Daily Comment (April 20, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with a discussion about concerns regarding bank lending. Next, we explain why stubborn inflation has led to greater scrutiny of the central banks. Lastly, we give our thoughts on supply chain efficiencies and the performance of the U.S. dollar as tensions between the U.S. and China continue to escalate.

Lending Sentiment Sours: The latest earnings report has added to concerns that a credit crunch is imminent.

- Despite the four largest banks showing strong earnings in the first quarter of 2023, there are still concerns about the financial system. On Wednesday, Morgan Stanley (MS, $90.25) announced an increase in the company’s provision of credit losses to $234 million, up from $57 million a year ago. The upward revision in its loss expectations is related to concerns about commercial real estate and the overall economy. Goldman Sachs (GS, $335.91) announced that its profits fell 18% in the year’s first three months due to a slump in dealmaking and bond trading. Additionally, Zions Bank (ZION, $32.72), US Bancorp (USB, $36.01), and Citizens Financial Group (CFB, $30.50) each reported declines in deposits, primarily from their wealthier clients.

- On a positive note, Western Alliance (WAL, $40.35) had an unexpected rebound in deposits.

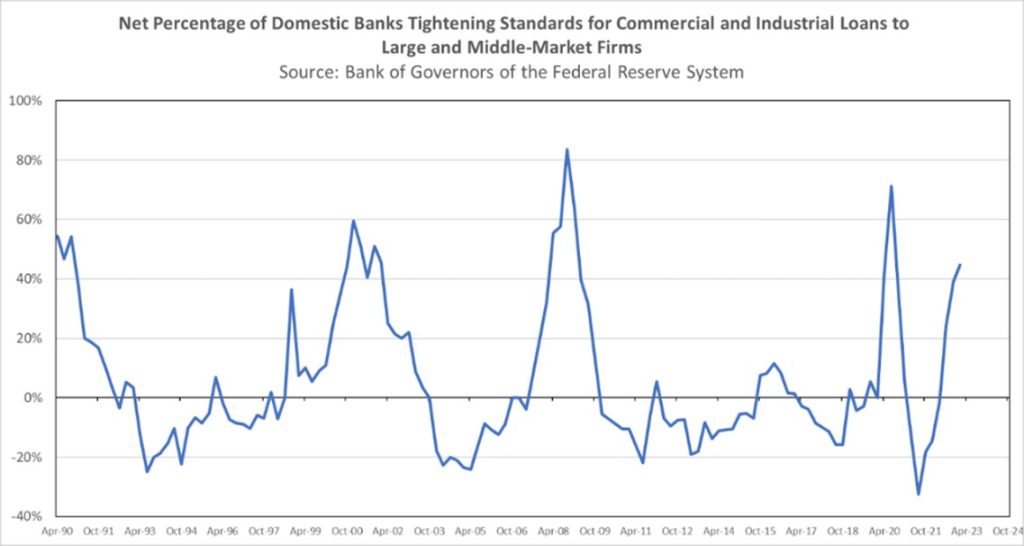

- Lenders were already tightening their lending standards before March’s SVB debacle. In February, a Fed survey showed that senior loan officers were restricting the amount of credit due to worries about demand weakness and deteriorating loan quality in the final quarter of 2022. The report showed that the net percentage of respondents tightening standards has risen to its highest level since the pandemic. Although the next report on senior loan officer sentiment will not be released until May, the latest Beige Book shows that banks are increasingly reluctant to issue credit given the recent banking crisis.

- Tightening credit conditions raises the likelihood of a hard landing. The Federal Reserve is expected to raise its target range for interest rates to 5.00%-5.25% in May. The Fed’s decision to increase borrowing costs will raise transaction expenses for bank dealmaking and reduce the value of bond holdings, thus weighing on the profitability of financial institutions. The Fed’s new emergency facility did relieve pressure on the regional banks from needing to lift rates in order to keep borrowers, but banks may still be reluctant to lend due to interest rate uncertainty. As a result, businesses and consumers may be unable to obtain loans when they need them as the economy slows.

