Daily Comment (May 18, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment starts with an update on the U.S. debt-ceiling discussion and an explanation as to why it may not be as bullish as some investors would expect. Next, we explain why calls for a Fed interest rate cut in September may be a bit premature. Finally, we end with our thoughts about how global fracturing may improve relations between governments and corporations.

The Debt Ceiling: Market sentiment was lifted on Thursday after President Biden reassured investors that the government would not default on its debts.

- President Joe Biden and House Speaker Kevin McCarthy announced that the two would meet to discuss the debt ceiling. Negotiations are expected to occur and include the potential for a deal on Sunday after President Biden returns from his trip to Japan. Talks between the two leaders will focus on possible budget cuts as the Republican party aims to reduce the deficit through spending decreases and Democrats look to increase government revenue. The two sides remain far apart on a potential agreement, but after weeks of posturing, there is now progress.

- Markets welcomed the announcement; however, there are still concerns about whether the two sides can reach an agreement by the June 1 deadline. On Wednesday, the S&P 500 closed 1.2% higher than the previous day, while the tech-heavy NASDAQ finished the day up 1.3%. The improvement in stocks is related to investors’ confidence that the U.S. government will avoid breaching the debt limit and triggering an unprecedented default. That said, government data released Monday showed that the Treasury’s cash balance fell below $100 billion, suggesting lawmakers are less than a month away from hitting the government’s spending cap.

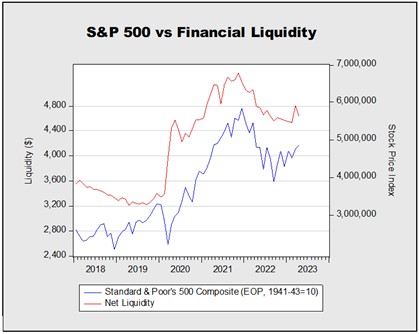

(Source: Haver Analytics, CIM)

- A lift in the cap will potentially lead to a knee-jerk reaction in the market, but we would not expect it to last. Over the last few weeks, policymakers have used the cash pile in the Treasury Government Account to keep the government afloat during the debt-ceiling showdown. Research from Strategas shows that the TGA spending has offset much of the impact of quantitative tightening, leading to an overall increase in net liquidity within the financial system. If the two sides agree by Monday, it may lead to a temporary bounce; however, the lack of cash injection would make it difficult for the market to sustain any rally.

Fed Speak: Policymakers have left the door open for an additional hike despite signs that the economy may be slowing.

- Investors have adjusted interest rate expectations after several Federal Reserve officials signaled support for another rate hike in June. The latest CME FedWatch Tool shows that the probability of a 25 bps rise in the Fed benchmark policy rate increased from 10.7% a week ago to 27.3% as of this morning. Earlier this week, Richmond Fed President Thomas Barkin and Cleveland Fed President Loretta Mester maintained that another interest rate increase is not off the table. Meanwhile, Atlanta Fed President Raphael Bostic emphasized that he prefers a Fed hike over a cut. The hawkish tone has added pressure on the dollar as traders are less confident that the central bank is ready to pivot.

- Fed officials’ preference toward higher rates comes amidst signs that financial conditions are tightening while household debt burdens are rising. A Fed survey of Senior Loan Officers showed that financial institutions have looked to tighten credit standards in response to economic uncertainty and concerns about funding costs and liquidity. Even buy now, pay later services have reduced or limited credit availability. The lack of credit will likely crimp consumption. Over the last few months, households have looked to fintech to purchase everyday essentials such as groceries. Additionally, the latest data from the New York Fed showed that consumer debt and delinquencies are currently still below dangerous levels but are on the rise.

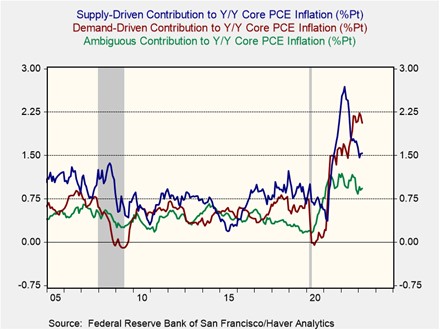

- Despite investor expectations, it is unclear whether the Fed will cut rates during a recession. JP Morgan Asset Management stated that it supports the market view that the Fed will cut as soon as September. The remarks reflect previous Fed reactions to recessions where it cut aggressively to protect the labor market. However, this time may be different. As the chart above shows, aggressive interest rate increases have done little to reduce demand-driven price pressures. As a result, we suspect that the Fed may decide to keep rates higher for longer before it chooses to pivot. This scenario raises the likelihood of a prolonged recession.

Global Repositioning: State involvement in industry is becoming more prevalent as countries prepare to move into blocs.

- The U.S. push for its allies to provide more support for the green transition is starting to gain traction. On Thursday, the United Kingdom hinted that it might offer clean energy subsidies to firms in response to Joe Biden’s Inflation Reduction Act, despite rejecting the approach initially. The shift in sentiment is related to concerns that Brexit rules will prevent automakers from manufacturing electric vehicles in the U.K. Earlier this week, automaker Stellantis NV (STLA, $16.18) warned the U.K. government that it was becoming too expensive to assemble cars in Britain.

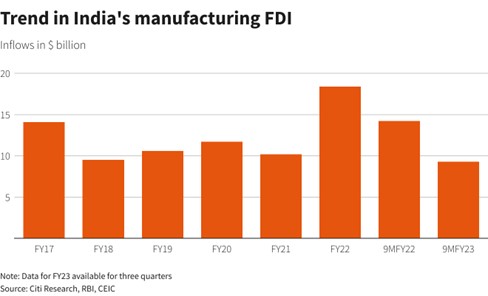

- At the same time, India is taking advantage of the uncertainty related to the ongoing rivalry between the U.S. and China to attract foreign investment. New Delhi announced plans to offer $2 billion in financial incentives to bring more tech production to India. Earlier this year, Apple (AAPL, $173.06) announced plans to build more of its iPhones in India, but it has yet to begin making its iPads and computers in the region. The new initiative will improve the level of foreign direct investment into the country, which is projected to increase modestly in the 2024 fiscal year. As the chart below shows, the current rate of FDI flows in India lags behind the previous year.

- The fragmentation into global blocs will likely bring government and state interests closer. This dynamic will lead to greater cooperation between lawmakers and businesses that look to prioritize national strategic aims over wealth accumulation. A similar situation occurred during WWI when households loaded up on government bonds to show patriotism. Additionally, firms had friendlier relations with their workers during those times of war in order to maintain positive national sentiment. As a result, we suspect that firms that have close ties with the U.S. strategic aims like defense and aerospace should make suitable long-term investments.