Weekly Energy Update (May 11, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Although prices have bounced to return to the lower end of the $84/$72 trading range, recession fears continue to dominate sentiment.

(Source: Barchart.com)

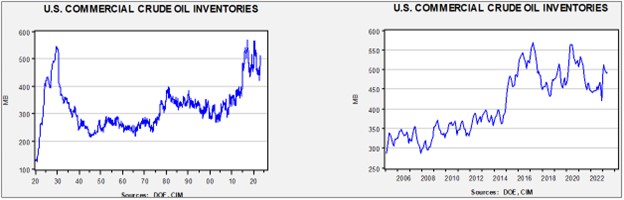

Commercial crude oil inventories rose 3.0 mb compared to the forecast draw of 2.5 mb. The SPR fell 2.9 mb, putting the total draw at 0.1 mb.

In the details, U.S. crude oil production was unchanged at 12.3 mbpd. Exports fell 1.9 mbpd, while imports declined 0.8 mbpd. Refining activity rose 0.3% to 91.0% of capacity.

(Sources: DOE, CIM)

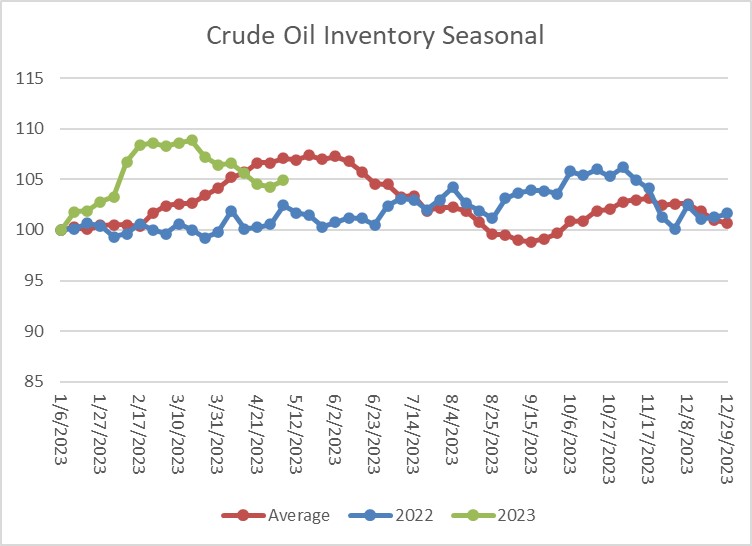

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined. This week there was an increase, although storage levels remain below seasonal norms.

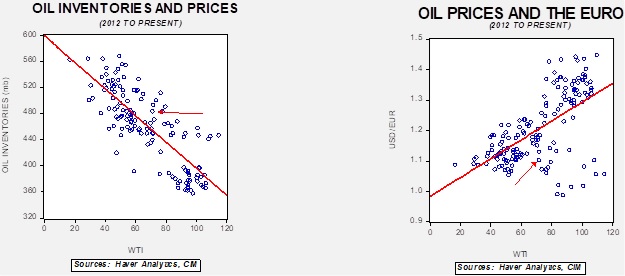

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $58.00. Although OPEC+ is trying to stabilize the market, recession worries are clearly pressuring crude oil prices.

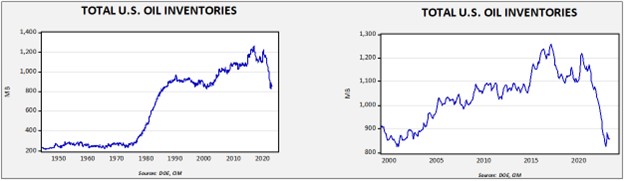

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $93.53.

Market News:

- Shale oil has been mothering short of a revolution, but there are worries that we may already be past the peak in production. If so, the impact on the world economy could be profound.

- The U.S. Chamber of Commerce has come out in support of streamlining the permitting process.

- As oil company earnings have risen, so has talk of a windfall profits tax.

- We live in divided times and there are very few topics that unite groups in America. Opposing China is one such issue that has become bipartisan, as is the recognition that local opposition to energy projects is slowing buildouts, whether they be tied to the fossil fuel industry or renewables. Congress has tried to address the issue of “red tape,” but we don’t expect this issue to be resolved anytime soon.

- Usually, the focus on temperature-related energy consumption is focused on winter when cold temperatures drive the demand for heating. Increasingly, though, summer cooling demand is becoming significant as well. Last week, we noted that Southeast Asia is suffering from extreme temperatures early in the season, and hot, dry weather is triggering wildfires in Alberta, Canada. We also note that China is warning that a hot summer could lead to power shortages.

- Iraqi policymakers are renewing their focus on energy with a major goal being self-sufficiency in natural gas. Iraq probably does have the resources as its associated gas flaring is the world’s second largest.

