Weekly Energy Update (February 16, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices appear to have based but so far have failed to break above resistance at around $80-$82 per barrel.

(Source: Barchart.com)

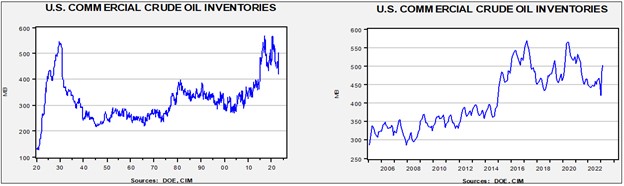

Crude oil inventories rose a whopping 16.3 mb compared to a 2.0 mb build forecast. The SPR was unchanged.

In the details, U.S. crude oil production was unchanged at 12.3 mbpd. Exports rose 0.2 mbpd, while imports declined 0.8 mbpd. Refining activity fell 1.4% to 86.5% of capacity.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

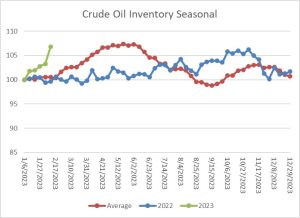

The above chart shows the seasonal pattern for crude oil inventories. We are accumulating oil inventory at a rapid pace, even without SPR sales (see below). The primary culprit is low refining activity, which should pick up later this year. The rapid rise in stockpiles, though, is a bearish factor for oil.

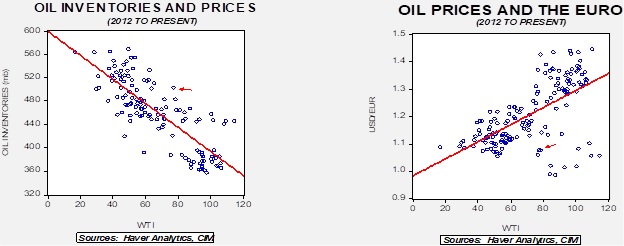

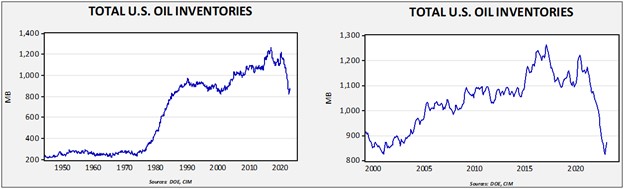

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $95.37.

The Nord Stream Issue: Seymour Hersh, a long-time investigative reporter, released a blockbuster allegation a few days ago, suggesting that the U.S., along with Norway, attacked the Nord Stream pipelines. According to his report, U.S. Navy divers from the Diving and Salvage Center based in Panama placed explosives on the pipeline and were responsible for the damage. If these allegations are true, it would create a crisis. Arguably, this action is a casus belli and could put the U.S. and NATO into a direct conflict with Russia. Although, before we take the report at face value, caution should be exercised.

Hersh is an 85-year-old investigative reporter who won a Pulitzer Prize in 1970 for uncovering the Mỹ Lai massacre. However, over the years, a good bit of his reporting has been increasingly discredited. He wrote a large piece for the London Review of Books that suggested the Obama administration’s account of the assassination of Osama bin Laden was essentially a lie. He faced strong criticism for that report, which relied heavily on unnamed sources. Later, he seemed to side with the Assad regime over chemical weapons, but the allegations he made were not entirely refuted either. Our take is that Hersh, at least at one time, was an important journalist. Over the years, though, his reporting seems to have become increasingly erratic.

As we noted, Hersh isn’t a crackpot, but likely due to his experiences in dealing with the U.S. military and intelligence agencies, he seems to have taken a position more recently that the benefit of the doubt should go to foreign interests. Thus, there is a potential bias to his reporting. At the same time, even though there is a notable lack of sourcing in the report, there are solid geopolitical reasons for the U.S. to want to end Nord Stream.

