Daily Comment (May 24, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a few new developments in Russia’s invasion of Ukraine. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including new evidence of the threat from China’s hypersonic missiles and economic retaliation against other Western countries, plus a few items of note on the U.S. financial markets.

Russia-Ukraine War: Two right-wing Russian militias that support Ukraine reportedly attacked and occupied at least one Russian village less than a mile from the Ukrainian border earlier this week. The groups were then surrounded and destroyed by Russian forces yesterday. Ukrainian officials acknowledged they were aware of the incursion but denied any involvement in it beyond “cooperating” with the groups. All the same, reports yesterday said the groups had used U.S.-made military vehicles in the raid, including at least two M1224 MaxxPro armored vehicles and several Humvees. The State Department responded to the allegation by reiterating that the U.S. doesn’t “enable or encourage” Ukrainian attacks on Russia itself. The attack could marginally help the Ukrainians by diverting Russian military resources to the border area and undermining the Russians’ sense of security within their own country. Nevertheless, we believe the use of U.S. equipment in the incident raises the risk of U.S.-Russian conflict.

- Separately, in an effort to bolster the U.S.’s commitment to aiding Ukraine, former British Prime Minister Boris Johnson gave a pro-Ukrainian speech on Monday to a group of prominent conservative politicians, donors, and business executives in Dallas. In his speech, Johnson said, “I just urge you all to stick with it . . . . It will pay off massively in the long run.”

- In another effort to address pushback against the U.S.’s support for Ukraine, a new media commentary directly addresses the controversy as to whether the U.S.’s aid to Kyiv is undermining its ability to deter China from seizing Taiwan.

- The article notes that most of the U.S. military equipment sent to Ukraine so far was designed for a major ground war, leaving most of the naval and air assets needed to deter China in the Indo-Pacific region untouched.

- The article argues that even if aid to Ukraine has depleted some of the U.S. arsenal, it may actually increase the country’s deterrence against China by signaling the U.S.’s resolve to protect fellow democracies from territorial aggression.

China-United States: Speaking of a potential U.S.-China conflict, a Chinese technology magazine this month published details of a People’s Liberation Army war game in which just 24 hypersonic missiles were able to destroy a U.S. aircraft carrier and its strike group. Using a complex three-way attack strategy, the missiles were reportedly able to sink the entire U.S. force in each of the 20 iterations of the game. Of course, the report can’t be independently verified, and it may not be indicative of China’s true hypersonic capabilities. Nevertheless, it does underscore China’s head start in hypersonic technology even as the U.S. continues to struggle with its program and with its decision whether to emphasize the hypersonic technology itself or just anti-hypersonic missile defense.

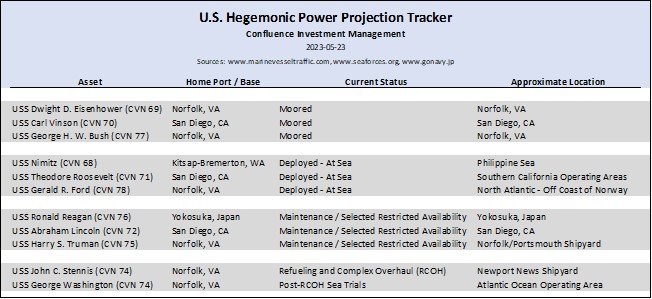

- Separately, the USS George Washington, one of the U.S. Navy’s 11 aircraft carriers, embarked on Monday for sea trials following a full six years out of service due to major maintenance.

- The vessel’s maintenance period was expected to be four years, but it was disrupted due to issues such as the COVID-19 pandemic, cannibalization of some systems for spare parts to be used on other carriers, a shortfall in maintenance funds, and its unexpectedly bad condition when it entered the maintenance period.

- Once the ship is back in service, it could help relieve the shortage in carrier availability as geopolitical threats continue to worsen. The table below shows the current status of all U.S. aircraft carriers. (Note that none are anywhere close to the Persian Gulf and its critical oil supply lanes.)

