Daily Comment (July 11, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with news that Turkey has agreed to support Sweden’s accession to NATO, creating an even more formidable military bulwark in response to Russia’s invasion of Ukraine. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including today’s voting on a controversial environmental law in Europe and new statements about interest rates by several policymakers at the Federal Reserve.

North Atlantic Treaty Organization: Just ahead of today’s big NATO summit, the Turkish government yesterday unexpectedly released its veto on Sweden’s accession to the alliance. According to NATO Secretary-General Stoltenberg, Turkish President Erdoğan agreed to forward Sweden’s accession to the Turkish parliament “as soon as possible” after achieving several concessions from Sweden and NATO. Those concessions apparently included steps aimed at aiding Turkey’s fight against Kurdish terrorists and the U.S. unlocking the sale of advanced F-16 fighter jets to Turkey. The Hungarian government has also recently said it would lift its veto of Sweden’s accession.

- The Turkish move helps ensure that the NATO summit will project heightened unity and new strength in response to Russia’s aggression against Ukraine.

- Over the longer term, this year’s accession of both Sweden and Finland to NATO will give the alliance increased overall military strength, better insight into Russian activities in northwestern Europe, and the potential to strangle civilian and military shipping in the Baltic Sea in the event of war with Russia.

China-Taiwan: In a new sign that Taipei is getting more serious about defending against possible Chinese aggression, the government is holding its biggest civil defense drill in decades today. This year’s version of the Wan’an air raid drill will take place in districts across the country and include practice evacuations of civilians to bomb shelters.

China: The China Passenger Car Association yesterday said domestic Chinese brands made up 54% of the country’s wholesale shipments in the first half of 2023, up from 48% in the same period one year earlier. That marked the second consecutive half in which domestic automakers sold more vehicles than foreign makers did.

- As we have been discussing recently, the surge in domestic brands comes mostly from their sudden improvement in electric vehicles.

- That has sapped the profitability of foreign brands operating in China and serves as a harbinger of the competitive threat that Chinese electric vehicles are likely to pose as they begin to be sold in the rich, highly advanced countries of the world.

European Union: The European Parliament today and tomorrow will be voting on a divisive nature-restoration law that would require setting aside land to encourage the return of healthy ecosystems. The law, proposed by the European Commission under the leadership of Ursula von der Leyen, has been criticized for potentially undermining farmers’ livelihoods, preventing wind farms from being built, and putting EU food security at risk.

- Ahead of EU parliamentary elections in June 2024, von der Leyen’s own center-right European People’s Party has come out against the legislation. EPP leaders appear to be concerned that the law would play into the hands of far-right politicians, who are already gaining influence through Europe.

- In an interview with the Financial Times, European Parliament President Metsola, who is also a member of the EPP, has warned that parliament members should refrain from crossing an “invisible line” between ambitious green policies and citizens’ support for the changes imposed on their lives.

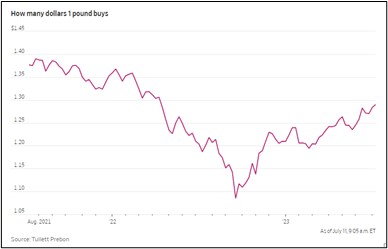

United Kingdom: Average weekly earnings in March through May were up 7.3% from the same period one year earlier, significantly more than anticipated and matching the record gain in the three months to April. The strong wage growth has prompted even stronger expectations that the Bank of England will keep hiking interest rates, which in turn has given a further boost to the pound (GBP). So far this morning, sterling is trading up 0.3% to a 15-month high of about $1.2895.

U.S. Monetary Policy: At events yesterday, San Francisco FRB President Daly and Cleveland FRB President Mester both signaled interest rates should go at least a bit higher, with Mester saying a “somewhat tighter” policy stance would help strike the right balance between tightening too much and tightening too little in the face of price inflation. The statements are consistent with the rising market expectation that the Fed will raise its benchmark short-term interest rate one or two more times, although perhaps with another pause interspersed.

- Separately, New York FRB President Williams reiterated in a Financial Times interview that he sees a need for a few more rate hikes. In his view, the labor market remains tight enough to drive up wages and inflation, even though he sees signs that labor demand is gradually cooling.

- Williams also noted that he doesn’t currently have a recession in his forecast. Nevertheless, he admitted that he sees “pretty slow growth” in the coming quarters.

U.S. Bank Regulation: Michael Barr, the Fed’s vice chair for regulation, said in a speech yesterday that larger U.S. banks should further strengthen their capital cushions after the crisis among mid-sized lenders this spring. According to Barr, a recent Fed review of big banks’ capital requirements suggested they should be required to boost their capital/risk-weighted asset ratio by about 2%. The speech is being taken as a signal that Fed regulators will formally propose the change later this summer.

U.S. Labor Market: Amid a general shortage of workers, a number of companies have said in recent earnings reports that a shortage of accountants is hampering their efforts to address weaknesses in financial reporting and control. The lack of accountants reflects both a recent fall in the number of young people pursuing accounting degrees and a growing share of established accountants who are retiring.

Global Gold Market: A survey by Invesco (IVZ, $17.37) found that global central banks not only boosted their purchases of gold in 2022 and early 2023, but they also shifted toward buying the physical asset instead of derivatives and opted to hold their gold in their own country. As we’ve been arguing, the U.S.’s move to freeze Russia’s foreign reserves over its invasion of Ukraine last year has prompted many central banks to purchase more of the yellow metal for their own financial security. Along with our expectations of higher average price inflation in the future, strong central bank buying is a key reason why we think gold will produce good returns in the medium-to-long term.

Global Green-Tech Minerals Market: The International Energy Agency has issued a report saying global investment in green-technology mineral resources is starting to catch up with the growing demand for those materials. According to the IEA, worldwide investment in green-tech mineral facilities rose 30% to more than $40 billion in 2022, building on a 20% increase in 2021.

- Still, the report also cited some negative trends. For example, the rise in investment in 2022 was driven by China, which already dominates the production and refining of key green-tech materials.

- The report also noted that the supply of some of these minerals, such as lithium and cobalt, remains too concentrated.