Weekly Energy Update (June 1, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices have been volatile in front of the OPEC+ meeting.

(Source: Barchart.com)

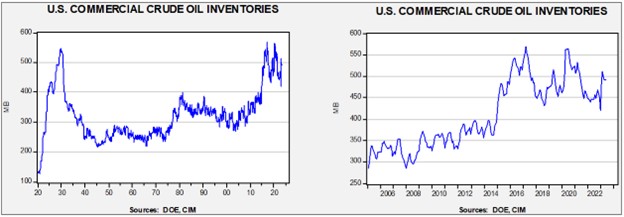

Commercial crude oil inventories fell a whopping 12.5 mb when compared to the forecast build of 1.5 mb. The SPR fell 1.6 mb, putting the total draw at 14.1 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 12.2 mbpd. Exports rose 0.4 mbpd, while imports rose 1.4 mbpd. Refining activity rose 1.4% to 93.1% of capacity.

(Sources: DOE, CIM)

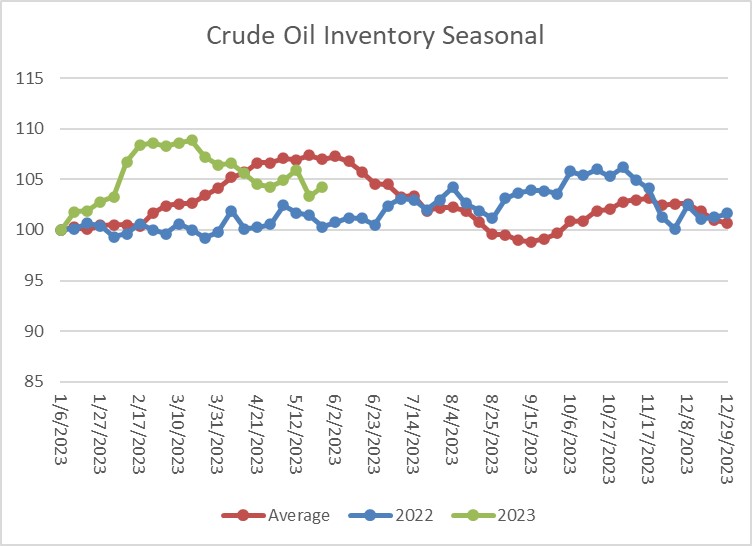

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined. As the average line shows, we are nearing the seasonal draw period, although that pattern has become less reliable with the U.S. exporting crude oil.

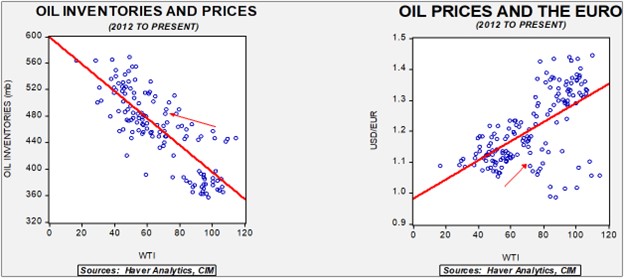

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $59.17. We will wait to see if OPEC+ (see Market News below) moves to push prices higher by cutting output.

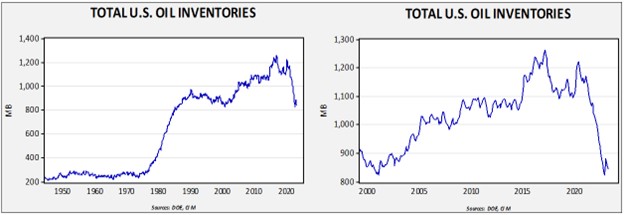

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $94.63.

Market News:

- The IEA notes that investment in fossil fuels has stalled, while investment in clean energy is rising steadily. If this trend continues, it means oil and natural gas prices will likely rise in the future.

- As we noted earlier this month, WTI Midland will now be part of the Brent basket. As U.S. oil becomes increasingly used globally, quality issues are cropping up which may affect export capacity.

- The debt ceiling situation does appear to be resolved. The proposed arrangement hammered out by the White House and the Speaker will still need to pass Congress, but we suspect it will. As the details emerge, it does look like some easing of permitting did make it in the final bill. Both the fossil-fuel and clean-energy industries are plagued by permitting Of course, both sides want to gain permitting approval while restricting the other, but such outcomes are rare in democracies. It is worth noting that the debt deal didn’t actually address transmission lines and pipelines, which will help its passage but neglects the key problems with streamlining permitting.

- Last year, coal was the largest net contributor to power generation.

- Methane is considered one of the most potent greenhouse gases, and it is also the key component of natural gas. There are increasing regulations designed to reduce methane leaks which tend to lift production costs. There are now efforts to use new technology to measure and cap unwanted methane emissions.

