Daily Comment (April 18, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a couple of big-picture views on the global economy and a key commodity market. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including stronger-than-expected economic growth in China and a range of developments in U.S. economic policy.

Global Fracturing and Inflation: European Central Bank President Lagarde warned in a speech yesterday that if the world continues to fracture into relatively separate geopolitical and economic blocs, global consumer prices would be boosted by about 5% in the short run and about 1% over the long term due to less efficient supply chains. She also warned that global fracturing would threaten the position of the U.S. dollar as the world’s key reserve currency.

- Clearly, Lagarde has been reading the many analyses Confluence has been publishing on this topic. Her analysis is consistent with our view that as the world breaks into U.S.-led and China-led blocs, shortened supply chains and increased geopolitical tensions will lead to higher costs, increased inflation, and rising interest rates.

- The evolving U.S.-led bloc is likely to look much like today’s group of rich, advanced, highly industrialized countries with a few closely related emerging markets but will have more manufacturing “brought home” to that bloc from China and its bloc. We suspect companies will eventually adjust to this new world, meaning equities and commodities are likely to remain attractive. However, higher inflation and interest rates will likely contribute to the beginnings of a long-lasting bear market in bonds.

Global Copper Market: At this week’s World Copper Conference in Santiago, Chile, a key topic of discussion is the worsening outlook for the metal’s supply/demand balance. Driven by new construction and soaring use in green technologies such as electric vehicles, global demand for copper is expected to rise to 36.6 million metric tons per year by 2031. However, because of lackluster investment at the present time, which is driven in part by restrictions in South America, global output is expected to grow slowly to just 30.1 million metric tons per year.

- Analysts expect the supply shortfall to drive prices much higher over the coming years.

- We agree that tepid investment today is likely to boost prices for a range of commodities in the coming years. We think geopolitical tensions and the fracturing of the world into relatively separate blocs will also tend to drive values higher. We therefore continue to believe commodities will offer attractive returns in the coming years, once we get through any short-term softness due to the impending recession in the U.S.

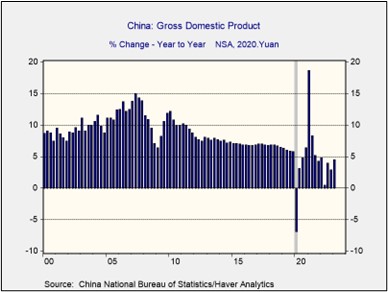

China: As we flagged in our Comment yesterday, first-quarter gross domestic product was up a relatively healthy 4.5% from the same period one year earlier, beating expectations and marking a strong acceleration from the growth of 2.2% in the year ending in the fourth quarter of 2022. The acceleration in the first quarter came largely from stronger consumption spending as the economy continues to recover from its previous Zero-COVID restrictions, but it also benefited from increased government infrastructure investment and rebounding exports.

- China’s growth in the first quarter puts it on track to meet the government’s target of having GDP expand about 5% in 2023.

- The rebound in Chinese GDP growth will likely give a boost to global economic activity and commodity prices, at least to the extent that it relies on investment and imports. However, some economists are concerned that rebounding consumption spending, especially on services, will mute the benefit of economic growth outside of China.

Germany: The country’s last three nuclear electricity plants were shut off over the weekend pursuant to a law passed two decades ago and strong anti-nuclear protests over the last decade. The shutdowns come despite an energy crunch touched off by Russia’s invasion of Ukraine last year. The shutdowns are expected to leave German and European energy supplies more volatile and precarious going into the future.

Saudi Arabia-Iran-Israel: Reflecting the recent China-facilitated rapprochement between Iran and Saudi Arabia, the Iranian government said it has invited Saudi King Salman bin Abdulaziz to visit the country in the near future. The invitation comes as Iranian President Ebrahim Raisi has already accepted an invitation to visit Saudi Arabia, although no date has been set for his visit. Meanwhile, senior Saudi officials on Sunday met with leaders of the Palestinian militant group Hamas, which is backed by Iran, to discuss renewing their ties for the first time since they were put on ice in 2007.