The age of oil has been difficult for Europe, mainly because the continent doesn’t have much oil of its own. Although Europe is blessed with ample coal resources, the superiority of oil as an energy source meant that without secure sources of oil, European dominance of the world was in trouble. There is a bit of production available in Romania, and of course, after oil prices spiked in the 1970s, oil was extracted from the North Sea, but Europe was never going to achieve oil and gas independence. The European powers attempted to expand their colonial reach into the Middle East and Asia to acquire oil, but those areas proved difficult to secure. The Dutch lost the oil in Southeast Asia to Japan during WWII. After WWII, when the U.S. fostered independence for European colonies, Europe lost controlled access to oil in North Africa and the Middle East. Until the early 1970s, Europe was mostly dependent on the U.S. for oil. Not wanting to be fully dependent on Washington for energy, Europe, and especially Germany, turned to Russia. Naturally, this reliance on Russia wasn’t popular with the U.S. Consistently, American administrations criticized Europe for its increasing reliance on Russia oil and gas. The Nord Stream projects were especially galling because they directly linked Russia to Germany.

Thus, the destruction of the pipelines is arguably in American interests. That’s why this narrative will likely be hard to quash, even if the Hersh reporting is false. It is natural to assume that if a party benefits from an event it might have had a role in causing it. However, that is about as far as this goes. It is quite possible that Hersh received this information from someone that would also benefit from increased tensions between the U.S. and Russia. And since no sources are named, it may be impossible to really prove anything.

We will continue to monitor developments and reporting around this issue. We doubt that we will see anything definitive on this in the near term, so the most likely outcome is that it won’t cause an escalation directly involving the U.S. and NATO against Russia. But we could see “tit-for-tat” actions, such as sabotage of LNG facilities, cutting of fiber optic cables, etc.

Market News:

- The big news this week, although maybe it shouldn’t be, is that the U.S. will sell an additional 26 mb out of the SPR. This sale was previously mandated by Congress. Over the past couple of decades, Congress has, on occasion, used the SPR as sort of a “slush fund” to address budget issues that couldn’t be met with taxes or by borrowing. This is a rather small sale given the scale of recent withdrawals, but the market didn’t take the news well by selling on fears of further sales from the reserve. In fact, the administration considered canceling the sale, but doing so would have required an act of Congress, probably difficult to do in the current environment. We don’t think this sale matters all that much, but our Twitter feed lit up with all sorts of commentary about how irresponsible the SPR sales were, and “look, they are at it again.” We don’t disagree about the risks from earlier sales, but this one isn’t all that big of a deal.

- The IEA is forecasting oil demand will reach a new high this year due to China’s reopening.

- In response to the G-7 price cap, Russia announced a 0.5 mbpd oil production cut. There are two concerns beyond the obvious one that this action will lift prices. The first is that Russia may not be making this cut voluntarily but is finding that demand for its oil is falling. Announcing a cut may be a measure to save face. Second, cutting production is always a risky idea because once a well is shut in, in a short amount of time that production is lost without having to redrill. Complicating matters further is that Russia was dependent on Western expertise to drill and maintain technically difficult oil fields. Sanctions and disinvestment may lead to further output losses. Oil prices initially rose on the report but failed to hold gains. Oil markets are most likely worried about global recession weakening demand rather than the loss of supply.

- As the Russia Urals discount widens, the Duma is considering legislation to limit the discount. If put into practice, it would likely lead to a lower supply. There are reports suggesting that Russia’s discounts may be worse than the official price spreads indicate.

- China is working on an LNG deal with Qatar. As Qatar develops its North Field, it is apparently looking for long-term contracts to finance the development.

- Although Freeport began exporting LNG this week, regulators report that the plant has systemic safety concerns.

- The U.S. natural gas market is dealing with increased demand, especially from LNG, and rising production. However, inventory capacity is mostly fixed, meaning that price volatility is rising. Complicating matters is that most U.S. inventory facilities are depleted gas wells where, to maintain integrity, gas is injected and withdrawn at a mostly steady pace. This factor leads to a seasonal pattern of storage where gas is injected from April to October and withdrawn from November to March. Storage seasonality is why price lows usually occur in January; however, if temperatures are moderate, stored gas must still come to market. Exports come with their own set of difficulties. Although European gas prices have declined due to mild temperatures, once the European refill season begins, export demand will likely increase. Volatile natural gas prices will make planning difficult and could increase volatility for fertilizer and chemical prices as well.

