Weekly Energy Update (June 22, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices may be establishing a new trading range between $67 and $75 per barrel.

(Source: Barchart.com)

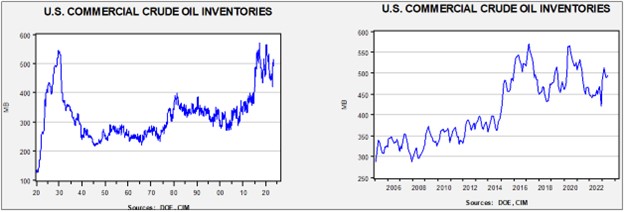

Commercial crude oil inventories fell 3.8 mb when compared to the forecast build of 0.5 mb. The SPR fell 1.7 mb, putting the total draw at 5.6 mb.

In the details, U.S. crude oil production fell 0.2 mbpd to 12.2 mbpd. Exports rose 1.3 mbpd, while imports declined 0.2 mbpd. Refining activity declined 0.6% to 93.1% of capacity.

(Sources: DOE, CIM)

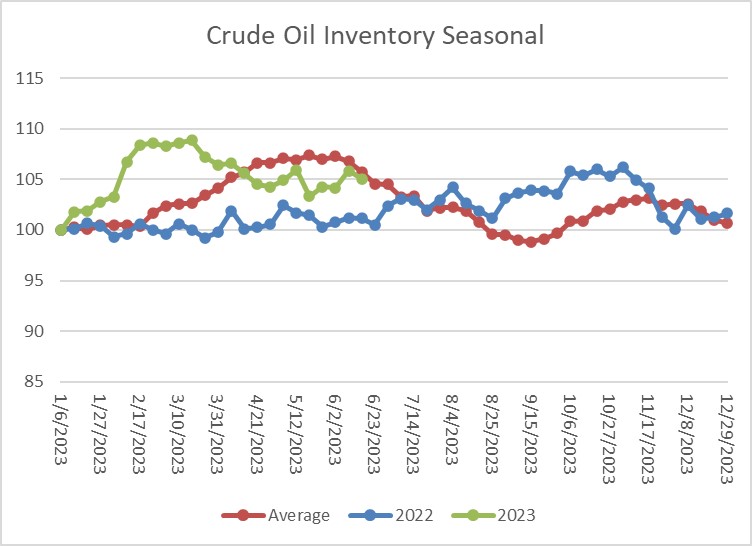

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined. This week’s draw is consistent with seasonal norms. The seasonal pattern would suggest that stocks should fall in the coming weeks, but this pattern has become less reliable due to export flows.

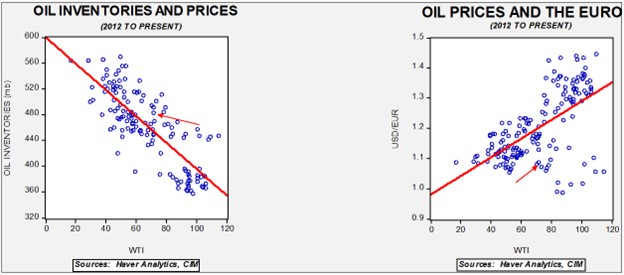

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $58.21. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

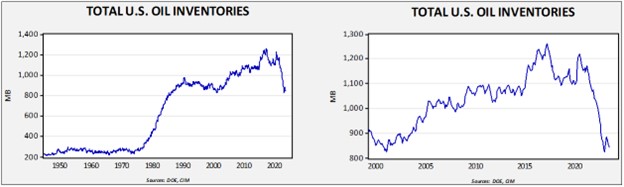

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $93.15.

Market News:

- The Netherlands is closing Europe’s biggest natural gas fields due to local concerns about earthquakes. Often oil and gas extraction can lead to earthquakes; Oklahoma has experienced similar issues. This decision, though, will put the EU at risk of supply shortages.

