Daily Comment (April 27, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with our thoughts about the positive news regarding Big Tech and why it may not relieve concerns about a possible downturn. Next, we discuss the controversy regarding regional banks and the Federal Reserve’s new lending facility. Lastly, the report provides an overview of the ongoing debt ceiling debate and its impact on bond volatility.

Why the Gloom? Earnings are better than expected, but recession fears weigh on investor sentiment.

- The Tech-heavy NASDAQ Composite rose 0.5% Wednesday after Microsoft (MSFT, $295.36), Alphabet (GOOGL, $103.67), and Meta (META, $209.40) reported earnings and revenue that beat expectations. Microsoft’s fiscal Q3 2023 results showed that the company’s cloud service business slowed but not as much as investors had feared. Alphabet’s Google search engine was able to generate solid ad sales. Meanwhile, Meta added 37 million daily users to its flagship Facebook app. The tech behemoths’ strong performances have boosted confidence in the sector as layoffs and restructuring have helped make the companies leaner and more efficient. That said, market participants are not convinced that the worst has already come to pass.

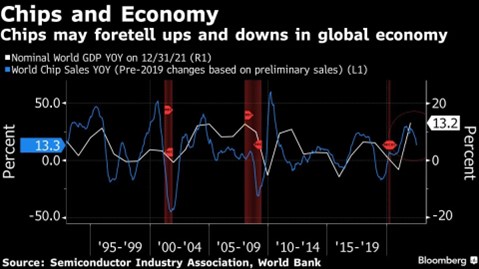

- Despite the strong performance by Big Tech companies, there are concerns from the market of further trouble ahead. The S&P 500 closed down 0.4% on Wednesday on investors fear that quarterly earnings are reinforcing views that consumers are reining in their spending. Dutch Semiconductor equipment maker ASM International (ASMIY, $347.99) reported a drop in first-quarter earnings and stated that the company expected sales to decline in the second half of 2023. Similarly, South Korean company Samsung Electronics (SSNLF, $40.60) posted a record $3.4 billion loss in chip sales in Q1 2023. The decline in semiconductor sales is related to a slump in demand for consumer electronics, which has been associated with changes in the business cycle.

- Although the S&P 500 is up 6% this year, a few stocks have driven much of the gain. Microsoft and Apple (AAPL, $163.76) accounted for 40% of the increase and now account for a record 13.3% of the index. The lack of market breadth has led to concerns that this year’s rally may not be sustainable. The recent banking turmoil has worsened those concerns. That said, investors should remember that much of the recession fears have already been priced into the market, suggesting that equities remain fertile for long-term investment growth.

Now the Zombies! First Republic’s deposit exodus has put the Federal Reserve’s new emergency lending facility into focus.

- First Republic Bank’s (FRC, $5.45) troubles are still weighing on investor sentiment. On Monday, the bank disclosed that it had lost $100 billion in deposits last quarter. Although in March First Republic Bank was able to replace some of the lost holdings with $30 billion in deposits from major banks, the new injections were not enough. In order to shore up its cash position, First Republic has now decided to sell assets, likely at a discount. Its precarious situation has led regulators to consider downgrading their assessment of the bank, which would limit the firms’ access to the Federal Reserve’s lending facilities, if it can’t find a quick solution to its woes.

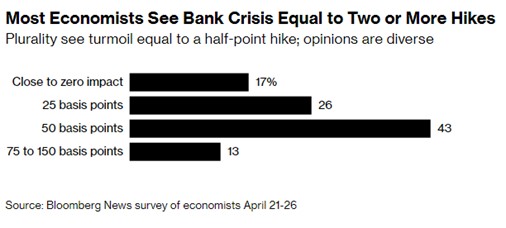

- The struggles of First Republic Bank are a reminder of the tensions caused by fractional reserve banking. Banks convert deposits, which depositors view as “money,” into loans and securities, which pay a higher interest rate. This model relies on a normally sloped yield curve. When central banks tighten policy, yield curves tend to invert, meaning that funding costs for banks (those short-term deposits) may now be paying a higher rate than the loans and securities held by the bank. What we have seen recently is that a few banks have held long-duration risk on the asset side (loans and securities) as policy tightening has threatened their solvency. As long as deposits “stay put,” the bank can continue to operate, however, if depositors withdraw their funds, the bank is in trouble. As we mentioned in yesterday’s report, unlike Silicon Valley Bank, most regional banks don’t have a high level of exposure to long-term Treasuries, but deposit outflows remain a problem. So far, the smaller financial institutions have been able to depend on Federal Reserve backstops for relief, but even that solution has its flaws.

