Daily Comment (March 31, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with an update on the ongoing banking crisis and how it may impact the real estate sector. Next, we review why precious metals, such as gold, have been able to perform well during a time of heightened uncertainty in the market. Lastly, the report discusses the ongoing friction between the U.S.-led and China-led blocs.

Back to Banks: Deposit withdrawals are becoming less of a problem; however, it is still too soon to say that the banking crisis is over.

- There is growing evidence that banks are in need of less cash. The latest data from the Federal Reserve shows that the U.S. bank liquidity problem is slightly improving. Emergency loans to banks from the Federal Reserve backstops declined from $163.9 billion to $152.6 billion in the week ending March 29. Meanwhile, European Central Bank official Isabel Schnabel noted that deposit outflows were not a problem for European banks. Research published by Jefferies Group (JEF, $30.58) went further and argued that the average European bank could lose 38% of its deposits before having to sell any of its government bonds at a loss.

- Despite improving financial conditions, some central bankers remain wary about the health of the banking system. Minneapolis Fed President Neel Kashkari hinted that the banking crisis might not be over. Given his experience working at the Treasury during the financial crisis, he explained that strains in banking may take a while to work themselves out. He added that the ongoing crisis could extend longer than many people realize. His colleague at the Richmond Fed, Thomas Barkin, also cautioned that it is too soon to tell whether the banking turmoil will lead to tighter credit conditions.

- That said, deposit flight remains a major threat to commercial real estate. According to JPMorgan (JPM, $129.57), European banks have as much as €1.9 trillion ($2.07 trillion) worth of commercial real estate exposure, while U.S. banks have $1.7 trillion. This asset class has been the hardest hit since the pandemic due to the drop in demand for office space and would be severely impacted by a credit crunch. Hawkish central bank policy worsens the problem by incentivizing depositors to move their money out of banks and into money market funds and U.S. Treasuries. As a result, we advise investors to pay close attention to their real estate exposure as this banking situation plays out.

- The European real estate market is already showing signs of weakness due to the banking turmoil. The MSCI Europe Real Estate Index of large and mid-cap property companies has dipped to its lowest level since 2009.

Gold Great Again? Precious metals have performed well amidst the growing market turmoil.

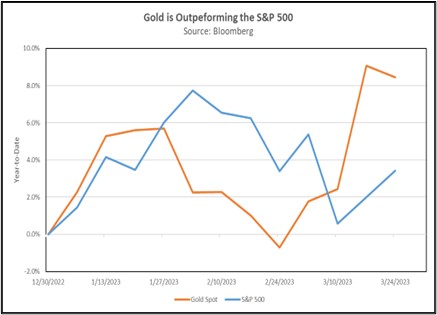

- Concerns over the financial system and the economy have led investors to retreat temporarily from equities and move into safer assets. Gold has outperformed the S&P 500 this year, 8.5% to 3.4%. Similarly, the Bloomberg Commodity Precious Metals Subindex has rallied 10.9% since March 8, despite being down in the first three months of the year. The preference for precious metals over equities is related to uncertainty over interest rates. As inflation remains elevated and a recession approaches, investors are unsure of what the Fed’s next moves will be and have sought safety in real assets.

- Central banks have expressed a willingness to hike policy rates, but the market doesn’t buy it. On Thursday, Boston Fed President Susan Collins insisted that the banking system remains sound and that the Federal Reserve is still focused on taming inflation. Meanwhile, stickier core inflation in Europe has complicated efforts by the ECB to conclude its tightening cycle. Because of the central bank’s insistence on raising rates, financial market participants anticipate a cut later this year. The CME Fed Funds Watch Tool shows that there is an 80% chance of a cut in the Federal Reserve policy rate by the end of 2023, while the overnight index swap curve for the EUR shows that the ECB will also cut within that period.

- Although there is much to be worried about in markets, there is still a lot of opportunity to earn solid returns. Precious metals are an attractive option as they are relatively more liquid when compared to digital currencies and have a solid reputation for being a hedge against market uncertainty. Additionally, the movement into cash and cash equivalents could also lead to sub-optimal portfolio returns. That is why we would like to caution investors away from fleeing the market, as there is a realistic possibility that they could miss many attractive opportunities. As the saying goes, there is no great reward without at least some risk.

Beijing Shuffle: China and Russia are looking for ways to outmaneuver the West as they seek to avoid being isolated from the rest of the world.

- The U.S. and its allies continue to form a united front against China and Russia. On Thursday, the Turkish parliament approved Finland’s petition to join NATO. Turkey’s consent removes a significant hurdle for the military alliance as it looks to deter Moscow from further aggression by adding new members. Meanwhile, European Commission President Ursula von der Leyen has urged EU countries to back restrictions on the transfer of sensitive technologies to China. The remarks come amidst pressure from the U.S. to have EU members support trade restrictions on goods that can potentially boost Beijing’s defense capabilities.

- The ostracization of China and Russia has made it difficult for their economies to recover. Beijing is still working to boost GDP growth following its stringent Zero-COVID policies and a wave of infections that limited consumption. Recent PMI data shows the economy is improving, but consumer confidence indicates that sentiment remains stubbornly low. At the same time, President Vladimir Putin recently admitted that Western sanctions are starting to negatively impact the Russian economy. The isolation of these two countries has made them draw closer to one another as they look to work together to reduce their dependence on Western markets.

- The rivalry between the U.S.-led and China-led blocs shows how trade can quickly devolve into a zero-sum game. As the two sides look to decouple from one another, we expect that, in the long term, the rest of the world will split into two camps that prioritize trade ties with one of the major blocs. Although a few countries, such as Turkey and Brazil, will be able to find some middle ground to work with both blocs, we suspect that others will be forced to choose. As noted in previous reports, China is looking to build alliances with major commodity producers, while the U.S. prefers to build security ties with other advanced economies.

- At some point, there may be a direct confrontation between the two sides; however, that time remains in the distant future.