Daily Comment (March 16, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment starts with a discussion about the latest development in the ongoing banking turmoil. Next, we give our thoughts about the path for future central bank policy. Lastly, we review other market movement news.

On the Horizon: If Silicon Valley Bank (SIVB, $106.08) was the opening shot, then Credit Suisse (CS, $2.25) is the bazooka igniting concern about the global banking system.

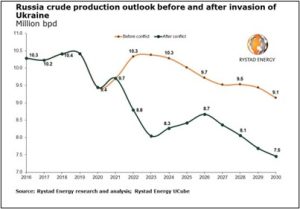

- America’s six largest banks have lost a total of $183 billion in market value since February 1. The market rout started when Silicon Valley Bank was forced to offload its bond holdings at a loss of $1.9 billion and worsened after Credit Suisse’s largest shareholder, Saudi National Bank (1180, SAR, 41.50), refused to offer more capital. These events are not inter-related, but their timing has led investors to reevaluate their exposure to financial services companies. Although the Fed’s backstops helped alleviate the problems associated with SVB, the Treasury Department is actively reviewing the U.S. financial sector’s exposure to Credit Suisse.

- Credit Suisse remains the biggest problem for markets currently. The bank’s funding costs have become so high that some analysts believe that it will either need a capital injection or a breakup. Unlike Silicon Valley Bank, Credit Suisse has the liquidity to handle a significant outflow of deposits and has access to central bank facilities in multiple countries. Its problem lies with its profitability. Morningstar analyst Johann Scholtz estimates that the bank will lose $2.2 billion in 2023 and could maintain those losses going into 2024. Despite the bank’s bond being rated as investment-grade, on Wednesday it was trading at distress levels due to concerns that the bank could fail without outside financial support.

- While the bank may be too big to fail, it is unclear who will save it. The potential collapse of Credit Suisse has been known since October 2022. Economist Nouriel Roubini went as far as to claim that the bank is “too big to be saved.” Additionally, merger and acquisition options remain limited as major banks debate the price that they would be willing to pay for the struggling institution. Wednesday’s announcement that Credit Suisse will borrow up to 50 billion CHF ($54 billion) to purchase shares has calmed markets, but the bank is far from being out of the woods.

- In more unwanted news, First Republic Bank (FRC, $31.16) is expected to make a sale after S&P Global Ratings and Fitch Ratings cut its debt to junk status.

Other Central Banks: The backstops provided by the Federal Reserve and Swiss National Bank have alleviated concerns but have also complicated the central banks’ efforts to combat inflation.

- The European Central Bank reluctantly raised rates by 50 bps in its policy meeting today and signaled that it would be paying closer attention to the market going forward. In their statement, policymakers emphasized that they will be monitoring inflation pressures and financial stability. The move suggests that the bank may feel confident that the Credit Suisse issue will not have significant spillover effects. Its lack of guidance indicates that the central bank does not want to lock itself into a decision currently.

- Despite the ECB rate move, the Federal Reserve’s decision to raise rates is still very complicated. Federal Reserve Chair Jerome Powell has put himself in a bind. During his testimony before Congress, Powell emphasized that the cost of failing to restore price stability will exceed the cost of success. Now that we have had two bank scares in less than a week, his words may come back to bite him. Over the last few weeks, Fed officials have assured markets that they were determined to bring down inflation at all costs, but the market now believes their fight is close to an end. Fed futures contracts, at the time of this writing, are signaling that the Fed will likely raise rates by 25 bps at next week’s meeting, and may be more cautious moving forward.

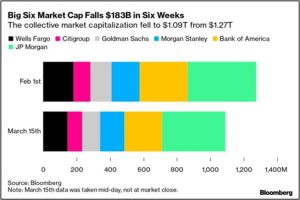

- That said, talk of “disinflationary shock” may be enough for central banks to be less aggressive going forward. The belief is that the ongoing banking crisis could encourage banks to pull back on lending. If true, it would be mean that a recession is much closer than policymakers realize. We have noticed that recent events have made trading government securities’ more difficult as banks look to shore up their cash positions for emergency situations. The Bloomberg Government Liquidity Index, which increases as bonds become less tradable, shows that government securities illiquidity from Japan (gray), the U.K. (orange), and the U.S. (blue) have risen to levels not seen since the start of the pandemic.

U.S. – International Relations: While the market is focused on banks, it is missing other important stories abroad.

- TikTok is under increased pressure to distance itself from China. The Biden administration has threatened to ban the Beijing-based social media site from the United States if Chinese owners don’t sell their stake in the company. The warning comes amidst rising tensions and growing distrust between the world’s two largest economies. The move helped support Snap Inc. (SNAP, $10.48) and Meta (META, $197.50) shares, but is likely to signal further decoupling between the two major powers.

- Meanwhile, tensions between Russia and the U.S. continue to escalate. The Pentagon released footage of the surveillance drone that crashed into the Black Sea. The video showed that a Russian fighter jet had dumped fuel on it and the U.S. military claimed that another jet collided with the drone. Both sides have blamed the other for the downed drone and accused the other of taking more aggressive behavior over the Black Sea. At this time, there do not appear to be calls for retaliation from the U.S., but the incident suggests that there is a heightened risk of direct confrontation between the two countries.

- Iran agreed to stop sending military weapons to the Houthis in Yemen as part of its pact with Saudi Arabia. The two countries had taken opposite sides of the conflict in Yemen. As a result, the Chinese-brokered deal may pave the way for the Houthi rebels to come to the negotiating table for peace talks. The arrangement reinforces the view that China is pivoting its foreign policy toward the Middle East as it looks to prevent being ever dependent on the U.S. for resources.

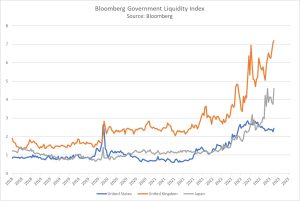

- Although China has relied heavily on Russia for its oil needs, there is a concern that Russian crude production will fall in the coming years due to a lack of investment related to Western sanctions.