Weekly Energy Update (May 18, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices were mostly steady over the past week. Recession fears continue to stifle price movements.

(Source: Barchart.com)

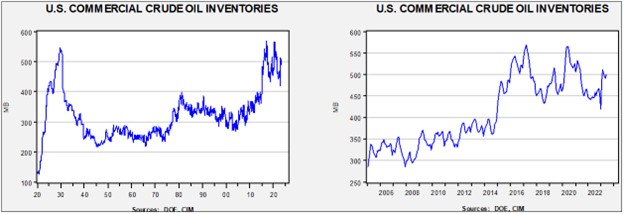

Commercial crude oil inventories rose 5.0 mb compared to the forecast draw of 2.0 mb. The SPR fell 2.4 mb, putting the total build at 2.6 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 12.2 mbpd. Exports rose 1.4 mbpd, while imports increased 1.3 mbpd. Refining activity rose 1.0% to 92.0% of capacity.

(Sources: DOE, CIM)

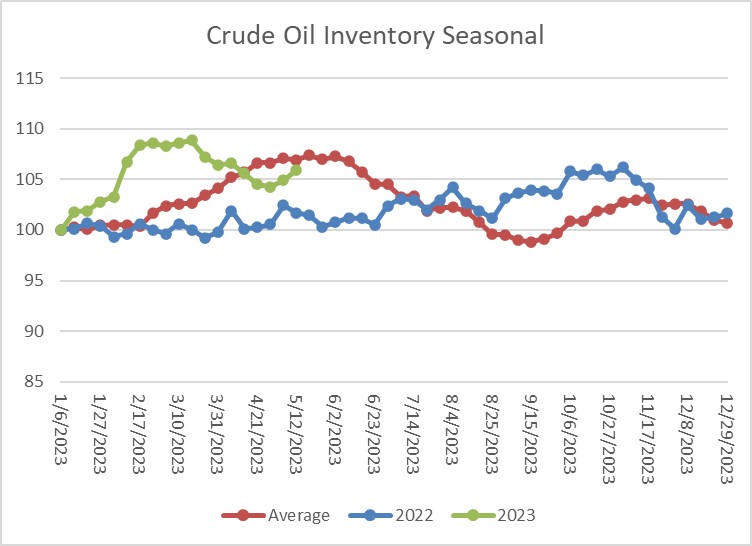

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined. For the past two weeks, stock have increased, putting the current level near average.

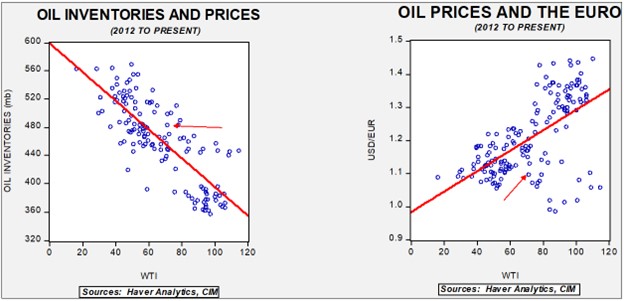

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $56.42. Although OPEC+ is trying to stabilize the market, recession worries are clearly pressuring crude oil prices.

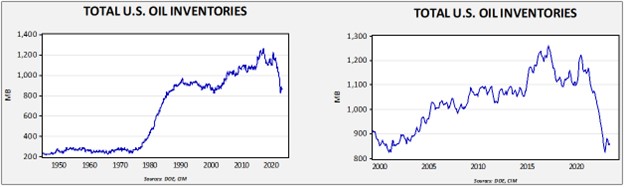

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $93.20.

