Daily Comment (May 5, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment starts with our thoughts about the recent changes to monetary policy in Europe and the U.S. Next, we explain why safe-haven assets have become more attractive over the last few days. Finally, the report ends with a discussion about why the rivalry between the U.S. and China has spilled over into Africa.

Next Stage? Global monetary tightening may be heading toward a close as central bankers focus their attention on a potential downturn.

- Investors are not convinced that the Federal Reserve and the European Central Bank are willing to continue to raise interest rates until inflation is tamed. A day after the Fed removed mention of “additional policy firming” from its statement, ECB President Christine Lagarde tried to reassure markets that the ECB was not going to halt its hiking cycle anytime soon. However, investors fear that the banking turmoil in the U.S. could force most central banks to rethink future policy decisions. Despite hawkish rhetoric from Lagarde, the EUR fell 0.41% to $1.1018 on Thursday.

- The market expects the ECB and Fed to cut rates later this year, regardless of their comments that they won’t. The latest Euro Area Bank Lending Survey for Q1 2023 showed that the net percentage of financial institutions restricting credit has risen to its highest level since the European Sovereign Debt Crisis. At the same time, the Federal Reserve’s Senior Loan Officer Opinion Survey is expected to show similar results on Monday. Expectations of a lending slowdown have added to concerns that policymakers will need to pivot to prevent a severe recession. The CME FedWatch Tool predicts that the Fed will continue to raise rates until November, at the latest. Meanwhile, Euribor future prices suggest that the ECB will take its foot off the pedal this fall.

- Although a recession will likely force the ECB and the Fed to prematurely end their hiking cycle, we expect EU policymakers to be less aggressive. European banks are relatively healthy when compared to their American counterparts. This is mostly because there are fewer banks for depositors to choose from. Additionally, European banks are required to regularly mark to market their securities holdings. Hence, they are unlikely to have the same maturity mismatch problems that plagued Silicon Valley Bank (SIVBQ, $0.41) and First Republic Bank (FRCB, $0.32). The differences between the American and European banking systems will likely mean that the banking turmoil will have less of an impact on ECB policy which should be bullish for the EUR and supportive of European equities.

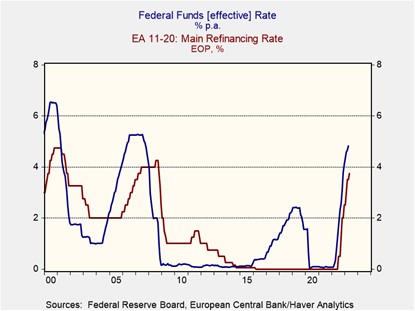

-

- Additionally, the ECB has typically been slower to cut rates than the Fed, as the previous chart shows.

Risk Aversion: Uncertainty over the state of the economy and the future path of U.S. interest rates have investors retreating to safety.

- Investors are still worried that problems within the regional banking system will spill over to the broader economy. On Thursday, several regional lenders ran into financial trouble. PacWest (PACW, $3.17) shares tanked after it confirmed that it was exploring strategic options including a possible sale. Meanwhile, Western Alliance’s (WAL, $18.20) stock took a hit following a now debunked report stating that it was considering a sale. At the same time, a deal for TD Bank (TD, $60.33) to take over First Horizon (FHN, $10.06) collapsed. This overall weakness in the regional banks has led to a steep drop in the sector’s benchmark KBW index.

- Wary investors have sought comfort in traditional safe-haven assets in response to the higher volatility. The recent bank fiasco helped push gold prices close to their all-time high on Thursday, while yields on the two-year Treasury fell 15 bps in the same period. The flight-to-safety response comes amidst rising uncertainty after a week of subpar economic data which led investors to question the health of the economy. The number of workers applying for initial jobless claims hit a six-week high last week; meanwhile, labor productivity was shown to have contracted in the first three months of the year. On Thursday, concerns about the economy helped push the VIX index past the critical level of 20.

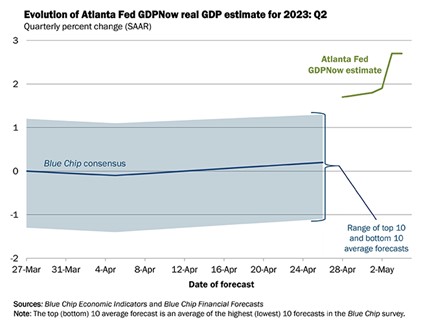

- The shift away from riskier assets reflects overall concerns about an imminent downturn. Luckily, these worries have yet to fully materialize in the data. The latest nowcast model from the Federal Reserve Bank of Atlanta estimates a 2.7% annualized rise in GDP for Q2. Additionally, April’s jobs report shows that the economy is still adding 200k+ jobs a month. As a result, the Federal Reserve may be more inclined to hike rates at its next meeting than the market realizes. That said, safe-haven investments, particularly in precious metals, may be a way to protect against a sharp reversal in economic activity.

African Spotlight: Influence over the commodity-rich continent is becoming increasingly important as the U.S.- and China-led blocs search for additional resources to fuel their economies.

- After years of neglect, the West is now looking to reengage African countries. German Chancellor Olaf Scholz started his three-day trip across the continent earlier this week and is expected to push for deeper Western integration. Meanwhile, Japanese Prime Minister Fumio Kishida told African leaders that G-7 countries are prepared to cooperate to help resolve the conflict in Sudan and would like to invest more in the region. The new attention on African nations is meant to offset the inroads made by China and Russia as the major blocs look to secure access to the continent’s energy commodities and growing market.

- However, the West has a long way to go before it is able to catch up to China. Beijing’s Belt and Road Initiative has invested over $155 billion in the continent over the span of two decades. In comparison, the U.S. has financed roughly $14 billion worth of projects from 2007 to 2020. The funding gap has led to concerns that the West may not be able to convince African governments to join the U.S.-led bloc. For example, it was reported that South Africa allowed a sanctioned Russian aircraft to land on one of its bases earlier this week.

- Africa may not have many investment opportunities at this time, but it still has much potential. The continent’s population is expected to account for 20% of the world by 2030 and could reach 25% in 2050. The massive jump in people will help fuel GDP growth in a region that has largely been ignored by market participants. As the world breaks into regional blocs, we suspect commodity firms in Africa may be attractive for investors looking to broaden their exposure to emerging markets.