Germany: The latest trade statistics show German exports to China in January through April were down a whopping 11.3% from the same period one year earlier. The drop reflects German automakers’ reduced market share in China, high costs for German chemical producers and other energy-intensive manufacturers, and the euro’s recent appreciation versus the dollar.

- However, the drop in Chinese demand could also reflect explicit or implicit retaliation for the European Union’s recent hawkishness against China.

- If so, it would provide more evidence that the world is indeed fracturing into relatively separate geopolitical and economic blocs, as we have been arguing.

United Kingdom: In a speech today, Chancellor of the Exchequer Jeremy Hunt warned that persistently high inflation will prevent the government from cutting taxes anytime soon, based on concerns that tax cuts would provide extra stimulus to the economy and boost prices further. The chancellor offered assurances that he wanted to cut the U.K.’s tax burden—currently the highest since World War II—but he first had to create economic conditions where it was safe to do so.

- Hunt’s speech came on the same day that the U.K. statistics agency issued its latest report on consumer price inflation. The April consumer price index was up 8.7% from the same month one year earlier, suggesting inflation cooled significantly from the 10.1% increase in the year to March. However, the April CPI still overshot expectations, which had been that inflation would cool to 8.4%.

- The chancellor’s speech reflects how inflation is discouraging tax cuts in many developed countries; at the same time, politicians are loathe to use tax hikes to cool demand and bring down inflation.

Pakistan: The country’s anti-terrorism court yesterday granted Former Prime Minister Khan bail on his corruption and terrorism charges, marking another step in the seesaw legal battle between Khan and the government. The arrest of Khan and the government’s effort to prosecute him continue to rile the country’s politics, making it even more difficult to address Pakistan’s economic and financial crisis.

Mexico: President Andrés Manuel López Obrador said his administration is considering buying retail bank Banamex, the country’s fourth-largest bank and a unit of Citigroup (C, $45.91) which the U.S. financial giant put up for sale last year. A well-known Mexican businessman has already bid for Banamex, but the leftist-nationalist president indicated that if the private bid fell through, he would have the government buy it in a public-private partnership to make sure it stays in Mexican hands.

- Any such government purchase of Banamex would increase concerns about AMLO’s penchant for nationalizing businesses.

- That would likely be a further headwind for Mexican stocks, which otherwise would probably be benefiting more from the way global companies are “near-sourcing” production away from China.

U.S. Fiscal Policy: Staff-level negotiators from the Biden administration and the office of House Speaker McCarthy met yesterday to hash out the details of a deal to raise the federal debt limit and avoid a potentially devastating default, but they reportedly made little, if any, progress. Other reports this morning suggest Biden and McCarthy will talk later today. Direct talks between Biden and McCarthy will likely be necessary to secure a deal before the apparent deadline of June 1, when the federal government may no longer be able to pay its bills without taking on new debt.

U.S. Stock Market: Even though institutional and individual investors have cooled their stock purchases in the face of rising interest rates and recession fears, data from Birinyi Associates shows companies in the Russell 3000 have announced plans to buy back more than $600 billion of their own stock so far this year, matching last year’s record pace. If actual purchases for the full year come in above $1 trillion, as the first-half pace implies, the buybacks could provide an important support for stock values despite the current headwinds in the market.

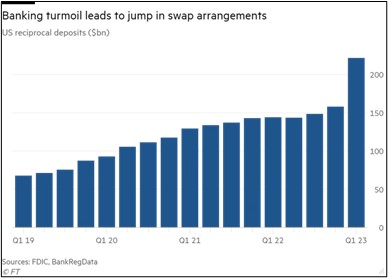

U.S. Banking Industry: To hold on to large depositors with account balances well above the insured amount of $250,000, many regional banks have reportedly boosted their offerings of “reciprocal accounts.” In these accounts, a customer’s large deposit balance is divvied up and shared among partner banks so that each carries just the insured amount.

- The goal is to keep the customers who were spooked by this spring’s bank failures from moving their money elsewhere.

- According to bank data firm BankRegData, deposits in reciprocal accounts soared to a new record high of $221 billion at the end of the first quarter, up from $158 billion at the end of 2022.