- OPEC+ meets this week. Last week, the Saudi oil minister warned oil speculators not to be short going into the meeting. Initially, the market rallied, but as reality set in, it’s becoming clear that the cartel is facing internal divisions as Russia is taking market share from the other oil producers, especially in the Far East. We will be watching to see how the cartel handles Russian output.

- One interesting sidelight is that OPEC+ has banned the media from their meetings. It isn’t clear why, although one possibility is that the cartel expects an acrimonious meeting due to falling prices.

- Lloyd’s of London has stopped underwriting tanker insurance on an Indian shipper that has transacted in Russian oil. Indian underwriters have stepped in to insure these fleets, but it is uncertain if the major canals will accept the new insurance as legitimate. At the same time, European insurers are growing nervous about the loss of market share to other insurers.

- Russian oil continues to flow due to a growing network of tankers that help Moscow evade sanctions.

- There are worries that this “fleet” of tankers is substandard. We note that Singapore has seen more tankers fail safety inspections.

- Production in Guyana is reported to be ramping up. It is projected to be a 1.2 mbpd oil producer by 2027, which would make it the largest oil producer in South America. Managing the windfall of revenue will be a challenge for the government (although one they probably would prefer over not having the revenue).

- Another area of potential growth is Argentina.

- Canadian tar-sand production is showing signs of increasing. Although production levels remain below pre-pandemic trajectories, the increase is notable.

- As drought spreads in China, we could see hydropower reduced, which could then lead to the use of other fuels to replace the lost power. Warm temperatures are already lifting demand. If this continues, we expect coal and LNG demand to rise.

- To a great extent, insurance is where climate change will be enforced. Firms are already leaving the California market due to persistent wildfires. At the same time, the insurance industry is shunning net-zero groups that have come under fire from the GOP. Essentially, the industry will likely be driven by the assessment of risk, which could lead to changes in underwriting that would restrict development in vulnerable areas.

- Weak natural gas demand in Europe could lead to much lower prices in some markets. We view this issue as temporary, but low prices could discourage production and raise the odds of a spike in prices this winter.

- Colombia is considering a ban on fracking, and if implemented, it may create shortages of natural gas.

- Nigeria is ending petrol subsidies, which has led to mass hoarding.

Geopolitical News:

- China continues to delay approval for another pipeline from Siberia. As we discussed last week, China appears to be getting remarkably cheap natural gas from the current Power of Siberia pipeline and is seemingly driving a hard bargain on funding a second pipeline. Russia is in a tough spot on natural gas as its pipeline network is designed to send gas to Europe, but that market has been mostly lost due to sanctions (although not completely as Ukraine is still allowing Russian gas and oil to go through its territory). Moscow needs to reroute pipelines away from Europe and toward Asia. Beijing knows this, but despite promises of friendship, it isn’t willing to invest much to support Russia’s goal of moving its gas east.

- The Kingdom of Saudi Arabia (KSA) is participating in the evasion of Western sanctions on Russia by importing Russian diesel and then re-exporting it.

- One of the key benefits of a globalized world is that countries can specialize in what they most efficiently produce, which tends to lower inflation. As geopolitical tensions lead to a breakdown of globalization, nations may be forced to manufacture items that they might not be best at but still need to produce due to insecurity of supply. China is especially vulnerable to food and energy deficiencies. Due to its high population, limited arable land, and water constraints, China has tended to be a net importer of food. With energy, China became a net importer in 1994. As relations between the U.S. and China deteriorate, Beijing is vulnerable to the U.S. Navy’s ability to close off shipping lanes. In response, China is considering new ways of securing food and energy.

- Russia has always considered Central Asia to be in its sphere of influence. In fact, during the Soviet era, the “stans” were part of the union. These areas are rich in natural resources. China is openly competing with Russia for dominance in this area, in part to secure key resources, and in part to exercise dominance over Russia.

- We also note a Russian scientist working on hypersonic missiles has been detained on charges that he was selling secrets to China.

- German regulators are promoting heat pumps and looking to ban gas-fired boilers. The Greens support this idea, but other members of the ruling coalition oppose the measure. This issue is fracturing the coalition, and although we doubt the government will fall over this measure, tensions within the coalition have been rising for some time.

- Iran has launched an alternative to the S.W.I.F.T. network in a bid to circumvent U.S. financial sanctions.

- There are reports the IAEA has resolved some of the issues surrounding Iran’s nuclear program. However, the traces of highly enriched uranium have not been resolved. As we noted last week, Iran may have built underground facilities so deep that U.S. conventional “bunker busters” can’t destroy them. Iran may be close to the nuclear weapons threshold.

- Iran has stated that it is near to unveiling an indigenous hypersonic missile.

- Security forces in Iran claim to have uncovered a large “terrorist cell” allied with Israel.

