Weekly Energy Update (March 23, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil decisively broke its recent $72-$82 per barrel trading range. Problems in the banking sector are raising fears of a global economic slowdown. Classic technical analysis would suggest that the former support at $72 will become resistance; in other words, this level will need to be overcome if prices are going to rise.

(Source: Barchart.com)

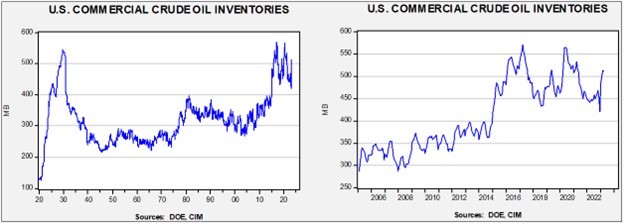

Crude oil inventories rose 1.1 mb compared to a forecast of a 1.8 mb draw. The SPR was unchanged.

In the details, U.S. crude oil production rose 0.1 mbpd to 12.3 mbpd. Exports fell 0.1 mbpd, while imports were steady. Refining activity rose 0.4% to 88.6% of capacity.

(Sources: DOE, CIM)

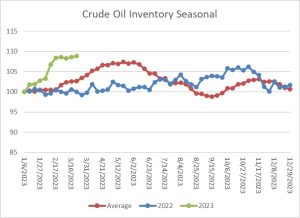

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections have slowed. Levels remain above seasonal norms, but with refinery activity starting to ramp up for summer, we should see some declines in the coming weeks.

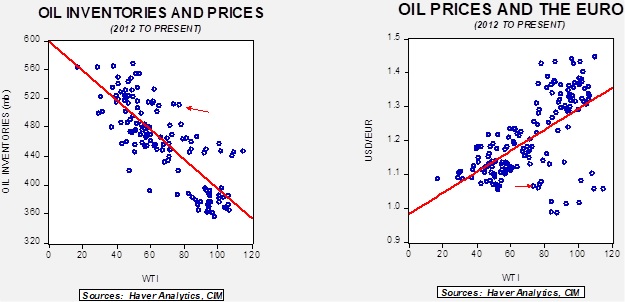

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $51.90. Although we think there is enough geopolitical risk in the world to prevent a decline to this level, it does suggest that the oil market is dealing with rather weak fundamentals.

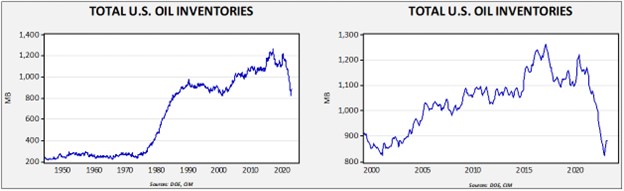

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $92.66.

Market News:

- Weaker oil prices appear to be mostly due to fears of a global recession. So far, OPEC+ has decided not to reduce supplies in response. This may be due to the cartel expecting slower production growth worldwide. We note that the Joint Organisations Data Initiative, a group of oil producers and data providers, reported that global oil output fell 0.4 mbpd in January.

- Last year, the U.S. exported a record amount of petroleum products.

- The EIA is projecting mostly flat U.S. oil production in the coming years, which suggests that there won’t be significant growth in shale production.

- One of the behaviors we have been monitoring is hoarding. As supply security comes into question, consumers at all levels attempt to secure extra inventory. At the national level, export restrictions are one common practice. India is currently capping product exports to keep domestic prices down, while China is reportedly continuing to build crude oil inventories.

- Although Europe escaped high natural gas prices this winter due to warm temperatures, German regulators warn that next winter could bring a crisis. We do note that U.S. gasification investment is rising rapidly.

- U.S. refineries have been structured to produce more gasoline than other products, but as the fuel mix changes due to EVs, the industry is beginning to shift the focus toward diesel.

Geopolitical News:

- Last week, we discussed the Iranian/Saudi détente. Already, we are seeing the effects from the agreement. Iran announced that it will stop supplying arms to the Houthis, and Saudi Arabia has opened up talks with Houthi groups with the likely goal of ending hostilities. Although negotiations with the Houthis will be difficult, we do expect a peace deal to eventually emerge.

- As we reported last week, Iran is moving quickly to bolster relations with other Arab states. We note that Iran has secured a new accord with Iraq in the wake of the Saudi talks.

- There are reports that Iranian President Raisi and MBS may have an official visit, providing further evidence of improving relations between the two countries.