- We are hearing of increasing concern over the future production from the Permian Basin. In some respects, this is nothing new. A few years ago, some analysts were sounding the alarm that drilling practices were damaging reservoirs. Now, firms operating in the region are considering consolidation which is rational if production has peaked.

- A growing number of long-term forecasts suggest that U.S. oil demand may be close to peaking. If true, the case for investing in future production would be hard to make. At the same time, the lack of refining investment could lead to strong margins for the foreseeable future.

- A warming trend over the Arctic may bring much colder temperatures to Europe and North America. If it persists, it could lead to a cold spring which could delay crop planting.

Geopolitical News:

- Iran’s President Raisi is visiting China this week after being invited to Beijing by President Xi. This is the first visit to China by an Iranian president in more than two decades. China and Iran have been increasing ties in recent years. China has been willing to break with sanctions on Iran by purchasing Iranian oil (although at discounts). China’s willingness to refuse to cooperate with U.S. sanctions has led to China becoming Iran’s largest trading partner. China and Iran have a 25-year cooperation agreement, although little of the arrangement has been implemented so far. We suspect Iran was keen to meet with Xi in the aftermath of the Chinese president’s recent visit to Riyadh. Iran and Saudi Arabia have been at loggerheads since the Iranian revolution and, even before the revolution, both countries vied to dominate the Middle East. Iran was likely concerned about China’s wooing the Saudis, even proposing to price oil in CNY. China has also recently sided with the UAE on a five-decade dispute over three islands in the Persian Gulf that Iran seized after the British had left the region. China is likely to find that managing relations in the Middle East is difficult as there are age old rivalries in play and showing favor to one party can infuriate another.

Alternative Energy/Policy News:

- Ford (F, $13.07) has announced a $3.5 billion battery plant in Michigan. Stimulating such investments was a goal of the Inflation Reduction Act. However, there is a complication. Ford intends to license the battery technology from Contemporary Amperex Technology (CATL, CNY, 451.05), a Chinese company. The plant will be a wholly owned subsidiary of the U.S. automaker and will create 2,500 jobs. The licensing of Chinese battery technology, though, is quite controversial. Ford was considering building the plant in Virginia, but Governor Youngkin withdrew his state’s bid due to the connection to China.

- To a great extent, Ford’s decision to license a Chinese company’s technology is an example of the difference between the business class and the political class when it comes to China. In simple terms, opposition to China is perhaps the only bipartisan issue. No politician wants to be outflanked or seen as being “soft” on China. On the other hand, business interests continue to want to work with China and take advantage of their manufacturing prowess.

- Recently, China appeared to be working hard to improve commercial relations. The balloon controversy has scotched that effort and will make business interests wanting to work with China more difficult.

- Although EVs continue to dominate the news, fuel cell/hydrogen vehicles remain a potential competitor. Using hydrogen would avoid the range concern which plagues EVs, but the problem is that the hydrogen is derived from fossil fuels and isn’t all that environmentally friendly. There is a whole “color coding” system for hydrogen, and oil firms are pressing regulators for more open rules on “green” hydrogen to capture tax credits. However, the determination of what qualifies various colors of hydrogen remains controversial.

- The search for EV metals is leading to the Arctic. The U.S. has even appointed an ambassador to the region.

- Electric car trips of any distance require careful planning. This account shows just how much planning is required.

- Commodity markets are notorious for boom/bust cycles. Although the long-term outlook for EV metals is favorable, we are seeing increasing inventories which could lead to a period of price retrenchment. China’s solar sector is facing issues of overcapacity as well.

- Saudi Arabia is launching a domestic EV industry in part to reduce its own demand for oil to allow for greater exports. Indonesia, a major nickel producer, is considering developing a battery industry.

- China’s wind and solar industry generates enough electricity to meet its household demand.