Weekly Energy Update (June 15, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices may be establishing a new trading range between $67 and $75 per barrel.

(Source: Barchart.com)

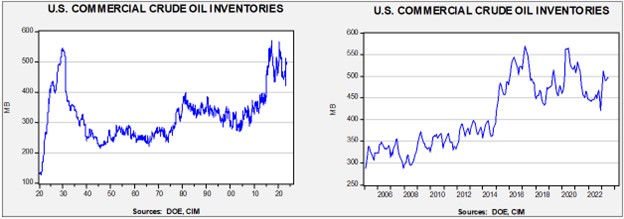

Commercial crude oil inventories rose 7.9 mb when compared to the forecast draw of 1.5 mb. The SPR fell 1.9 mb, putting the total build at 6.0 mb.

In the details, U.S. crude oil production was steady at 12.4 mbpd. Exports rose 0.8 mbpd, while imports were flat. Refining activity declined 2.1% to 93.7% of capacity.

(Sources: DOE, CIM)

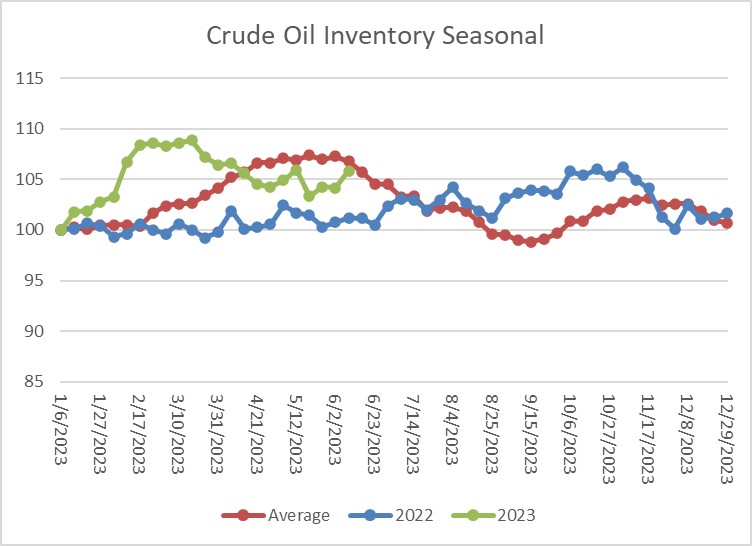

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined. This week’s outsized build puts inventories back at seasonal norms. The seasonal pattern would suggest that stocks should fall in the coming weeks, but the seasonal pattern has become less reliable due to export flows.

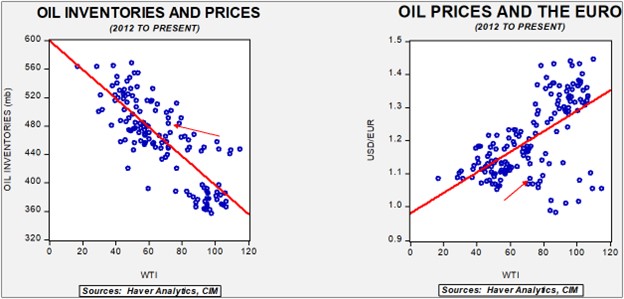

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $57.11. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

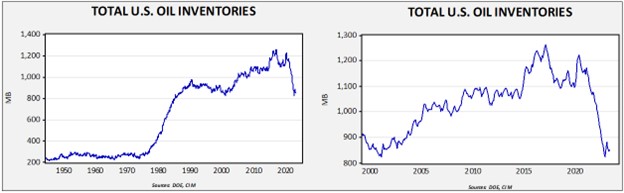

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $92.53.

