Weekly Energy Update (April 13, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil gapped higher in early April on reports that OPEC+ was cutting production targets. It has held those gains and is now moving above chart resistance at $82 per barrel.

(Source: Barchart.com)

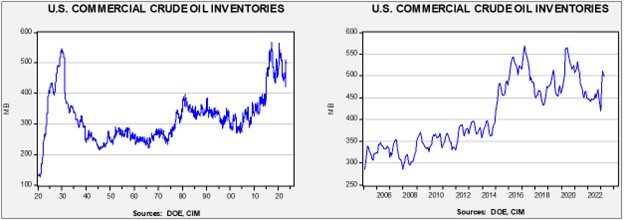

Commercial crude oil inventories rose 0.6 mb compared to the forecast draw of 1.7 mb. The SPR fell 1.6 mb, putting the total draw at 1.0 mb

In the details, U.S. crude oil production rose 0.1 mbpd to 12.3 mbpd. Exports plunged 2.5 mbpd, while imports dropped 0.9 mbpd. Refining activity declined 0.3% to 89.3% of capacity.

(Sources: DOE, CIM)

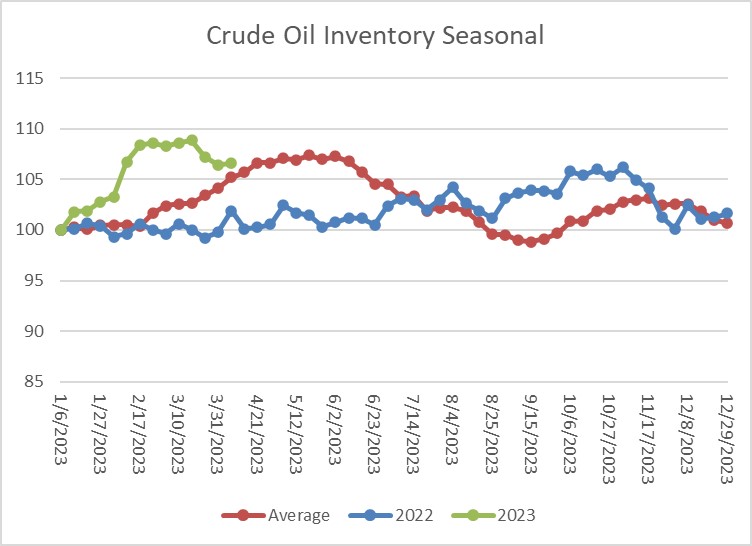

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined for two weeks. The mostly steady report for last week puts stockpiles near seasonal norms. Past history would suggest there will be mostly steady inventory levels into early June.

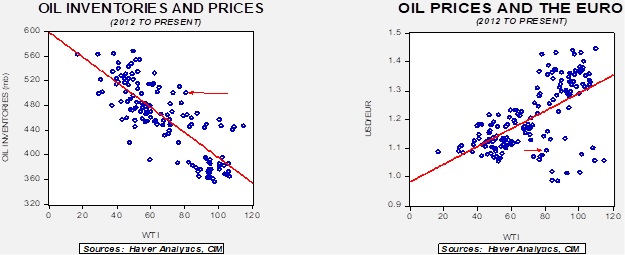

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $55.36. The actions of OPEC+ this week are clearly designed to prevent this sort of price from emerging.

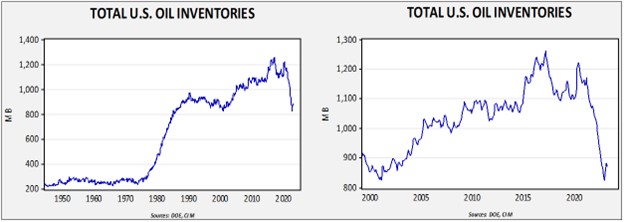

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $93.33.

Market News:

- The DOE released its Short-Term Energy Outlook this week. The government lifted its oil price forecast by around $2 per barrel in light of the recent OPEC+ supply cuts.

- The EPA announced massive changes to pollution targets for the auto industry which, if implemented, will almost certainly trigger a rapid shift to EVs. At this juncture, we view this news as more of a trial balloon, but we do think this announcement suggests the “direction of travel” for regulations. Once implemented, these regulations would eventually depress oil demand. In the near term, though, they could have just the opposite impact since discouraging investment will keep oil supplies tight. Also, a rapid shift to EVs will almost certainly increase our dependence on China for key components of the vehicles. And, the U.S. electrical grid isn’t ready for such a major adjustment.

- Related to the investment issue is pressure brought by environmental groups and others against the financing of oil and gas projects. The problem with such movements is they run the risk of causing higher oil and gas prices.

- Another tactic of the environmental groups has been to use the courts to delay pipeline projects. The Mountain Valley Pipeline faces another delay due to a court decision. This outcome highlights the call from the industry to streamline the permitting process.

- As we noted last week, the OPEC+ decision to cut production is pushing Russia’s oil price above the cap. It is looking increasingly likely that the cap’s effectiveness will be reduced.