- The new lending facilities give the banks funding by offering cash for their securities at par. This feature allows them to meet deposit withdrawals without selling the securities at a loss, but it doesn’t solve the disintermediation problem. If banks keep deposit rates low, then those deposits are still at risk of leaving for better yielding alternatives. The long-term solution is lower short term interest rates, which discourages disintermediation. However, that solution conflicts with the Fed’s goal of raising rates to contain inflation.

- As a disclaimer, we note that the regional banking system is relatively stable today, and thus zombie banks are a worst-case scenario that is very unlikely to materialize.

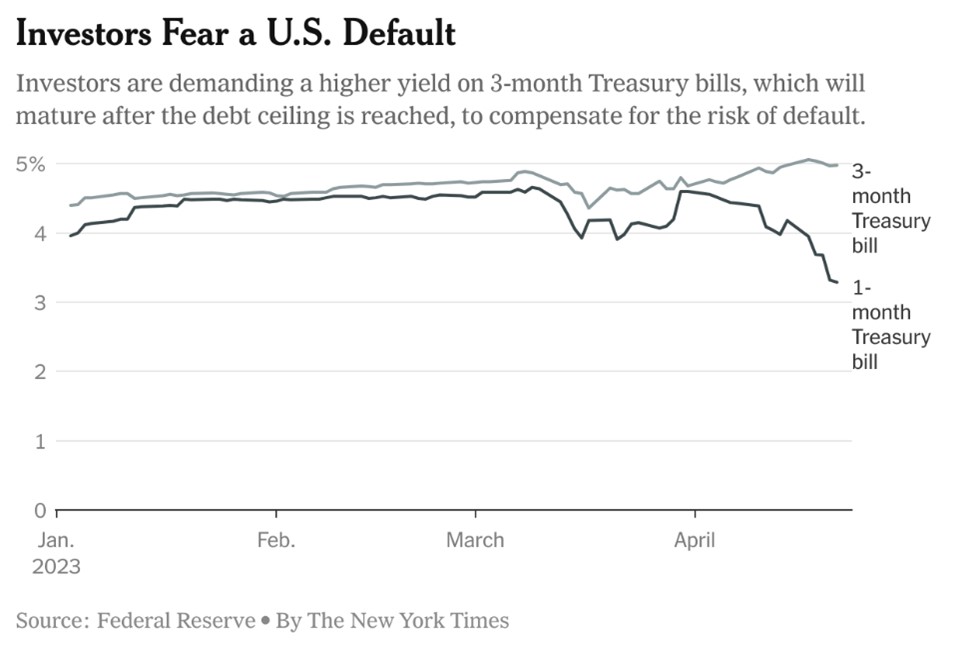

McCarthy’s Opening Salvo: Republicans raised the stakes in their stand-off with President Joe Biden after narrowly passing their debt ceiling bill through the House of Representatives on Wednesday.

- The bill will not be made into law but suggests that debt talks will likely extend into the summer. Voted primarily on partisan grounds, the bill passed 217 to 215, with four Republicans refusing to back it. The legislation would increase the U.S. debt ceiling by $1.5 trillion in exchange for $4.8 trillion in budget cuts. Additionally, the bill would push back the potential default date to March 31, 2024, at the latest, setting up a potential battle during the election year. President Biden has vowed to veto the bill if it comes to his desk.

- The Biden administration has made it clear that they prefer a “clean” increase in the government’s borrowing authority. As a result, President Biden has refused to hold negotiations with his Republican counterparts. White House officials argue that it is the responsibility of Congress to raise the debt ceiling, and thus, should come with no conditions. The president had released his own budget proposal in March. His plan would cut the deficit by $2.9 billion over a decade and raise $4.7 trillion primarily from higher taxes on corporations and wealthy households.

- There is unlikely to be much incentive to come to an agreement now. Typically, the stand-off over raising the debt ceiling comes down to the wire, and that is when both sides eventually start making concessions. The focus on the debt ceiling has taken on increased importance due to the impact it may be having on Treasury bills. The yield on one-month Treasuries jumped 26 bps on Wednesday; meanwhile, the spread between three- and one-month treasuries continues to widen. The sudden interest rate change is possibly indicating that investors are worried about not being repaid. Although we think the risk of a government default remains relatively low, uncertainty over the debt ceiling could lead to increased volatility within the financial markets.