- The Biden administration is floating the idea of imposing an energy tax on crypto mining. Data suggests the activity is the fourth largest consumer of household electricity.

- Russian natural gas production has declined 10% so far this year.

Geopolitical News:

- As China and the Kingdom of Saudi Arabia (KSA) have agreed to price oil sales in CNY, there has been a notable uptick in Chinese investment into the KSA.

- We note that National Security Advisor Jake Sullivan is in Saudi Arabia this week as part of a trip to the UAE and India. It appears that part of this visit will include a discussion on a possible U.S./KSA railway project, perhaps to compete with China’s Belt and Road Initiative.

- As is often the case when sanctions are applied, firms willing to violate the sanctions (and bear the risk) can be rewarded with unusual profits. In the case of Russia, Greek firms appear to be the most active. Indian shippers are also involved.

- The G-7 price cap has led the Kremlin to boost taxes on energy companies. Falling production and sales have crimped tax revenue and the state has decided to raise taxes to maintain revenues. Of course, this action will also reduce revenue for investment.

- There is a raging debate underway surrounding the USD’s reserve currency status. Our take is that U.S. financial sanctions are encouraging nations that are fearful of sanctions to develop alternative international trade and financing arrangements. We doubt these arrangements will totally supplant the dollar’s deeply entrenched status. We note that Russia and India suspended talks on settling trade in INR, most likely for the simple reason that Russia has realized it would accumulate the Indian currency without a clear way to recycle the INR.

- At the same time, Pakistan says it wants to buy Russian oil with CNY. Pakistan is a major recipient of Chinese aid and investment, and thus, is likely to find it easier to secure CNY instead of USD.

Alternative Energy/Policy News:

- The UAW has refrained from endorsing Biden for reelection. The union is worried about the EV movement. Since EVs have fewer parts than an ICE vehicle, job losses will be inevitable. We don’t doubt that an endorsement will eventually arrive, but it’s a warning to Biden that he may have to support the UAW which will likely mean higher prices for EVs.

- The IEA notes that 15% of energy-related emissions come from oil and gas operations. Fortunately, the agency notes that existing technology exists to curb these emissions at affordable costs.

- Although controversial, this graphic shows the allure of atomic power due to the fact that the energy density of uranium dwarfs all other forms of energy.

- Microsoft (MSFT, $310.52) has agreed to purchase nuclear fusion energy beginning in 2028 from a privately held firm called Helion. Although we are not sure anyone will have commercially available fusion power at scale, the fact that a large company like Microsoft is willing to forward purchase power can help boost investment and research.

- Toyota (TM, $138.18) announced it will supply hydrogen fuel cells for semi-trailer trucks. Although battery technology dominates light vehicles, the batteries are too heavy to be practical for over-the-road trucks. Hydrogen offers an alternative to diesel-powered trucks. Toyota has lagged in the EV space, in part, because it has been more focused on fuel cells. In this application, hydrogen may pay off.

- The GOP and nine Senate Democrats have passed a measure to overturn President Biden’s pause on solar tariffs; Biden has signaled he will veto the resolution. There has been a constant state of tension between those who want to source alternative energy production domestically (at higher costs) or leave the possibility open to import solar panels from China (the world’s low-cost producer).

- Lawmakers are also displeased with the administration’s easing of local content rules for critical minerals.

- Israel unveiled a massive thermal storage operation which is expected to open by year’s end.

- There is growing alarm over recent moves by nations in South America to nationalize various mineral mining operations. Moves to nationalize lithium, specifically, have raised concerns.

- Eighty percent of new cars sold in Norway are EVs. The good news, so far, is that the grid has handled the change well, the cars are quieter, and pollution is much lower. The bad news is that it has hurt the established car makers and lines have developed at charging stations.

- There is growing concern about the U.S.’s deficits in rare earths, which are critical for the energy transition. We note that a large rare earths deposit has been found in Wyoming.

- The Biden administration is moving to expedite a manganese and zinc mine in southern Arizona but is running into environmental opposition.

- Direct carbon renewal projects are starting to operate. These are being helped by carbon-credit exchange markets. However, environmentalists are increasingly opposing these efforts, fearing that they will reduce the incentive to reduce fossil fuel usage.

- Direct lithium extraction technology promises to boost production of the key mineral significantly.

- China’s outbound foreign direct investment has been declining over the past decade. One bright spot, though, is China’s investment in European EV battery factories. This development could be problematic and is similar to the issues regarding solar panels. China is the low-cost producer of EV batteries, so having China build factories in Europe accelerates the energy transition. However, allowing China to build these factories makes European EV producers more dependent on and vulnerable to China.

- Glencore (GLNCY, $11.24) is planning to build Europe’s largest EV battery recycling plant.