- The war in Ukraine has led to a massive restructuring of the global energy market. LNG has become an important fuel, and there has been a clear expansion of its use. This expansion has led to a rapid increase in the infrastructure for the fuel, including gasification plants in the Middle East, Australia, Canada, and the U.S.

- China has embarked on long-term contracts with suppliers, which establish the funding for investment. The EU, likely because of expectations of renewable growth, is less open to long-term contracts. If natural gas usage continues, Europe could find itself isolated.

- Russia’s oil refineries hit new highs in utilization, which may mean that Russia intends to meet its OPEC+ obligations by replacing oil exports with product exports. Russian oil exports have been affected by the war.

- Russia’s oil flows to India have been at deep discounts, helping to improve India’s economy.

- Russian natural gas is still flowing through Ukraine, but the current agreement ends next year, and Kyiv expects Russian gas flows to stop.

- There are some unusual actions being taken by the Kingdom of Saudi Arabia (KSA) regarding oil flows. For example, consistent with its decision to reduce oil flows, Saudi oil exports fell to a five-month low in April. However, there are numerous reports that the KSA is storing 20 mb of oil on 10 tankers in the Red Sea. We also note a spike in supertanker rates, which may be tied to the KSA’s decision to float oil storage.

- The Permian Basin is now producing more oil than the KSA’s giant Ghawar field.

- So far, the KSA’s bid to boost prices has failed to work.

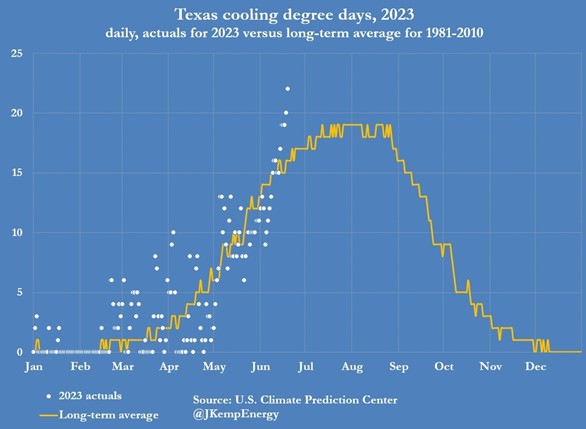

- The summer solstice came this week, marking the onset of astrological summer (meteorological summer began on June 1). We are seeing a strong heatwave in the South, especially in Texas. Hot weather boosts electricity demand and usually is bullish for natural gas prices. We note Texas degree days are running well above normal.

(Source: Reuters)

-

- Texas isn’t alone in its drought; Iran is facing a crisis as well.

- Mexico has joined several firms in a deep-water oil and gas project.

- Guyana is delaying offshore oil-block auctions in a bid to increase the number of participants in its oil exploration.

- Ship channel dredging will allow larger oil tankers to directly load oil and products from the Texas coast.

- The DOE suffered a data breach tied to Russian hackers.

- DOE Secretary Granholm failed to disclose stock holdings; it is unclear if this fact will lead to her ouster.

Geopolitical News:

- The U.S. is still buying uranium from Russia for American power plants. Although nuclear power is an attractive alternative energy, the lack of a non-Russian supplier is a risk.

- One of Russia’s long-term geopolitical goals is a warm water port. Although the warming of the Arctic may give Moscow the sea access it wants, it has eyed the Middle East as a possible path to the ocean. As Iranian and Russian relations improve, Russia is looking to build access to the Indian Ocean through Iran. A risk to this path is that the Arab states in the Persian Gulf have tended to side with the U.S. However, as relations fray between Washington and these Arab states, the risks in using Iran for sea access decline. Thus, the recent thaw between Riyadh and Tehran is a benefit to Moscow.

- We are seeing a concerted effort by China to secure energy sources. China appears to be deploying an “all of the above” strategy, including both alternatives and fossil fuels. What is important here is that China is most interested in energy security, with less regard for the source.

