Daily Comment (April 4, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

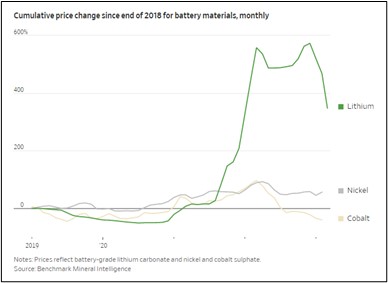

Our Comment today opens with some good news on global lithium prices and the prospect of lower costs for batteries and electric vehicles. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the Australian central bank’s decision to pause its long campaign of interest-rate hikes and new signs of weakness in the U.S. commercial real estate market.

Global Lithium Market: Global lithium prices are now down more than 30% for the year, partially reversing a massive two-year surge and boosting hopes that the cost of batteries and electric vehicles could come down. The drop in lithium prices stems from weaker demand for electric automobiles, especially in China, and a decline in risk appetite as global interest rates rise. However, given that lithium is a key mineral for electric vehicle batteries, many industry leaders believe its price will eventually rebound as the world transitions away from gasoline-powered cars.

North Atlantic Treaty Organization: NATO foreign ministers who met in Brussels today formally accepted Finland into the alliance. The move vastly expands NATO’s land border with Russia, makes the Baltic Sea essentially a NATO lake, strengthens the alliance’s military power, and enhances its deterrent credibility, even if Sweden’s bid to join remains held up by Turkey and Hungary.

France: As mass protests continue against President Macron’s recent pension reform decree, police trying to get control of the situation have reportedly revived some of the tough, controversial tactics that helped them quell the country’s “yellow vest” protests in 2018. The tactics include preventative arrests and massive police deployments even for modest-sized protests. So far, however, it isn’t clear whether the tactics will help deflate the protests or merely add to the political fire facing Macron.

United Kingdom: So far this morning, the British pound (GBP) has jumped to $1.2488, reaching its highest value in 10 months. The recent surge in the GBP has been driven by better-than-expected economic performance and higher interest rates in the U.K., as well as a broad drop in the value of the USD following last month’s U.S. banking crisis. With this surge, the GBP is now the best-performing major currency so far in 2023.

Source: Wall Street Journal

Australia: The Reserve Bank of Australia today held its benchmark short-term interest rate unchanged at 3.60%, after 10 straight rate hikes that lifted the benchmark by 3.50% since last May. The central bank moved to pause its rate-hiking campaign even though Australian consumer prices have only recently begun to decelerate. The pause could boost expectations for a similar move by the Federal Reserve in the U.S.

China-United States: According to media reports and a Defense Department briefing yesterday, the Chinese spy balloon that traveled over the U.S. and was shot down off the coast of South Carolina in February was maneuverable enough to hover over sensitive military sites, prompting the Pentagon to take evasive steps. The media reports said the balloon was able to transmit intelligence back to China in real time, although Pentagon officials would not confirm that in public. The revelations could lead to renewed concern about Chinese spying and further worsen U.S.-China tensions.

U.S. Space Exploration: Yesterday, the National Aeronautics and Space Administration announced the four astronauts who will make up the crew of the Artemis II mission that will fly past the moon in late 2024. The NASA mission will mark the first human flight near the moon since 1972, with the goal of testing spacecraft systems needed for a future lunar landing. The NASA crew will consist of two U.S. men, one U.S. woman, and one Canadian man.

U.S. Water Supplies: Surveyors from the California Department of Water Resources said yesterday that the mountain snowpack near Lake Tahoe now stands at more than 126 inches, the deepest snow in four decades and some of the deepest snow recorded there over the last century. Driven by this winter’s nearly constant precipitation, the snowpack is expected to sharply reduce the state’s drought conditions, providing a boon to industry and agriculture, but with the risk of dangerous flooding as temperatures rise.

U.S. Commercial Real Estate Market: Blackstone (BX, $84.96) said investors asked to redeem $4.5 billion from its Breit commercial real estate fund in March, marking the fifth straight month in which the fund has faced large redemption requests that have forced it to limit withdrawals. The big redemption requests came despite Blackstone’s conference for Breit investors last month when it argued that the recent U.S. banking crisis will create stronger long-term investment opportunities for the fund by reducing the amount of available bank loans and cutting the risk of an excess supply of properties. The news drove Blackstone’s stock down 3.3% yesterday and put further downward pressure on real estate investment trusts (REITs).

- In another sign of the weakening market for commercial real estate, data firm CoStar Group said sales of apartment buildings in the first quarter were down a whopping 74% from the same period one year earlier. That marks the worst annual sales drop since the first quarter of 2009.

- The drop in multifamily transactions reflects the impact of rising interest rates, regional banking turmoil, and slowing growth in apartment rents.