Daily Comment (June 8, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with our thoughts on the reasons that central bankers may have for not being finished with rate hikes. Next, we explain the possible liquidity issue in international markets. Lastly, we discuss why a possible BRICS currency is not a threat to U.S. dollar hegemony.

A Canadian Surprise: An unexpected rate hike from the Bank of Canada (BOC) adds to concerns that other central banks may follow suit.

- Canadian monetary policymakers raised rates by 25 bps to 4.75% on Wednesday, defying market expectations of a continued pause. Although central bank officials warned that another rate rise is possible, only one in five economists surveyed by Bloomberg predicted the outcome. In a rare statement, the central bank mentioned that “excess demand in the economy” drove the decision. This policy reversal comes a week after a GDP report showed that the Canadian economy rose at a 3.1% annualized rate in the first quarter of the year, after contracting 0.15% in the previous quarter.

- The U-turn from the BOC has led many investors to modify their expectations of a rate cut by the end of the year. Global bond prices slumped on Wednesday as investors begrudgingly accepted that other central banks, such as the Federal Reserve and the European Central Bank, may not be finished hiking rates. For example, there are members of the Fed that believe that the bank should not lower rates until 2024. Similarly, European Central Bank head Christine Lagarde has argued that the bank should continue to hike rates until inflation is under control. The insistence on tightening comes amidst expectations that growth in the United States and Europe has accelerated during Q2, despite the persistent rate hikes, thus reinforcing the view that central bankers may need to tighten further to bring down demand-driven inflation.

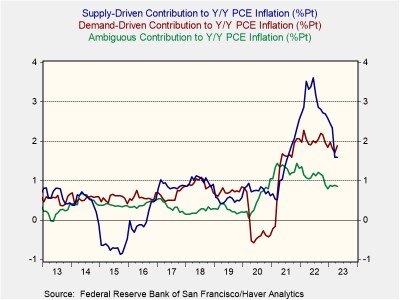

-

- Demand-driven inflation has not made much progress since the Federal Reserve started its hiking cycle, according to the San Francisco Fed.

- The Bank of Canada’s (BOC) decision to hike rates following the report of a rebound in its GDP suggests that other central bankers are going to be mindful of recession risks as they decide on policy. This is not to say policymakers will not consider raising rates if economic growth contracts. However, it does suggest that future rate hikes may be less predictable, especially if inflation begins to accelerate. The Bank of Canada’s decision provides further evidence that market bets of a potential 2023 rate cut from the Fed and ECB are possibly misguided.

Global Liquidity Drying Up? Banks are struggling to attract capital due to the U.S. government’s demand for new funds and central banks’ removal of stimulus.

- The race to refill the U.S. Treasury coffers will cause a strain on the American banking system. It is estimated that the government will need to borrow $1.1 trillion in short-dated Treasury bills by the end of 2023, with $850 billion in net over the next four months. The increased demand for cash will suck out liquidity from the financial system and put more pressure on U.S. banks to raise rates in order to attract savers. Additionally, the lack of available money in circulation may have an adverse effect on equity markets as investors can place their cash into safer assets.

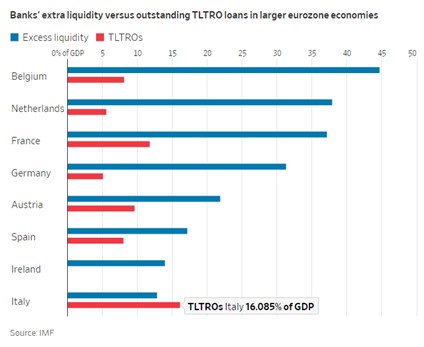

- Additionally, European banks are set to make their first payment at the end of the month to the European Central Bank for loans it took out during the pandemic. The nearly €500 billion repayment of funds borrowed from targeted longer-term refinancing operations (TLTRO) could hurt fragile eurozone banks. The end of the program will force banks to survive on their own as the era of easy money concludes. Strategists at Bank of America suggest that banks may be forced to rely on alternative funding such as money markets for capital. If true, the increased competition could push up interest rates in Europe right at a time when the economy is expected to be in recession.

- Italy will garner the most attention as the country was heavily reliant on ECB capital during the pandemic.

- Out of the top five central banks by total assets, only the People’s Bank of China and the Bank of Japan are anticipated to inject stimulus into the financial system throughout the year. The remaining three, the Federal Reserve, Bank of England, and Swiss National Bank, are expected to wind down their balance sheets as they look to control inflation. The lack of flows will be a temporary headwind for financial markets, but we expect the situation to improve once central banks start to normalize policy, which could happen as soon as this year. In the meantime, we think investors should expect more market volatility.

Dollar Is King: The greenback is likely to keep its throne as the global reserve currency, despite what critics may think.

- Led by China and Russia, there is a growing bloc of countries willing to create a currency to challenge the U.S. dollar’s dominance. Last week, foreign ministers from each of the BRICS countries, as well as representatives from Saudi Arabia, the United Arab Emirates, and Kazakhstan, met in South Africa. The countries gathered to discuss establishing a shared currency to avoid having to use the U.S. financial system to facilitate trade. The meeting was a precursor to a summit in Johannesburg, South Africa that is set to take place in late August but also serves as a reminder of the ongoing frictions between regional blocs.

- The American greenback is an attractive currency for countries to hold, especially in times of uncertainty. This is due to the deep financial market and open consumer market in the United States. Argentina’s presidential candidate, Javier Milei, has advocated for the country to abandon the peso in favor of using the dollar as its official currency. Although it is unclear whether Milei will succeed in his push to change the country’s currency, his proposal reflects foreigners’ faith in the U.S. dollar. However, unlike the U.S. dollar, the currencies of BRICS countries do not have the same level of liquidity and depth in the global market. This lack of market breadth and capital flexibility will make it difficult for other countries to use the currencies of the BRICS countries for international trade and investment.

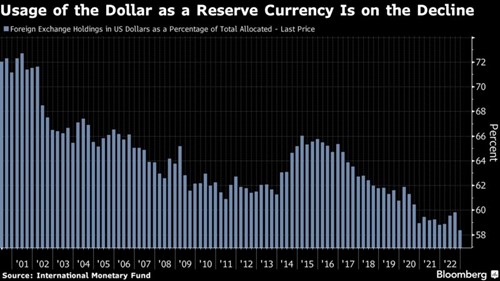

- The chart above shows the percentage of foreign holdings of U.S. dollars relative to other currencies in use. The dollar is the dominant currency, but its popularity is declining. While the threat of a competing BRICS currency is unlikely to dethrone the U.S. dollar, we expect countries to diversify their currency holdings as the world splits into blocs. If this happens, the greenback could depreciate against other currencies, providing a boost to investors looking to invest abroad. Additionally, the new currency regime may lead U.S. policymakers to adopt more hawkish policies to prevent a weaker dollar from inflating the price of imported goods and services, and thus, contributing to inflationary pressures.