Market News:

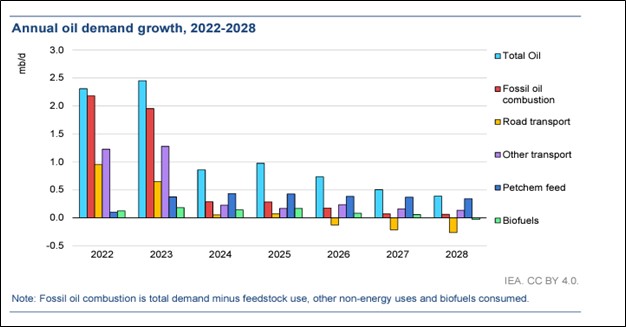

- The IEA released its forecast for oil demand over the next five years. The group estimates that expanding EV usage will dampen gasoline demand and thus lead to a peak in global oil demand after an almost continuous rise for 80 years.

- As the above chart shows, oil demand is forecast to fall dramatically mostly due to negative growth for road transportation. We have serious doubts that this will actually occur, but oil producers, especially those beholden to shareholders, have to be aware of this forecast since it suggests that investment in new production is at risk of being stranded. Therefore, shareholders are likely to demand a shareholder return instead of investment into new production, and it appears this trend is already beginning to happen. This forecast is likely to add to bullish pressure for prices, especially if demand exceeds expectations.

- Oil prices continue to mark time in the wake of the OPEC+ announcement. Our take is that the U.S. wants prices around $60 per barrel and the Saudis have a target of at least $80 per barrel. Because of this, we are sitting in a netherworld between these two price points. Worries about Chinese demand are acting as a bearish factor on prices and offsetting the supply cuts coming from OPEC+.

- We note that it’s hot in China, but so far, coal and LNG demand have been remarkably modest. This situation would suggest weak industrial activity.

- OPEC+ production fell last month, with some sources suggesting a 67 mbpd cut while others report a lesser one. In any case, we are seeing a decline in supplies.

- There are reports that the Saudis were targeting bearish oil speculators. Given the market’s reaction, that idea makes some sense. We note that each OPEC+ announcement seems to be having less of a bullish impact.

- U.S. crude oil exports have been increasing, but we are starting to get close to capacity at some export facilities.

- Natural gas production in the Permian Basin has hit a new record high.

- There is always tension between commodity project development and environmental concerns. Oil drilling in the Amazon Delta is pitting oil drillers against environmentalists.

- Much to our surprise, it looks like the U.S. will add 3.0 mb to the SPR. Of course, this injection pales in comparison to the sales over the past year. We note the Biden administration wants to purchase another 12.0 mb over this coming year.

- Venezuela has suffered falling oil production for years. However, we are starting to see a slow recovery in this area. As Russian sanctions change global oil flows, the U.S. has begun easing sanctions on Caracas.

Geopolitical News:

- Although Putin and Xi seem to have a close personal relationship, the geopolitics of China and Russia are often contentious. One reason is that both nations have interests in the same regions, with one area of potential conflict being Central Asia. Russia views this region as part of its “near abroad” as some of these states were part of the Soviet Union. China wants the natural resources of these nations and is making investments in a bid to improve ties. As nuclear power demand rises, China is trying to encourage the Central Asian nations to supply it with uranium. The region is rich with this material. This development is raising tensions between China and Russia.

- There are reports that U.S. and Iranian negotiators have made progress in restarting the nuclear deal. We remain highly skeptical of such reports. Although corralling Iran’s nuclear program would be potentially positive, the political costs of helping Iran would be high. Also, we doubt that the incumbent administration could promise any agreement would be binding for future administrations barring an actual treaty agreement, which seems unlikely.

- The U.S. has denied having these reported talks, though that doesn’t necessarily mean they didn’t happen. Israel reported that the U.S. and Iran held talks on what might be a narrowing set of goals. At the same time, the lead Iranian negotiator has been invited to Norway for talks. Overall, we think the Europeans really want access to Iranian oil and may be trying to foster talks. As we noted above, we think the political hurdles are too high for success.

- Furthermore, the U.S. has begun to offload the Iranian oil it seized due to sanctions. If there were serious efforts being made to restart nuclear negotiations, we doubt this would be happening.