It’s Getting Sticky: Stubborn inflation adds to concerns that the central banks are not finished tightening monetary policy.

- The lack of progress toward price stability has hurt the credibility of the central banks. The current board of the Reserve Bank of Australia is set to lose responsibility for setting interest rates because it has come under scrutiny for its poor guidance. The task will be given to a separate board within the RBA that will specialize in managing monetary policy. Several months before it started its most aggressive tightening cycle in three decades, the RBA had stated that a rate hike was unlikely before 2024. Additionally, its inflation forecast failed to detect the acceleration in price pressures. The revamp of the central bank is expected to take place in July of this year after the RBA Act is amended.

- Australia is not the only country with a central bank currently under pressure. The Bank of England, the European Central Bank, and the Fed have all moderated expectations of a pause due to higher-than-expected inflation. Their inability to succeed in reining in price pressures may be related to demand-side inflation. The chart below breaks down inflation by demand, supply, and ambiguous contributors, as determined by the U.S. personal consumption expenditure price index. The series suggests that improvements in the supply chain are the primary drivers in the recent decline of price pressures.

- The chart may reflect issues with containing service-related inflation figures.

- A tight labor market and a resilient economy have given central banks more leeway to increase benchmark interest rates. The Federal Reserve Beige Book, which provides anecdotal information on economic conditions within regional Fed districts, showed that the country is not currently in a recession. Meanwhile, better-than-expected growth from China has boosted confidence that a global recession is not imminent. These positive signs have forced market participants to push back their expectations of a shift in central bank policy. The latest CME FedWatch Tool now forecasts a Fed pause or cut in interest rates to take place at the September meeting, a month later than investors were predicting last week. Overnight index swaps for the EUR and GBP have also shown a similar trend.

- That said, we believe that many central banks will be finished hiking rates by the third quarter.

The Great Decoupling: Supply chain efficiency and the dominance of the U.S. dollar may be casualties as the world splits into separate blocs.

- Companies are accepting that they may have to prioritize supply chain resiliency over efficiency as a way to hedge against geopolitical risks from rising U.S.-China tensions. India appears to be an attractive destination target. A day after opening its first store in India, Apple (AAPL, $167.63) CEO Tim Cook met with Indian Prime Minister Narendra Modi to discuss plans for future investment in the country. The iPhone maker is expected to double or triple its investment expenditure in Asia’s second-biggest economy which could pave the way for more companies to follow suit.

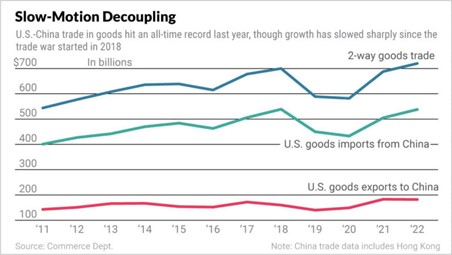

- The decision to broaden supply chains comes amidst heightened rhetoric from the U.S. regarding China. Treasury Secretary Janet Yellen is expected to warn Beijing of a U.S. response if it continues unfair trade practices. Her remarks will reinforce the notion that China and the U.S. are headed for a divorce as the two sides grapple with disagreements over human rights, support for Russia, and accusations of industrial espionage. Although U.S.-China trade increased to an all-time high last year, it is now showing signs of slowing.

- Frictions between the U.S. and China will lead to a decline in the usage of the dollar for global trade. Beijing has already gotten a head start in this process as its foreign exchange reserves have declined from nearly $4 trillion in 2014 to slightly above $3 trillion as of March of this year. Meanwhile, Brazilian President Lula has called on emerging economy countries to reduce their reliance on the U.S. greenback for trade. We suspect countries that align with China will be persuaded to use other currencies for trade, especially if they want access to the world’s second-largest economy. If we are correct, the U.S. dollar should be headed toward a secular decline against other global currencies.