Daily Comment (March 27, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the U.S. and European banking crises. Fortunately, it is looking more and more like the crises are dissipating for now, although we remain cautious about any other stresses in the financial system because of the central banks’ continuing interest-rate hikes. We next review a range of other international and U.S. developments with the potential to affect the financial markets today, including signs that U.K.-style mass strikes for higher pay are spreading to Germany and an outbreak of major political protests in Israel.

U.S. Banking Crisis: Earlier today, the Federal Deposit Insurance Corporation announced that First Citizens Bancshares (FCNCB, $550.00) had agreed to acquire the deposits, loans, and branches of failed Silicon Valley Bank (SIVB, $106.04). To facilitate the deal, the FDIC said it would share any of First Citizens’ losses or potential gains on Silicon Valley’s commercial loans.

- Overall, the FDIC estimated that the failure of Silicon Valley will cost the federal insurance fund about $20 billion.

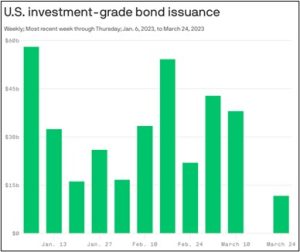

- In response to the deal, shares of regional banks are surging so far this morning, offering additional evidence that the crisis is abating, at least for now. Nevertheless, since the Federal Reserve continues to hike interest rates, we are keeping our eyes open for additional stresses that could arise in the financial system. For example, commercial real estate lending could be a concern, as could a drop in the demand for corporate bonds (see chart below).

- Illustrating the turmoil in the financial system, data provider EPFR said flows into U.S. money market funds have totaled some $286 billion so far in March.

- The jump in inflows likely stems in large part from individual and corporate bank depositors shifting investments to money market funds in search of higher yields and greater security.

Source: Axios Visuals.

Source: Axios Visuals.

European Banking Crisis: Ammar al-Khudairy, the chairman of Saudi National Bank, said he will resign his position “for personal reasons” two weeks after his comments about Credit Suisse helped spark a panic about the Swiss banking giant and led to its government-led takeover by UBS (UBS, $18.99). The resignation is just one aspect of the fallout from the Credit Suisse collapse and takeover. All the same, consistent with the rebound in U.S. regional bank shares so far this morning, major European bank shares are also on the upswing today.

Germany: Strikes by two major transportation unions have disrupted economic activity throughout the country today, potentially indicating that public sector strikes for higher pay like those in the U.K. may be spreading to the rest of Europe. Organizers of the 24-hour warning strike in Germany say they are protesting huge increases in the costs of food and energy and are demanding higher pay to compensate for them.

Russia-Ukraine War: Ukraine’s top military commander, Gen. Valeriy Zaluzhnyi, stated that his forces are close to halting any further Russian advances around the eastern Ukrainian city of Bakhmut. Meanwhile, an analysis by the British Ministry of Defense also suggests the Russian advances around the city have run out of steam in the face of massive losses of troops and equipment.

- If the Ukrainians can indeed stabilize the front around Bakhmut and avoid having to abandon the city, the victory could help maintain Western support and continued arms deliveries.

- At the same time, the huge losses incurred in trying to take Bakhmut have left Russian forces extremely weakened. That could potentially set the Ukrainians up for a romp against the Russians when they finally launch the spring counteroffensive they have long telegraphed.

Israel: Prime Minister Netanyahu fired his defense minister, Yoav Gallant, yesterday after he publicly urged postponement of Netanyahu’s controversial proposal to weaken the country’s judiciary. Not only has the proposal sparked massive protests among Israeli citizens, but Gallant said it had also caused turmoil in the country’s military and was therefore undermining security.

- The firing highlights the political polarization and instability touched off by Netanyahu’s proposal, which could impede Israel’s hard-won attractiveness as a place to invest.

- The firing and imminent final passage of the legislation has sparked especially large and intense protests so far today. The Israeli president has called on Netanyahu to postpone the reform, the country’s biggest union is threatening to strike, and flights out of the major airport, Ben Gurion, have been suspended after its workers said they would join the protests. As of this writing, members of the governing coalition are reportedly deeply divided on whether or not to proceed.

Japan-China: Illustrating how strained relations between Japan and China have become, new reports say Japanese Prime Minister Kishida declined to meet with former Chinese Ambassador to Japan Kong Xuanyou before his departure in late February. Kishida’s decision not to bid farewell to the ambassador was also aimed at registering his complaint about a Chinese spy balloon that recently passed over Japan. The reports claimed that Kishida took the unusual step to protest the Chinese navy’s recent forays into the waters around the Japanese-controlled Senkaku Islands in the East China Sea, which China also claims.

- The incident suggests Japan will remain fully onboard with the aggressive U.S. efforts to suppress both China’s military and its territorial aggression in the region.

- That means investors could suffer collateral damage not only from actions taken by the U.S. and China directly, but also from Japan and other allies of either power.

China-Honduras-Taiwan: As suggested by President Xiomara Castro earlier this month, the Honduran government formally recognized the People’s Republic of China yesterday, severing its longstanding diplomatic relations with Taiwan and leaving Taiwan recognized by just 13 countries. The announcement appeared to be a warning to the U.S. to stop intensifying its relationship with Taipei, as Taiwanese President Tsai Ing-wen embarks on a trip to the U.S. this Wednesday.

- As we have noted before, China is leaning heavily on its enormous economic heft to manage the countries in its own evolving geopolitical bloc and try to peel countries away from the evolving U.S. bloc (our analysis assigns Honduras to the U.S.-led bloc). Many countries are also trying to play China and the U.S. off each other to maximize their own economic and political benefits.

- Prior to switching its diplomatic relations to Beijing on Sunday, Honduras reportedly asked Taipei to double its economic aid to the country and restructure its debt, but the request was refused. As part of China’s economic carrots and sticks, it is highly likely that Beijing offered Honduras an attractive package of economic aid, infrastructure investment, and debt relief.