- Central Asia isn’t just the focus of China and Russia. Germany is also looking to secure energy from the region and held talks with Kazakhstan

- As we noted last week, we were mostly wrong about an Iran nuclear deal. What we got right was that the JCPOA was dead. What we didn’t expect was that the U.S. would opt for a limited deal in what looks like a bid to reduce regional tensions. We doubt this will increase global oil supplies much since Iranian sanctions are far from tight, but easing tensions will likely make more oil available to the West. We suspect the White House is fully focusing on November 2024, and although there will be a political cost to a thaw, the chances of lower oil prices are probably seen as a greater benefit.

- It isn’t clear what will actually be agreed to in the deal. The U.S. appears willing to accept Iranian uranium enrichment to around 60%, which is less than weapons-grade but still shows that the country can reach the 98% required for bombs. Particles enriched to nearly 84% have already been reported.

- Iran will receive some funds that are currently frozen, and the U.S. will get prisoners freed.

- The KSA has invited Iran’s president to Riyadh for an official visit.

- China has agreed to build a nuclear power plant in Pakistan.

- Here is a cool map of China’s energy infrastructure.

Alternative Energy/Policy News:

- One of the emerging themes for the next few years will be the choice Western nations face on EVs. If the goal is extensive adoption, the most effective way of achieving this is to allow Chinese imports. China’s EV industry has improved rapidly and is now producing world-class cars at reasonable prices. On the other hand, if the goal for Western nations is re-industrialization, Chinese cars should be restricted. So far, we have generally expected Europe to be much more open to Chinese EVs compared to the U.S. However, there is evidence that the EU is rethinking that position.

- Tesla (TSLA, $268.75) is rapidly becoming the connection standard for the EV industry as more EV makers adopt its standard. Doing so gives car owners access to Tesla’s charging stations.

- In fact, meeting climate goals is often in direct conflict with meeting geopolitical goals. There are serious doubts as to whether the West can move toward carbon neutrality without China.

- Solid state EV batteries have the potential to revolutionize the industry. Toyota (TM, $157.40) has a test vehicle it claims has a range of 932 miles with a 10-minute charge. If high range/short charging becomes the norm, ICE vehicles will be much less attractive.

- The U.S. is leading a critical minerals partnership in a bid to create a strong supply chain for metals needed for the energy transition. Presently, China holds a commanding position in these metals, but the U.S. and its allies want to build a supply network that prevents China’s dominance.

- It should be remembered that part of the reason for China’s dominance is that it was willing to accept the environmental costs of mining and processing these metals.

- The U.S. is facing calls from nations with key minerals but without free trade agreements with the U.S. to join this partnership. So far, Washington has restricted the subsidies, but if the U.S. doesn’t expand the list, China might become an alternative funder.

- Minnesota may become an important source of nickel, but the permitting process could be daunting.

- Chinese regulators approved a thorium reactor. Thorium reactors have some major advantages over uranium reactors. They didn’t get used in the early days of nuclear power because nations wanted the dual option of being able to make nuclear weapons, and thorium can’t be weaponized. In addition, this reactor will use molten salt, which is another significant benefit.

- Hydrogen is a fuel that offers promise in providing clean power but tends to fail at gaining traction due to costs. The U.K. is looking to use the fuel for home heating but is struggling with the details. In the EU, there is a program to expand the pipeline network to move hydrogen.

- The U.K. has opened its first deep geothermal project in 37 years.

- Although there is great hope for fusion power, the reality is that we are a long way from commercial fusion power.

- The Biden administration announced an increase in biofuel use, but surprisingly, the ethanol mandate was less than expected. Even with other biofuels, the mandates were less than expected. Biofuels replace fossil fuels to some extent, but also still require fossil fuels in production. In general, biofuels are more about reducing U.S. dependence on foreign oil and are an aid to farmers. Corn ethanol, for example, reduces greenhouse gas emissions by 19% compared to gasoline. The best benefit comes from biomass and cellulosic ethanol. But because neither comes from a cash crop, support for these fuels is lacking.