- It has been reported that Iran is sending drone parts for assembly in Russia; again, if Iran were really trying to restart talks, the U.S. wouldn’t be issuing this intelligence.

- The recent dam rupture in Ukraine has been in the news but the damage done to the Tolyatti-Odesa ammonia pipeline is also important. Ammonia is one of the key building blocks in fertilizer production. This pipeline is the world’s largest but has not operated since the Russian invasion. The attack on this pipeline may make Moscow less likely to extend the grain deal. Natural gas is important to ammonia production, and the loss of this pipeline could have a minor bearish impact on European natural gas.

- In the wake of SoS Blinken’s trip to the Kingdom of Saudi Arabia (KSA), Riyadh made it clear that it wants support for a civilian nuclear program. The Saudi foreign minister warned that the U.S. faces competition from other nations. The KSA is pressing for a civilian nuclear program in return for recognizing Israel.

- There are reports that the U.S. and the KSA both threatened each other after the kingdom cut oil production. It appears that recent visits were designed to repair relations.

- We continue to monitor the steady flow of leaks concerning the Nord Stream Pipeline sabotage. Reports now suggest the CIA warned Ukraine not to attack the pipeline. It remains unclear who did attack the pipeline as both the U.S. and Ukraine had an incentive to destroy the structure because it more closely tied Germany to Russia. These leaks do suggest the U.S. is trying to distance itself from the attack and pin the event on Ukraine.

- In related news, Dutch intelligence also reportedly warned the U.S. that Ukraine was planning an attack on the pipeline.

- Azerbaijan is making diplomatic engagements with regional powers likely in an effort to reduce the risks to oil flows.

- As relations between the KSA and China improve, Chinese businesses are “streaming” to the kingdom in search of investment opportunities.

- China is rapidly expanding its refining capacity and, according to the IEA, is poised to become the holder of excess refining capacity. Since there is little direct consumption of crude oil, this excess capacity will tend to narrow profit margins for refiners.

- Russia has resumed oil exports to North Korea. Given that North Korea has limited capacity to pay for such oil, we suspect that Moscow is swapping oil for military equipment.

- The EU is looking to ban all Russian pipeline gas imports by the end of the year. This move would most harm Hungary.

Alternative Energy/Policy News:

- EV growth is projected to rise steadily in coming years, but there are serious doubts about the availability of battery metals. The dependence on China for batteries remains a major issue as well.

- It’s arguable that short-sighted U.S. policies for the battery industry helped create China’s dominance.

- Battery metals are critical to the EV transition; the lack of mining talent could boost costs in the future.

- There is a significant price war going on in China’s EV market. A major producer has cut prices, suggesting the price war is spreading.

- BYD (BYDDY, $66.39), the Chinese auto company, is poised to become the world’s largest EV producer. It specializes in low-cost vehicles and makes one for the world market that costs just over $11k. We note BYD is also building the infrastructure to manufacture sodium-ion batteries, which are much cheaper than lithium-ion batteries.

- As more investment funds flow into alternatives, we continue to monitor new technological developments. Work being done on plasma drills could expand geothermal power which is nearly emissions-free.

- Although nuclear power is often heralded as a solution to climate change and carbon emissions, in reality, the U.S. has allowed its uranium industry to unwind, preferring to acquire the metal from other places. When the world was considered safe for trade and investment, this policy may have made sense; it doesn’t now.

- In our 2023 Geopolitical Outlook, we discussed the race for space. Part of the allure of space is the possibility of beaming electricity from orbiting solar panels that would be exposed around the clock. Although seemingly farfetched, a team at CalTech is testing such a program. Obviously, if this works it becomes a game changer for energy.

- Back on Earth, the expansion of wind and solar energy is being hamstrung by the lack of grid expansion. This is why there was an interest in Congress to address permitting in the debt ceiling negotiations. Smoke is a problem, too.

- Summers are becoming increasingly unpleasant for both coasts but especially for the West Coast. There have been several news items suggesting a rapid warming trend; however, this trend may be due more to non-recurring factors and may not actually signal permanent changes.