Daily Comment (May 11, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment starts with a discussion about why the market reacted so positively to a subtle drop in U.S. inflation. Next, we provide our thoughts on the latest developments in debt ceiling talks and how they impact U.S. Treasuries. Lastly, we provide an update on the ongoing competition between China and the West.

Now a Pause? A key inflation indicator bolstered investor confidence that the Federal Reserve is close to ending its hiking cycle.

- Consumer price data showed that the Fed is making progress in its inflation fight, despite only a modest decline in price pressures. Last month, the consumer price index rose 4.9% from the prior year. Although the increase only slightly beat consensus estimates of 5.0%, a deeper look into the data tells a different story. Non-housing core services inflation, Fed Chair Jerome Powell’s favorite indicator, declined to 5.2% last month from a peak of 8.2% in September 2022. The price indicator is viewed as a gauge of the wage pressures within the inflation data. Thus, its decline could give Fed officials the greenlight to pause in their next meeting.

- Speculation about the end of the interest rate hike lifted market sentiment. The NASDAQ Composite Index rose 1.04% on Wednesday as tech stocks were favored by traders looking to take on more risk. Additionally, the market is now convinced that the Fed will pause rates in June. The latest CME FedWatch Tool projects that there is more than a 90% chance that the central bank will hold rates at their current levels. Assuming the forecast is right, this may explain the strong performance in risk assets.

- At this time, there is a fundamental disagreement between the market and the Fed over the next policy steps. The market wants the Fed to cut rates as the economy slows down. In contrast, Powell insists that the FOMC should maintain rates in restrictive territory until inflation is under control. So far, there has been no sign that the Fed is ready to pivot interest rates; thus, it is still likely that it will keep rates elevated throughout the year. As a result, the market will likely see a lot of uncertainty over the next few months.

Debt Fiasco: The ongoing dispute over raising the debt ceiling is already starting to spill into financial markets.

- The two major parties continue to use the threat of triggering a potential crisis as the debt deadline approaches. On Wednesday, former President Donald Trump urged Republicans to push the country into an unprecedented default unless the Democrats commit to massive spending cuts. Meanwhile, his successor has floated the possibility of using the 14th Amendment to remove the debt ceiling. Congress has only six scheduled legislative days left, and there does not seem to be a pathway toward an agreement.

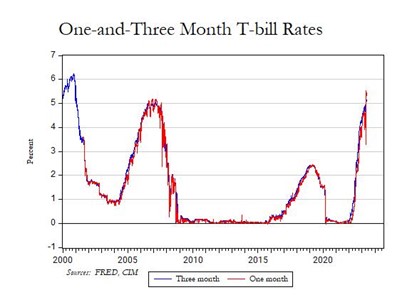

- Uncertainty over whether the U.S. will default on its debts has caused disarray within the Treasury market. One-month Treasury-bill yields have surpassed three-month government yields at levels not seen since one-month Treasury bills were introduced in 2001. This divergence is related to investors’ discomfort with the political brinkmanship over raising the debt ceiling. There is growing fear that the two sides will be unlikely to come to an agreement before the debt limit’s June 1 deadline. Failure to raise the debt limit could have catastrophic consequences for the U.S. economy and will undoubtedly push the country into recession.

- Congress will likely feel pressured to act on the debt ceiling when the market friction moves from the Treasury bills into equities. The lack of equity movement related to the standoff is due to market confidence that lawmakers will eventually come to an agreement even if it includes a few defections. Thus, market participants have been able to focus their attention on other market-related events. This dynamic will change over the next couple of weeks as the impasse draws more attention from investors. At this time, we suspect government officials may look for a temporary solution to avoid a default.

Beijing Pivot: As the West reduces its dependency on China, Beijing is looking to build ties with emerging market countries.

- Government officials in Europe are slowly distancing themselves from the world’s second-largest economy. Italy is expected to hold talks about a possible exit from China’s Belt and Road Initiative. At the same time, German Chancellor Olaf Scholz has described Beijing as being a “systemic rival” and has urged other EU countries to scale back their reliance on China. European countries’ decision to create “strategic distance” is related to concerns that China is looking to replace the global system with something that reflects its own ideology.

- China has looked to developing countries to hedge against its potential decoupling from the West. On Thursday, Ecuador signed a free trade agreement with China that would boost non-oil exports. However, the deal will likely face resistance as it makes its way through the legislature. Across the Pacific, local governments in China have looked to raise capital from sovereign wealth funds in the Middle East. Officials have held talks with the Qatar Investment Authority, subsidiaries of Saudi Arabia’s Public Investment Fund, and the Abu Dhabi Investment Authority. The recent outreach in the Middle East and South America shows how China is prepared to recruit from areas within the U.S.’s sphere of influence.

- Neither the West nor China wants an abrupt end to the trading relationship. Despite President Biden’s tough rhetoric, his administration has been aggressive in pushing the two Major Powers to reengage in talks. Secretary of State Antony Blinken is preparing to set up a visit to China later this year. At the same time, Defense Secretary Lloyd Austin has expressed interest in meeting China’s new defense minister Li Shangfu at an upcoming summit in Singapore. So far, China has rebuffed offers for communication as it describes Washington’s attempts at dialogue contradictory to its broader goal of Chinese containment. However, its lackluster recovery following the end of its Zero-COVID policy may force China to eventually relent to talks.

- We believe that the markets will welcome any sign of an easing of tensions between the West and China but talks alone won’t lead to an overall improvement in the relationship.