Daily Comment (June 27, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on Russian political stability following the weekend rebellion by Wagner Group mercenaries. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including fresh signs of further interest rate hikes in the Eurozone, the likelihood of currency market intervention in Japan, and some unexpected good news for office valuations in New York City.

Russia: In the aftermath of the short-lived weekend mutiny by Yevgeniy Prigozhin and his Wagner Group mercenaries, President Putin and Prigozhin himself spent yesterday trying to spin the events to their favor. In a televised statement, Putin pilloried Wagner for threatening bloodshed and extolled the Russian people for rallying around their government, despite clear evidence that many Russians were indifferent to Putin’s fate and supported Prigozhin. Meanwhile, Prigozhin insisted he had never tried to topple the government itself, despite the fact that his troops marched to within 125 miles of Moscow and killed over a dozen Russian aviators.

- Having survived the rebellion, at least for now, Putin has tried to go on the offensive against Prigozhin, initially announcing through his government that the Wagner leader still might be arrested and offering the Wagner troops just three options: sign up as regular soldiers in the official armed forces, go home, or follow Prigozhin into exile in Belarus. The Putin government today also said that Wagner’s heavy weapons would be transferred to the national guard.

- In any case, Putin’s statement suggests Wagner is finished as an independent, organized force. A key question will be whether Prigozhin accepts that fate as it would render him completely powerless. As we mentioned in our Comment yesterday, the crisis in Russia’s leadership is almost certainly not yet over.

Russia-Bulgaria: Bulgarian Economy Minister Bogdan Bogdanov suggested Russia may have been behind the explosion and fire that struck another weapons factory over the weekend. As Bulgaria has helped Ukraine arm its military in recent years, a number of the country’s defense industry facilities have suffered mysterious mishaps that are widely seen as Russian sabotage.

Eurozone: At the European Central Bank’s annual conference in Portugal today, ECB President Lagarde said tight labor markets, rising wages, and sticky price inflation will require “persistent” new interest rate hikes in the coming months. The statement provides additional evidence that the ECB’s benchmark rate will continue to move higher from its current level of 3.5%. If the Federal Reserve continues to slow its rate hikes, or if it stops them altogether, the additional rate hikes in the Eurozone could help push the value of the euro beyond its current resistance level of approximately $1.10 per dollar.

- Despite the hawkish stance taken by Lagarde and many other key central bank leaders, IMF Deputy Managing Director Gopinath warned at the conference that they may need to pull their punches and allow inflation to remain above the 2% target for some time if rate hikes threaten to cause a financial crisis.

- According to Gopinath, the central bankers risk being faced with a stark choice between solving a future financial crash among heavily indebted countries and raising borrowing costs enough to tame stubborn inflation.

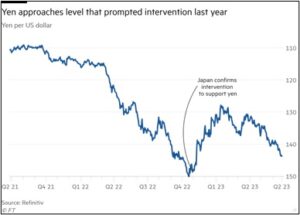

Japan: With the yen continuing to lose value, top currency official Masato Kanda yesterday said he would not rule out any options regarding intervention in the currency market, and Finance Minister Shunichi Suzuki today said the authorities would “respond appropriately” if the drop becomes excessive.

- So far today, the yen is trading at approximately 143.57 against the dollar, down almost 11% from its most recent high early this year.

- The yen is still a bit stronger than the 150.15 per dollar level that it hit last October before the government stepped in to buy up yen and sell foreign reserves to prop up the currency. Nevertheless, it is looking increasingly likely that the Japanese government could soon intervene in the currency markets again to prop up the yen.

Indonesia: President Widodo has indicated in a speech that he won’t back down on a new law that bans the export of bauxite ore despite concerns that China could file a complaint about it at the World Trade Organization. The law forces miners to refine their bauxite into aluminum before it can be exported, thereby creating domestic manufacturing jobs. It is similar to an older rule banning the export of raw nickel ore. The rules exemplify the growing global trend toward industrial policy that intervenes in the free market to bolster domestic industrial development.

United States-China: U.S. Treasury Secretary Yellen plans to visit Beijing in early July to meet with her new Chinese counterpart, according to press reports. The meeting would mark another step in the Biden administration’s efforts to ease tensions with China, or at least to been seen as doing so. However, if the meeting happens, it could come just before the administration announces new measures aimed at further curtailing U.S. investments in China. Prospects for improved relations from the meeting therefore seem low.

U.S. Dollar: The latest annual survey of central banks by the Official Monetary and Financial Institutions Forum (OMFIF) found that reserve institutions managing almost $5 trillion of assets combined expect the U.S. dollar to decline only gradually as a proportion of global reserves over the coming decade. The surveyed banks estimate the greenback will still account for 54% of total global reserves in 10 years’ time compared with 58% currently.

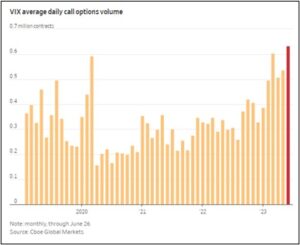

U.S. Stock Market: Just in the month through yesterday, investors have now bought more call options on the VIX volatility index than in any other month on record. The data suggests that investors are becoming more concerned that stock prices could turn volatile after a relatively smooth, technology-driven run up for the year to date. Since we continue to believe the economy is likely to slip into recession in the second half of the year, we would not be surprised if the U.S. stock indexes stage a significant retreat in the coming months.

U.S. Commercial Real Estate Market: Rising interest rates and work-from-home trends continue to batter office owners and commercial real estate lenders, but real estate investment trust SL Green (SLG, $28.20) has managed to sell its stake in a prime New York City office tower at a price that values the building at $2 billion. The price was only a modest decline from the building’s previous value, giving a healthy boost to much of the REIT sector in trading yesterday, including a 19.8% jump in SL Green shares.

U.S. Supreme Court: With the court wrapping up this year’s term on Friday, investors are bracing for the release of several key decisions over the coming days. The expected decision with perhaps the most implications for businesses will relate to the legality of affirmative action in college admissions. Whatever the justices rule, the decision is likely to affect affirmative-action policies in corporate settings as well.