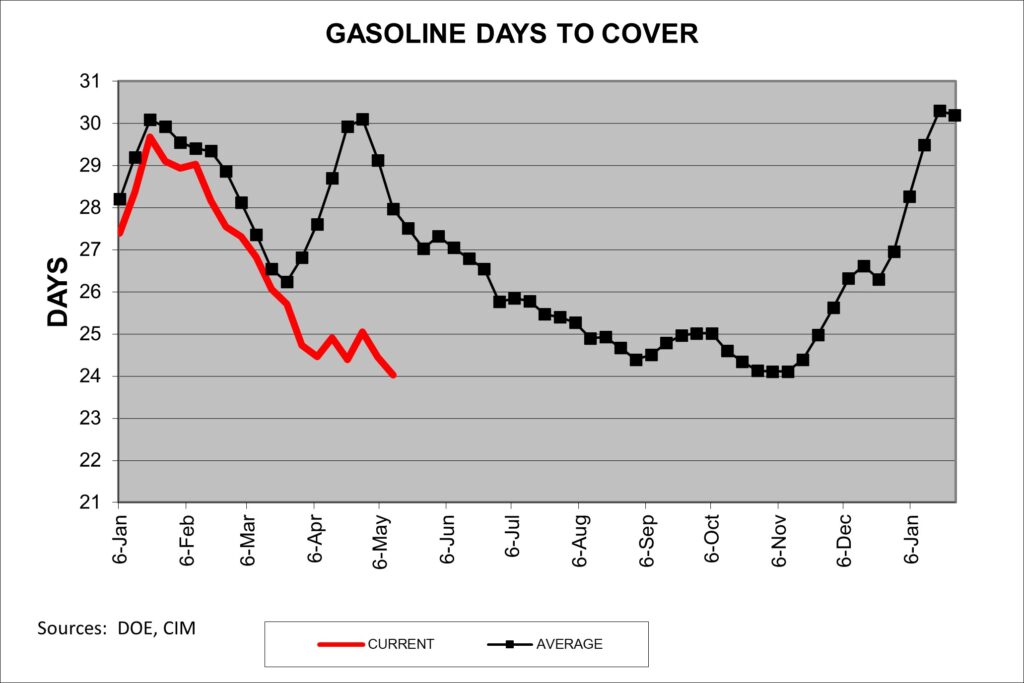

Gasoline markets are tight.

The previous chart shows the number of days the current level of inventory could cover based on current demand. The latest reading is 24 days, a level we usually see in late October, well after the summer driving season has ended. As the five-year average shows, we usually have about six more days of inventory available as we swing toward Memorial Day. Barring a sharp decline in demand, we are going into the summer with unusually tight gasoline supplies, which may boost prices.

Market News:

- The IEA projects that the oil market will tighten rather dramatically in the second half of this year. The forecast assumes strong Chinese demand.

- Although we continue to harbor doubts this will ever occur, the DOE has issued parameters to add 3.0 mb to the SPR in August. If prices are above $70 per barrel, we doubt the order will be executed; in addition, this is a very small amount given the fact that 231 mb have been drained since the start of 2022.

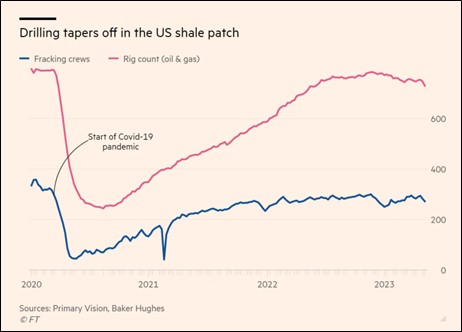

- There is growing evidence that the shale boom is fading. Rig counts have stalled, and some new rigs are being auctioned off at low prices. The bargain prices on rigs may simply reflect overbuilding, although rig count growth has clearly slowed.

- The DOE is projecting higher natural gas prices this year.

- Kazakhstan oil exports jumped 24% in March when compared to last year. The sharp rise reflects the disruptions caused by the war in Ukraine. We also note that Russian oil exports hit a post-invasion high in April, although the price for Russian oil has declined, leading to less revenue. To some extent, this was the goal of the U.S. from the outset—to maintain global supply levels for crude oil (to avoid high prices) but reduce Russia’s revenue—which it seems to have achieved. Thus, supply has remained elevated, which has kept prices lower than expected.

- An El Niño event is forming quickly and the NOAA says it will be significant. This will likely mean a warm winter. So far, 2023 is setting up to be the fourth warmest April on record over the past 174 years, and heat advisories have been issued for the Pacific Northwest. This El Niño is expected to boost global temperatures past the 1.5 C mark in the next few years, which has been a target for some environmental actions.

- With the EU outlawing the sales of internal combustion engine (ICE) cars by 2035, and the U.S. taking steps to advance the conversion, there is some concern that gasoline demand will decline. However, it’s important to remember that ICE vehicles have an ever-expanding lifespan, with the current average light vehicle lifespan being 12.5 years and it can be even longer for cars. That means that most ICE vehicles sold today will still be running into the mid-2030s.

- The EIA projects that EV new car sales will reach a 15% market share by 2030 but could flatten after that. If this prediction is correct, it suggests that oil will be needed well into this century.

- At the same time, we note that French President Macron has called for a time out on EU environmental regulations. He is worried that European firms won’t be able to compete against foreign companies less encumbered by environmental rules.

- Canadian oil prices often trade at a discount to U.S. prices due to the lack of transportation. However, as bottlenecks ease, we are seeing spreads narrow.

- Argentina is preparing to use natural gas from the Vaca Muerta (“dead cow”) shale fields to offset imported gas from Bolivia.

Geopolitical News:

- Iran’s economic minister is visiting the Kingdom of Saudi Arabia, providing further evidence of the diplomatic thaw between the two countries.

- Iraq and Shell (SHEL, $60.13) are in a joint venture to supply gas to an electric utility that is mostly owned by an Iranian company.

- The EU and G-7 have barred states in both groups from accepting natural gas from Russian pipelines. The goal is to take away any idea that Russian piped gas could return at some point, because if that hope was available, it might curtail the investment necessary to transition away from Russian gas.