- Iran’s persistent interdiction of Persian Gulf shipping has prompted the UAE to ask for greater U.S. involvement. Although the Persian Gulf Arab states continue to woo China, when security concerns arise, these nations are not calling Beijing. At the same time, China is looking to increase its economic partnership with the KSA; it is unclear if Beijing is willing to undertake the security arrangements.

- Iran is facing a geopolitical threat from Azerbaijan. As Azerbaijan’s power rises relative to Armenia, the former could stir up ethnic unrest among the Azeri population. Azeris are the largest minority in Iran comprising around 20% of the population. Israel has good relations with Azerbaijan which further complicates matters.

- Reports indicate that Iran plans to increase attacks on U.S. troops in Syria, and if true, it will raise tensions further.

- There are reports suggesting that Egypt and Iran are mending relations.

Alternative Energy/Policy News:

- During the first decade of this century, ethanol was thought to be a way to reduce America’s dependency on foreign oil. Regulations at the time envisioned a steady rise in the ethanol fuel mix. However, the shale revolution reduced U.S. dependence on foreign oil, undercutting the national security argument for corn-based fuels. Complicating matters further was that geopolitical disruption boosted grain prices significantly; using corn for fuel is seen as boosting food prices. The Bush-era ethanol mandate has expired and it looks like the industry is being forced to defend current sales rather than boosting future use.

- There are increasing doubts about ethanol’s green credentials.

- Ethanol blending complicates the refining process which drives up gasoline costs. High gasoline prices are politically problematic.

- From the outset of the environmental movement, there have been tensions between the “Buckminster Fuller” wing and the “Thomas Malthus” wing. The former leans on technological fixes to environmental problems, while the latter believes reliance on technology creates an endless “treadmill” of solutions that leads to new problems where the only real solution is a decline in living standards. This division often emerges, and the most recent instance appears to be tied to the carbon-removal industry. The UN released a report critical of carbon renewal, because it is fearful that relying on it will curtail the drive to deploy alternative energy. However, industry experts indicate that without direct carbon capture, meeting temperature targets will be impossible.

- German police raided the homes of climate activists on suspicions that they were planning attacks on oil pipelines.

- One interesting sidenote with captured CO2 is what exactly to do with it. Although the gas has some industrial uses (in beer, for example), the amount of gas that is needed to be captured to make a difference far exceeds industrial demand. However, one way the gas could be used, paradoxically, is to make synthetic natural gas. By combining hydrogen with captured CO2, you can create a clean methane that would seemingly be carbon neutral.

- Exxon (XOM, $102.61) has made a deal with steelmaker Nucor (NUE, $132.72) to build a carbon-capture program.

- Resource nationalism is on the rise. Recently, we noted that South American commodity producers are considering nationalizing production of key metals, such as lithium and copper. The Congo wants to change its royalty arrangements with foreign firms (mostly Chinese) on copper projects, in another example of resource nationalism. This factor increases the attractiveness of key minerals in geopolitically safe places. A new lithium development in Portugal has been especially welcomed.

- Clean energy proponents are pressing to streamline projects, a complaint heard from fossil-fuel companies as well.

- The president’s moratorium on solar panel tariffs survived a potential override of his veto.

- As we noted last week, China continues to dominate in EV components. Chinese battery companies are beginning to invest in productive capacity outside of China, perhaps to avoid a deteriorating geopolitical environment between the U.S. and China. Europe is a primary target for this investment.

- The Dutch trade minister, Liesje Schreinemacher, remarked that the energy transition is probably impossible without Chinese products. We suspect that nations will be forced to either use Chinese products, build them at home at higher costs, or forego them altogether.

- Research is increasing on sodium batteries, although at this juncture, it doesn’t appear that sodium will displace lithium in EV batteries. Another possible alternative is lithium-phosphate batteries, which are safer and have a longer life span.

- Toyota (TM, $139.88) announced it will build a large electric SUV in Kentucky.

- EU leaders worry they won’t be able to match the U.S. on EV battery subsidies…which was probably Washington’s goal.

- When a new technology is developed, it takes a while for the industry to establish standards. Initially, there is a temptation for each firm to create its own standards with the hopes that they become dominant, as this adoption can create market power. At the same time, widespread adoption usually requires a few standards so it’s easier for consumers to use the new technology. The classic example is the VCR versus Betamax standard for videocassettes. Although the latter was thought to be superior, the former dominated and eventually eclipsed Betamax. Consumers would have otherwise needed two machines to handle the format. This week, Ford (F, $12.13) announced that it would adopt the Tesla (TSLA, $197.40) NACS standard, which will allow Ford vehicles to use the 12k Tesla charging stations. Other EV makers use the CCS standard. By making this decision, Ford is increasing the odds that the Tesla standard will prevail.

- A German startup has won funding for a new fusion energy machine.