Daily Comment (June 1, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with our thoughts on the ongoing debate as to whether the Federal Reserve should hike or pause at its next meeting. Next, we explain why the European Union has taken a vested interest in the Western Balkans. Lastly, we discuss why uncertainty in China has unnerved both investors and businesses.

A Fed Divided: Much to the bewilderment of markets, Fed officials can’t seem to get their story straight regarding the path of future rate hikes.

- Federal Reserve Governors Michelle Bowman and Phillip Jefferson offered seemingly different interest rate outlooks on Thursday. During a “Fed Listens” event in Boston, Bowman implied that higher interest rates had not done enough to pull down housing inflation. Meanwhile, Jefferson warned that higher interest rates could “exacerbate stress” across the banking sector. The opposing viewpoints highlight the disagreements among policymakers as they struggle to articulate a path forward. As a result, investors have not been able to confidently gauge where interest rates will be set at the June meeting as exemplified by the CME FedWatch Tool which swung widely on Thursday. The model initially predicted a 70% likelihood of a 25 bps hike during mid-day, but it later revised its forecast to a 70% probability of a pause by market close.

- Mixed economic data partially explains why Fed officials are having trouble establishing a consensus on the future path of interest rates. The unexpected surge in the number of job openings bolstered investor sentiment regarding the labor market’s tightness, strengthening the belief that the central bank should raise rates. However, later that same day, the release of the Federal Reserve Beige Book supported a more moderate policy approach as firms expressed a decrease in hiring activity and waning inflation pressure. The conflicting business cycle indicators will complicate the efforts of the Fed to communicate a path forward for interest rates.

- The strong JOLTS report led to a rapid sell-off in equities that nearly wiped out gains made in the S&P 500 in May.

- Despite the disagreements evident within the Federal Open Market Committee (FOMC), it is highly likely that there will be no dissents at the next meeting. While members hold differing views on when to cease rate hikes, most are hesitant to signal the definitive end of the tightening cycle. Therefore, a plausible scenario is that the FOMC may indicate a hike every other meeting, a strategy often referred to as a hawkish pause. This policy adjustment will still be perceived as a form of moderation; however, the market’s response could be negative as investors generally prefer interest rates to decrease by year’s end or before a recession.

Sharing is Caring: As the war in the Ukraine rages on, the European Union is poised to broaden its reach in Eastern Europe.

- The EU countries have softened their stance with prospective members. Brussels announced that it would offer some single-market benefits to countries within the Western Balkans to prevent the region from destabilizing. The move comes amidst ethnic tensions in northern Kosovo which led to a clash between protesters and NATO peacekeepers. The measure would grant access to the bloc’s digital single market in areas such as ecommerce and cybersecurity. Additionally, the EU would also increase pre-accession funding. The decision to further integrate Western Balkan countries into the EU is meant to reduce Russia’s influence and prevent another war from breaking out in Eastern Europe.

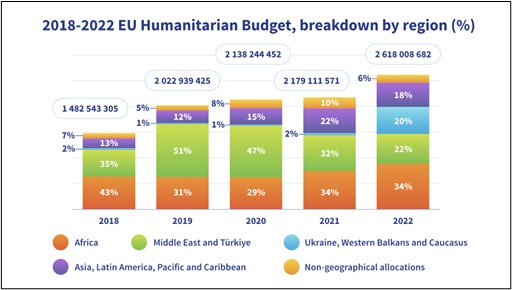

- Last year, The EU drastically increased humanitarian aid to countries in Eastern Europe.

- Additionally, the EU is doubling its support for Ukraine. Brussels is working on a four-year financial plan to support the embattled nation. The additional funding will allow Kyiv to manage its budget while it tries to repel Russian forces from its borders. Similarly, French President Emmanuel Macron signaled that he would back a path for Ukraine to join NATO. Ukraine considers membership in the military alliance as key to its future defense and security. However, Kyiv has yet to receive full support from members due to fears that adding war-fighting countries would set a dangerous precedent.

- Europe needs to pursue greater involvement within the Western Balkans to prevent Moscow from destabilizing the region. Since the beginning of the conflict, Russia has sought to broaden its war campaign by stirring up conflict in the Western Balkans. Currently, Russia is using its deep cultural and historical ties with the Serbs to help stir unrest in Bosnia-Herzegovina and Kosovo. To prevent a crisis from spiraling out of control, the EU will have to offer additional aid to prevent these countries from leaving its orbit. At this time, we suspect the greater EU involvement should be enough to prevent disputes within the Western Balkans from turning into major conflicts.

Not Yet! Prominent American CEOs want the government to cool it on talks about the U.S. decoupling from China.

- JP Morgan chief executive Jamie Dimon along with several other corporate executives warned American and Chinese lawmakers against the further exacerbating of tensions. During a summit in Shanghai, Dimon argued that the conflict between the two major powers had hurt investor confidence. His comments mirrored remarks made by Tesla CEO Elon Musk who described the U.S. and China as being conjoined twins. The sentiment expressed by the business leaders broadly reflects the unease companies have about a possible decoupling of the world’s two largest economies. As a result, we expect business leaders will try to lobby governments to resume trade talks.

- The U.S.-Taiwan trade deal reached on Wednesday will further escalate tensions as Beijing insists that any direct talks with the sovereign province is an encroachment on Chinese sovereignty.

- The recent surge in equities across Japan, Korea, and Taiwan can be attributed to investors hedging against the possibility of a decoupling between the United States and China, as well as concerns over a potential slowdown in the Chinese economic recovery. This strategic shift in portfolio allocations reflect investors’ eagerness to explore alternative opportunities within Asia. Moreover, apart from its ongoing rivalry with the United States, China’s reopening process has been characterized by fragility and unevenness, making it challenging for investors to accurately assess the country’s growth potential.