Asset Allocation Bi-Weekly – The Green Shoots of Re-Industrialization (July 3, 2023)

by the Asset Allocation Committee | PDF

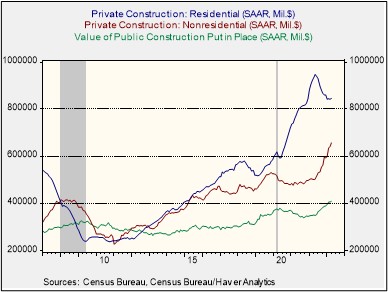

In a little-noticed report last month, total construction spending in April was up a modest 6.1% from one year earlier, but private nonresidential construction spending was up a whopping 30.2%. That marked the fourth straight month in which private, nonresidential construction, a proxy for commercial construction, was up more than 20.0% year-over-year. In contrast, outlays on public works (such as roads, bridges, and sewer systems) rose 15.1% in the year to April, while private residential construction spending fell 9.7%. We believe these figures confirm an important new trend in the U.S. economy that will have big implications for certain asset returns going forward.

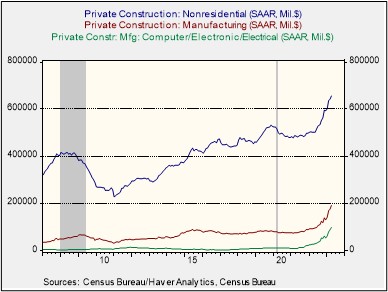

The strength in commercial construction may seem surprising, given today’s high vacancies and the pessimism regarding properties such as office buildings and shopping malls. Those sectors continue to face major headwinds, and they certainly were not responsible for this recent rise in commercial construction. The jump in commercial building has primarily come from new factory construction, especially manufacturing facilities for electronics and information-processing goods. Total outlays on factory construction in April were more than double their level in the previous April, with a year-over-year rise of 104.4%. Expenditures on just the subsector of electronics and information-processing factories nearly quadrupled, showing an astounding increase of 271.8% on the year. Of course, some of this increased spending simply reflects the high inflation in prices for construction inputs ranging from labor to cement. Nevertheless, the spending increases far exceed any reasonable estimates of inflation for construction inputs. The spending figures, therefore, confirm a huge rise in real factory construction.

The frenzy in building new electronics factories provides some of the first statistical evidence of U.S. re-industrialization, i.e., the rebuilding of the nation’s manufacturing, construction, and mining sectors as companies shift production back home from Asia or elsewhere abroad. We suspect that a lot of the new factory construction reflects the recently announced, high-profile projects for electric-vehicle batteries, semiconductors, and other green-energy or info-technology goods. However, we doubt that the recent spending uptick includes much of the hundreds of billions of dollars in subsidies provided by last year’s Inflation Reduction Act or the CHIPS Act. Slow bureaucratic and administrative procedures would suggest that most of those subsidies will only kick in later. In addition, higher military budgets have not yet had their full impact on the defense industrial base. The recent increase in factory construction, therefore, is probably only the beginning of a much larger, longer-lasting uptrend.

As geopolitical tensions between China and the West worsen, and as Chinese economic growth slows, we think the U.S. will be a key beneficiary of companies “near shoring” or bringing production back home. New data suggests even Europe will see some re-industrialization. The data shows that global businesses acquired or leased 9.6 million square feet of industrial space in the European Union during 2022, marking a 29% increase over the previous year. The uptake of factory buildings comes even as weak consumer demand in the region pushes down contracts for retail and warehousing space. Re-industrialization in the EU could accelerate even further if its member states adopt U.S.-style subsidies or if their defense spending increases spur an expansion in their defense industrial bases.

As the world fractures into relatively separate geopolitical and economic blocs, we have been arguing that re-industrialization will take root in the U.S. and, to a lesser extent, in Europe. The data discussed here shows re-industrialization has indeed started to take root and is now pushing up green shoots that are likely to grow further. Over the long term, this re-industrialization will be a mixed bag for Western societies. It will likely make the West more resilient to external supply shocks and provide more opportunities for workers without a four-year college degree, but these new facilities and the shortened supply chains they represent will be less efficient than under the extreme globalization of the last few decades. The result will likely be persistently higher inflation and interest rates.

Fortunately, shorter-term prospects are more positive. The building boom will likely support demand even as the overall economy slips into recession. The new, highly modern factories being built could also quickly boost worker productivity when they come on line. Finally, since rebuilding the nation’s factory sector will require repairing and expanding roads and other infrastructure, it could also help reverse the recent fall in state and local government investment that we recently wrote about. For these reasons, we believe this re-industrialization will provide a short-to-medium term boost to several different stock sectors, such as broad industrials, construction companies and the service providers that serve them, providers of construction materials and equipment, and perhaps even real estate investment trusts (REITs) that focus on industrial properties.