- The rapprochement with Iran threatens Israel’s strategy of strengthening ties with the Saudis and other Sunni Muslim states to form a bulwark against Shiite Muslim Iran in the Persian Gulf region.

- Saudi Arabia’s renewed ties with Hamas also threaten to unleash new terrorist attacks directly on Israel.

Ecuador: In an interview, conservative President Guillermo Lasso said he would dissolve the country’s congress and call new elections if the leftist-dominated legislature tries to impeach him on what he called trumped-up corruption charges. However, opinion polls indicate Lasso only has the support of about 22% of the population, and it appears his days in office are numbered. The result could be a constitutional crisis and lead to further political instability in Ecuador, potentially leaving it as yet another major Latin American commodity producer taken over by the left.

China-United States: Yesterday, U.S. prosecutors charged dozens of Chinese security officers and their associates in absentia for running thousands of fake social-media personas to discredit U.S. policies. They also arrested and charged two ethnic Chinese for setting up a secret Chinese police station in New York City to harass Chinese dissidents. Along with last week’s revelation that a former U.S. Navy sailor helped disseminate classified documents posted online by an Air National Guardsman, yesterday’s charges highlight how rogue-state officials and their domestic sympathizers are active in U.S. cyberspace and on U.S. territory. Reports today indicate the FBI is investigating the Navy sailor involved in the further dissemination of the leaked intel documents.

- Naturally, that realization is likely to further worsen U.S. relations with China and Russia.

- It could also potentially spark moves to root out any domestic “fifth column” of China and Russia sympathizers.

U.S. Fiscal Policy: Even though House Speaker McCarthy hasn’t gotten the Republicans he leads to agree on a budget proposal for the upcoming federal fiscal year, he said in a speech yesterday that the party would soon pass legislation linking a rise in the federal debt limit to cuts in spending. According to McCarthy, the majority of Republicans would only agree to a rise in the debt limit if it were linked to a limit on federal spending, a claw back of COVID-19 aid, and a requirement that people work to receive federal benefits.

- President Biden has signaled that he is willing to negotiate on federal spending levels, but he rejects linking those talks to the debt limit.

- McCarthy’s speech is a reminder that federal fiscal policy and the risk of a default remain a risk for the financial markets, even if the most likely scenario is a last-minute compromise.

U.S. Environmental Policy: The Treasury Department yesterday released an updated list of electric vehicle models that qualify for tax credits under last year’s Inflation Reduction Act. Because of tightened rules on pricing and the country of origin for key components, the list now includes just 16 models from U.S. brands. The pared down list illustrates the impact of the law’s preference for North American-made vehicles and technology, which has strained relations between the U.S. and some of its allies.

U.S. Banking Regulation: New research drawing on public filings indicates that most U.S. banks haven’t been hedging their exposure to rising interest rates. For example, the research shows that only about 6% of bank assets have recently been hedged with interest-rate swaps. The findings suggest that the rise in interest rates that helped bring down two key banks last month could have also left other institutions at risk. We continue to watch carefully for signs that other banks could be in trouble or that financial stresses will crimp bank lending and help push the economy into recession.

U.S. Labor Market: Privately held consulting giants McKinsey & Co. and Bain & Co. are reportedly delaying the start dates for new MBA hires to as late as April 2024, in some cases paying them thousands of dollars to work for a charity for a few months before starting their consulting jobs.

- The actions by McKinsey and Bain reflect concerns about an impending recession and slowdown in business. They also serve as a reminder that as recession nears, demand will likely soften even for expensive workers in business services.

- Separately, UPS (UPS, $193.29) and the Teamsters union begin negotiations this week for a new five-year contract covering some 330,000 employees before the current contract expires on July 31. Because the number of covered employees is so large, the negotiations and resulting contract could have significant implications for overall U.S. wage rates and labor market conditions.