- Venezuela is issuing export licenses to European oil companies. The two companies, ENI (ENI, $29.02) and Repsol (REP.MC, EUR, 13.30), already plan to export LNG and other natural gas liquids. The goal now is to export oil as well. Gradually, Venezuela has seen the sanctions regime ease.

- As we have noted in recent weeks, Russian oil is being processed into products and sold around the world. The EU is being pressed to stop buying these refined products to maintain sanctions on Russian oil.

- One way the EU is trying to protect their industrial base from environmental rules is with a carbon tariff. The idea is that if Europe has strict environmental restrictions, then foreign nations that don’t deploy similar policies will undercut EU prices. Foreign nations often view such measures as protectionist; we note India is taking its case to the WTO with regard to these carbon tariffs.

Alternative Energy/Policy News:

- The Biden administration has proposed sweeping new rules on electric utilities designed to reduce carbon emissions. As we noted last week, the Supreme Court may limit the ability of agencies to make such shifts, but regardless, the White House is moving ahead despite the risks. We do note that the rules may support carbon capture, which is controversial among environmentalists. Most carbon capture activity is occurring in the natural gas processing industry. The Biden administration is boosting funding for various carbon storage projects. Politically, these projects make sense as they allow for the continued use of fossil fuels but mitigate the carbon impact. Of course, most of these carbon storage methods are untested, but if they work, they will offer a “middle of the road” approach to deal with carbon emissions.

- The White House is also trying to ease permitting regulations, which has support from both fossil fuel proponents and environmentalists. However, streamlining permitting will remove one of the key tools used by environmentalists to thwart the expansion of pipelines. In the debt-ceiling talks, the GOP is trying to streamline oil and gas permitting while thwarting the expansion of power lines, which would be needed to make wind and solar more efficient. We suspect this stance is for bargaining purposes.

- Even in oil country, there is concern about carbon capture, since safely storing tons of CO2 underground is a new industry.

- Recent climate laws have around $11 billion in funding for rural low and zero emissions power projects. This money is designed to help co-ops deploy renewables, capture carbon, and execute other projects.

- One of the conundrums that we have been watching is that the conversion from fossil fuels will require lots of mining, some of which is environmentally disruptive. As environmental groups oppose mining projects, they are creating supply issues on critical metals needed for renewable energy technologies.

- Distributed power will raise costs for consumers who remain with traditional electric utilities. It may be necessary to tax those who install solar panels on their homes and businesses for equity reasons, but doing so will reduce the impact of distributed power.

- As the Biden administration unveils its rules for solar power subsidies and credits, the domestic solar panel industry is disappointed in the level of Chinese content that is still allowed for subsidies and credits. A number of companies in this area saw stock gains on the news. Still, there is fear that the rules will allow China to dominate solar power.

- On the EV side, Lithium Americas (LAC, $21.80) is splitting from China’s Ganfeng Lithium Group to develop a project in Nevada. The affiliation with China was becoming an issue.

- The president has vetoed a resolution that would have prevented the Commerce Department from suspending tariffs on Chinese solar panels. The panel manufacturing industry wanted the tariffs to remain in place, while the installers wanted access to cheap Chinese solar panels.

- As we have noted in recent weeks, there is interest in using less costly materials in EV batteries. One being considered is a lithium-iron-phosphate battery, which uses less nickel compared to other battery formulations. This battery tends to lose power in cold temperatures, but new developments suggest this downside could be limited.

- The Inflation Reduction Act upset the Europeans as it created subsidies to build out the EV infrastructure. European firms in this industry, including automakers, are considering investments in the U.S. to take advantage of these incentives. European nations are trying to figure out if and how they can match the support of the U.S. act. Recently, Germany offered Northvolt, a private Swedish battery maker, subsidies to build a battery factory in Germany. The EU has been trying to craft a broad European response, but individual nations have started to move independently.

- EV sales in Asia are rising rapidly. China is positioned to dominate the global EV market.

- China is the majority supplier of key EV components. This dominance includes both raw materials and processing. Through industrial policy, China has steered its economy toward creating the industrial structure needed for this transition.

- Other automakers are giving up on the Chinese market due to the growing prowess of Chinese firms. And it’s not just foreign firms. Chinese firms, as well, are locked in stiff competition with each other. The competition is leading to rapidly falling prices.

- For the rest of the world, there is a growing possibility that nations will either (a) import Chinese EVs at low cost to expand EV usage, or (b) exclude Chinese EVs to protect domestic industry. The consequence to the first choice is low inflation (imagine $15k new cars) and expanded EV adoption at the cost of harming domestic industry. The second choice supports domestic industry and jobs but slows the adoption of EVs and likely triggers higher inflation.

- Increasingly, automakers are being forced to buy mines to secure key metals for batteries. This vertical integration is similar to the early days of ICE vehicles.