- Also, EU diplomats have been meeting with their Iranian counterparts. The EU would like to see Iranian sanctions eased so Europe can import more Iranian crude oil.

- Although the oil price cap on Russia has mostly disappeared from Western news, it remains on the minds of oil producers. Russia and the Kingdom of Saudi Arabia (KSA) conducted talks last week and the price cap on Russian oil was a topic of discussion. Although there hasn’t been anything in the Western media about expanding the cap, the Saudis are clearly worried that it might be applied to other oil producers.

- Interestingly enough, although the price cap may or may not be to blame for reducing Russian oil revenue (falling prices for everyone might be doing the trick), oil exports are continuing mostly due to some oil traders who are willing to facilitate the trade. However, we are noting that Russian oil is struggling to find a home, in part because it can only sell directly to nations willing to ignore Western sanctions. Russia is both changing its benchmark for crude oil exports and the tax regime in order to capture more revenue.

- Oil trading firms are suggesting they would handle more Russian crude oil if Western governments had clear rules for the trade. The West really doesn’t want Russian crude oil sales to stop (the world needs Russian oil), but they want to reduce the revenue coming from Russian oil sales.

- Russia is now the largest oil supplier to China. In the past, the KSA took aggressive steps to maintain its market share in the U.S.; for example, when the KSA’s rank fell below second, it tended to boost output which lowered prices. It will be interesting to see how Riyadh reacts if this condition continues.

- Despite reports of oil sales above the price cap, the U.S. is arguing that the all-in costs are below the $60 target.

- We note that rising Chinese oil demand is pushing shipping costs higher.

- President Xi was in Russia this week. Although his meetings with President Putin were mostly on Ukraine and expressions of friendship, we note that China has been “slow walking” the expansion of natural gas pipelines that would supply piped gas to China. It is unclear why Xi is uncomfortable with expanding Russian gas sales, but it might be that Beijing doesn’t want to trigger sanctions. It is worth remembering, though, that Russia and China have had hostile relations in the past, and therefore, China may be worried about becoming overly dependent on Russia for energy supplies.

- Due to a spat over COVID origins, China had stopped buying coal from Australia. As relations with Australia improve, China has now begun to aggressively buy coal.

- There have been a series of military/security helicopter crashes in the Kurdish region of Iraq. Although it is difficult to know what exactly is happening, it has all the hallmarks of an internal squabble between Kurdish groups. One of the reasons a Kurdish state doesn’t exist is that the Kurds themselves are not unified. If these tensions continue to rise, it could adversely impact oil production in the region.

- The Venezuelan oil minister has resigned on suspicions of corruption.

Alternative Energy/Policy News:

- China’s $7.8 billion battery plant in Hungary, supported by the Orbán government, is facing strong local opposition. Meanwhile, South Korea is implementing a $35 billion battery investment program in an effort to catch up with China.

- Europe is taking steps to revive mining to reduce its reliance on Chinese EV materials. Over the past 40 years, raw material production has shifted to developing economies since the developed economies have shunned these activities for either cost or environmental reasons. However, as supply risks rise, there has been a renewed effort to find more reliable sources of these products. The U.S. is engaging in similar efforts.

- We note that Glencore (GLNCY, $10.91) is no longer the largest cobalt miner, losing that rank to China’s CMOC (603993, CNY, 5.70).

- We have been monitoring geoengineering for several years. Geoengineering can take many forms, but essentially it involves using various techniques to directly affect temperature or the climate. The practice is controversial as there are concerns that a private actor could deploy a measure that could have adverse effects on some parties who then have little recourse to respond. Unintended consequences could result. MIT has reported that the U.K. performed an experiment with a geoengineering delivery system that had limited oversight.

- General Electric (GE, $91.96) announced it is moving from prototype to demonstration scale for its direct carbon capture technology. Direct carbon capture will likely be needed to contain greenhouse gases.

- It should be noted that once this CO2 is captured, it must go somewhere. One method of dealing with the gas is to inject it into underground storage. Not surprisingly, the communities involved, either where the gas gets injected or near the pipelines carrying it, are concerned. Another way, although more costly, is to capture the gas in bricks.

- There is growing interest in using geothermal power as a battery.

- A surge in lithium production has led to lower costs for EV producers. Although lithium demand remains strong, prices have been falling since January.

- ESG investing has become controversial. Blackrock (BLK, $638.57) is attempting to manage the competing sides of the debate.