Weekly Energy Update (February 23, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil remains in a trading range between $72-$82 per barrel.

(Source: Barchart.com)

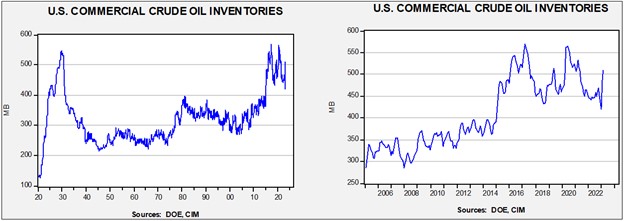

Crude oil inventories rose 7.6 mb compared to a 2.0 mb build forecast. The SPR was unchanged.

In the details, U.S. crude oil production was unchanged at 12.3 mbpd. Exports rose 1.5 mbpd, while imports rose 0.1 mbpd. Refining activity fell 0.6% to 85.9% of capacity.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

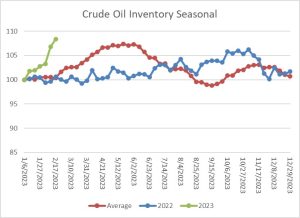

The above chart shows the seasonal pattern for crude oil inventories. We are accumulating oil inventory at a rapid pace, even without SPR sales. The primary culprit is low refining activity, which should pick up later this year. The rapid rise in stockpiles, though, is a bearish factor for oil, and current stockpiles have already exceeded the five-year average peak normally seen in early summer.

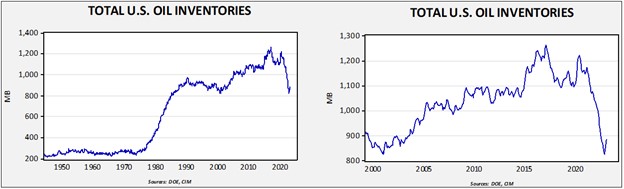

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

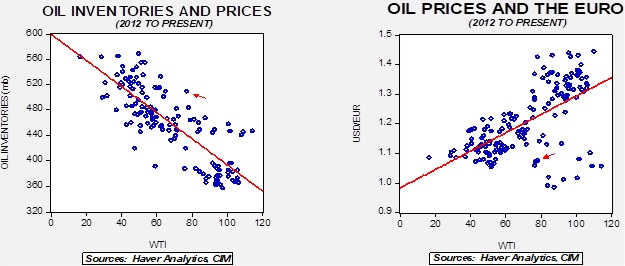

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $94.35.

Market News:

- Environmentalists have been using the courts to prevent oil companies from building pipelines, effectively bottling up supplies. Canadian oil and gas from Alberta have been especially vulnerable to transportation issues. The most logical direction of travel would be south into the U.S., but pipeline capacity issues around the Keystone pipeline limit exports. Attempts to expand the pipeline have been thwarted by regulators. In response, oil interests in Alberta are looking to use rail to expand sales into the U.S. While there is some interest, the recent tragedy in Ohio may present some opposition to this expansion.

- Pipelines to Corpus Christi are reaching capacity, which could cap U.S. oil exports.

- Oil companies are increasingly caught between the pressure to increase output and environmentalists attempting to reduce oil and gas supplies. Overall, this situation will increase costs and will likely reduce supply.

- Natural gas prices have had an epic decline over the past several months. High prices in the wake of the war in Ukraine have led to reduced demand and have moderately increased supply. However, a mild winter reduced seasonal demand and the need to reduce storage has caused a sharp drop in prices.[1] The EU’s natural gas consumption fell 19.3% in the period from August 2022 to January 2023 as compared to the same period last year. Price signals matter, and we note there are reports of reduced gas drilling in the U.S.

- The IEA warns that the current low prices for natural gas do not necessarily mean that supply problems won’t emerge in Europe later this year. EU inventories will be elevated going into the spring when inventory injections begin. Nevertheless, high stock levels at the end of winter won’t necessarily guarantee ample supplies for next winter.

- Heat pump sales in Europe are rising rapidly. Although heat pumps are not necessarily ideal for very cold temps, they do reduce heating demands under normal circumstances.

- Analysts are becoming increasingly worried that the world’s remaining oil reserves will be of lower quality, requiring higher levels of investment to produce usable oil. If so, this means that costs will rise which will likely lead to higher prices.

- Although Saudi Arabia continues to post optimistic demand forecasts for oil, the lack of investment suggests that the country doesn’t believe its own estimates.

- One behavior that we often see when supply concerns rise is hoarding. Nations with a key commodity or product will restrict exports to keep prices low in the home country. This is something of a dubious policy since export controls often lead to underinvestment and lower supplies over time. It can also increase smuggling in an attempt to arbitrage the usually higher prices abroad. However, just because a practice doesn’t always yield optimal results doesn’t prevent it from happening. We note that Australia is considering export caps on natural gas, and if this occurs, it could trigger panic buying by consumers who would lose access to this product and drive the prices even higher.

- A subcontractor to the CFTC that provides the commitment of traders’ data was hacked; the report has been delayed.