- Although the cartel’s decision has been taken as bullish by the oil markets, it is important to note that there are other oil producers increasing output which will partially offset the cut in production by OPEC+. In fact, the higher prices caused by the cartel’s decision could bolster the case for higher output.

- Russia announced its oil product fell 0.7 mbpd in March, a greater decline than projected as earlier estimates suggested a 0.5 mbpd drop. Revenues are also falling. Russia’s Urals oil price benchmark has been weak, although, as we note above, the recent decisions to cut production may improve Russia’s revenue in the coming months.

- Evidence is mounting that a key consequence of the war in Ukraine and added sanctions is a massive restructuring of oil trade flows. This change is leading to longer lead times for shipments and will likely cause greater stockpiling.

- Exxon (XOM, $115.05) announced it is abandoning a drilling project deep offshore of Brazil due to the inability to find commercially viable oil fields.

- Initially after the war in Ukraine began the RUB fell sharply; however, it recovered rapidly as higher oil prices boosted Russian revenue. Reports that Shell (SHEL, $60.58) will repatriate $1.2 billion from asset sales has triggered depreciation in the RUB.

Geopolitical News:

- The U.S. has sent the USS Florida, a guided missile submarine, to the Persian Gulf region. The U.S. often has a naval presence in this region, but this sub could be viewed as a show of force against Iran.

- The U.S has been restricting China’s ability to import semiconductor chips and the equipment for fabricating them. China is considering retaliation in the form of restricting rare earth exports. Rare earths are critical in technology and alternative energy.

- Last week, we noted that China hosted a meeting between diplomats from the Kingdom of Saudi Arabia (KSA) and Iran. Both sides agreed to resume flights between the two Middle Eastern nations.

- Officials from the KSA are meeting in Yemen for talks with rebel groups. One potential outcome from the recent détente between Iran and the KSA could be a ceasefire in the long-running civil war in Yemen.

- Graham (R-SC) had a “productive meeting” with Crown Prince Salman this week. Graham has been critical of the crown prince in the past, so the meeting might signal something of a thaw in U.S./KSA relations.

- Although the U.S. political class is moving decidedly against China, the business class is clearly loath to break ties. We think that eventually businesses will be forced to choose.

- Recently, we reported that schoolgirls in Iran were being poisoned in their schools. Apparently, the poisonings have continued. It isn’t clear if Iran is facing a dissident movement within Shia Islam, or if the acts are being perpetrated by radical Sunni groups. We note that the Islamic State and Taliban groups oppose education for women and so these acts may be being perpetrated by groups outside of Iran.

- Iran is apparently in talks with China and Russia to provide components for missile fuel. Russia is attempting to acquire ammonium perchlorate which is used in solid fuel propellants in missiles. If Iran supplies the component, it will surely face additional sanctions, but at the same time, Tehran may be reluctant to sell the fuel to Russia because it has its own needs for missile fuel.

- Recent leaks of classified materials indicate that Russian hackers were targeting Canadian pipelines. Although the hackers claimed success in penetrating the networks, there were no reports of disruptions from cyberattacks.

Alternative Energy/Policy News:

- As the energy transition gains momentum, countries are increasingly applying export controls on key materials. If this policy continues, it will slow the progress of the transition and drive up costs.

- We are also seeing automakers vertically integrate their supply chains, a characteristic observed in the 1920s when auto production reached a mass market. The latest example is General Motors’ (GM, $35.37) investment in a lithium technology startup EnergyX.

- Although lithium continues to dominate the auto battery market, Chinese researchers are working on sodium batteries. Lithium batteries remain superior, but reports suggest that progress is being made in replacing lithium with sodium. Sodium is far cheaper than lithium and batteries made from sodium hold a charge better in colder temperatures. The U.S. does have one great advantage in this race— about 90% of soda ash, the input product for sodium, is mined in America.

- A sizable community solar power project is underway in Georgia. The project has received some funding from the Inflation Reduction Act.

- As the market share of EVs rise, the issue of charging stations remains a problem. However, we note that Walmart (WMT, $150.47) announced it will begin expanding the number of charging stations in its parking lots. Due to the ubiquitous nature of Walmart stores, this decision could expand the availability of stations. At the same time, given the time required to charge an EV, it could give Walmart a “captured audience” of shoppers.

- The Inflation Reduction Act restricts the tax credit that comes from buying an EV or a plug-in hybrid. However, one way to get around the restrictions is to lease such a vehicle. Commercial buyers have fewer restrictions, meaning that although the lessor gets the tax credit, there is an incentive to at least share the credit with the lessee to “do the deal.”

- In China, Tesla (TLSA, $187.99) is facing increasing competition from local EV brands.

- Although geothermal energy holds great promise, there is concern that it won’t be possible to scale the energy source in a widespread manner.

- The U.S. is opening two new nuclear power stations in Georgia.

- Europe is expanding its hydrogen pipeline network.