likely off the table.

- Russian forces are regrouping along the border of Ukraine in preparation for a new offensive. Ukrainian officials have assessed that there are over 500,000 troops ready to invade the country. Due to this renewed aggression from Russia, Ukraine has asked the West to provide it with more weapons as it looks to repel Russian troops from its country. Although Western allies have increased their arms deliveries to Ukraine, it isn’t clear just how much advanced weaponry these countries are willing to dole out. Germany was hesitant to send over tanks, while President Biden is resisting calls to send over F-16s. As a result, the new spring offensive could provide the West with another test of its unity in backing Ukrainian war efforts.

- Renewed threats from Russia and China highlight the U.S. and its allies’ need to bolster defense spending. A higher level of military expenditures will allow the West to rebuild its inventory from the war in Ukraine and maintain its lead over China in its military technology. Therefore, government investment should support defense equities in the long run. Despite these stocks not having robust performance over the last few months, it is essential to remember that “defense moves in years, while equities move in seconds.” We believe that these equities are likely more attractive than the current sentiment would suggest.