Geopolitical News:

- Although the war in Ukraine and subsequent sanctions have not ended Russia’s oil and gas sales, it has caused serious disruptions to trade flows. Natural gas flows from Russia to Europe have been curtailed. Russian oil shipments are increasingly flowing to Asia, and especially China. Increased Russian oil sales to Asia are affecting Middle East oil sales to the region, putting the two oil regions into competition for market share. Despite increased flows from Russia, China continues to show interest in Middle Eastern We commented last week that the Iranian president traveled to Beijing to solidify relations, and China is also attempting to acquire Iraqi oil. However, China remains a significant buyer of Russian crude oil as well. We also note that China usually buys Russian oil at deep discounts.

- Kazakhstan is starting to export crude oil to Germany through the Druzhba pipeline which is owned by Russia. Technically, this oil isn’t under sanction, but it may be difficult to prevent Russian oil from being sold to Europe under the guise of Kazak oil.

- Essentially, we are moving away from a global oil and gas market to one with regional divisions. Commodity markets adapt, but the way markets are dividing is less efficient.

- The recent uproar over the Chinese spy balloon has raised questions about how well the CPC actually controls its companies and bureaucracy. In this vein, we note that Chinese officials are talking to refiners, both state-owned and private sector firms, about their oil purchases from Russia. It is unclear exactly what the government is trying to discover, but it is likely that Beijing doesn’t want to get surprised by news of Russian purchases.

- China is easing its import ban on Australian coal. The ban was initially implemented when Australia supported an international investigation into the origins of COVID-19. The ban is being lifted now that COVID has fallen from the news and China needs coal.

- Dutch intelligence is warning that Russia is targeting energy and internet infrastructure. Reports suggest the Russians are likely to use espionage to disrupt energy and data flows.

- The IAEA has indicated that Iran has enriched uranium to 84%, just under the 90% required for nuclear weapons. This level would suggest Iran is at the nuclear threshold, but, so far, there have not been any reactions to this news. Israel has indicated in the past that it views a nuclear-armed Iran as an existential threat, so this news could trigger a strong response from Israel. We note Iran has disputed the IAEA’s report as we suspect that the country does not want this news to become public.

- An Iranian drone has struck an Israeli-owned tanker in the Arabian Sea.

Alternative Energy/Policy News:

- One of the elements of the Reagan/Thatcher revolution was the discreditation of industrial policy. The idea that government could “pick winners and losers” seemed doomed to fail. The collapse of communism, which epitomized planned economies, further undermined industrial policy. However, as geopolitics is increasingly affecting economics, industrial policy is returning. The Inflation Reduction Act’s provisions to support the buildout of green energy is a clear example of industrial policy.

- Tesla (TSLA, $198.39) has cut prices to such an extent that the Model 3 is now the cheapest new car in America.

- The IEA is pressing governments to tighten rules on methane emissions. Methane is a greenhouse gas, and although it doesn’t last long in the atmosphere, it is much more potent than carbon dioxide. Tightening these rules will add costs to oil and gas exploration and development, which will likely lead to lower production.

- Rare earths are critical in the transition away from fossil fuels. EVs and wind turbines use these minerals, and they are also part of certain tech products such as smart phones. China is not only the world’s leading miner of rare earths, but it also dominates ore processing. The U.S. has reopened a rare earths mine in Mountain Pass, CA, but has exported the ore to China for processing in the past. Japan has built a processing plant and the U.S. has decided to move away from China and export the ore to Japan, further evidence that the U.S. is delinking from China.

- Battery technology really doesn’t work well for semitrailers. The need for power is great, and the battery weight becomes prohibitive. There are some efforts to use hybrid technology (going downhill with a semitrailer can generate significant power), but it’s hard to replace diesel. However, fuel cells and hydrogen may be a better alternative over the long term.

- On the subject of batteries, for stationary needs, such as utilities, gravity storage may become a solution.

- The U.S. is expanding its charging network, and U.S. regulations are requiring the installations to be U.S. made, riling trading partners.

- Mexico is planning to nationalize its lithium reserves. Bolivia is wooing China to help it develop its lithium industry. Bolivia has the world’s largest lithium reserves but doesn’t register as a producer due to years of government mismanagement. Although China has the wherewithal to build Bolivia’s industry, the infringement on sovereignty will be a problem.

- Chinese lithium prices are down 30% due to falling demand for EVs.

- China is continuing to expand its solar capacity.

- China’s leading EV producer BYD (BYDDY, $57.03) is now exporting and selling cars in Germany.

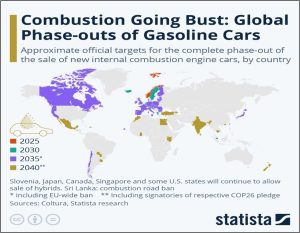

- For those keeping score, the map below shows the nations (and states) that have target dates to phase out the sale of internal combustion engines. Automakers remain divided on how fast EVs will replace gasoline-powered cars.

[1] Most natural gas storage is housed in depleted wells. To maintain well integrity, gas must be injected and withdrawn at a steady pace. During mild winters, current production and required storage withdrawals tend to cause significant price weakness.