Daily Comment (July 12, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with notes on global asset allocation strategy among hedge funds and new developments in the global race for electric-vehicle minerals. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a jump in the value of the yen and the opening of important negotiations for a new labor contract for U.S. automakers.

Global Asset Allocation Strategy: Brokerage data from Goldman Sachs (GS, $320.88) shows hedge funds currently have their lowest exposure to the U.S. stock market since records began in 2013, while their allocation to European stocks is at a record high. The low asset allocation to the U.S. is driven largely by concerns that many of the country’s key technology stocks are overvalued. We share that concern, although we also think the broader U.S. economy is likely to perform better than the European economy in the coming quarters.

Global Mining Industry: Automobile manufacturers Volkswagen (VWAGY, $16.90) and Stellantis (STLA, $18.00) have announced plans to contribute $100 million each to form a new, publicly-traded mining company producing nickel and copper in Brazil. The plan is to join the firm with a special-purpose acquisition company run by a well-known mining executive who hopes to do more deals to build a large battery-metals company. The deal illustrates the frenzy to find and develop electric vehicle materials and shows how the trend is pushing auto firms to vertically integrate to lock up their own supplies.

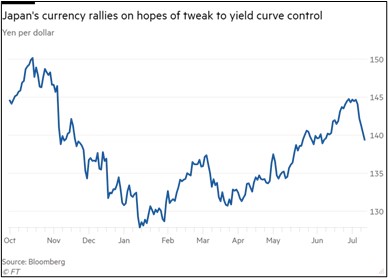

Japan: As investors begin to focus on the Bank of Japan’s next policy meeting on July 28, they are increasingly pricing in a chance that the officials could adjust or abandon their yield-curve control policy and allow bond yields to rise. In response, the yen so far today has strengthened about 1.0% to 138.99 JPY per dollar, meaning it has now essentially reversed all of its depreciation since early June.

- The market reversal appears to stem largely from a statement by BOJ Deputy Governor Shinichi Ushida last week.

- According to Ushida, the BOJ is now seeking “a balanced decision [on yield-curve control] with an eye on monetary interventions and market functions.”

- An adjustment to the yield-curve control policy is also more likely now that BOJ Governor Ueda has been in his position for three months. Ueda indicated at his appointment that he would more slowly and cautiously on any change in policy, but the longer he is in his position, the freer he would likely feel to move forward.

North Korea-Japan: North Korea today fired an intercontinental ballistic missile that flew approximately 600 miles before splashing down in the waters between the Korean peninsula and Japan. Besides being the latest example of North Korea’s belligerence, the launch is a reminder of the kinds of destabilizing events that could periodically transpire between Russia and Ukraine if their war eventually cools into a Korean-style “frozen conflict,” as we think is likely.

China-Mexico: Mexican President Andrés Manuel López Obrador said his government is considering whether to impose tariffs against Chinese shoe imports to slow their proliferation in the country and protect local manufacturers. The move underscores an important dynamic between China and the other so-called emerging markets—once China’s ultra-low-cost producers gained access to the global market in the early 2000s, they tripped up many other developing countries’ industrialization efforts and forced them to focus on more volatile, less profitable commodity production.

China-United States: Researchers at Microsoft (MSFT, $332.47) said Chinese hackers have broken into email accounts at more than two dozen organizations, including some U.S. government agencies, in what appears to be a major new espionage effort. Officials said the hackers didn’t gain access to classified information, but they continue to investigate whether sensitive information was stolen.

U.S. Antitrust Regulation: A federal judge yesterday said Microsoft (MSFT, $332.47) can move ahead with its acquisition of videogame maker Activision Blizzard (ATVI, $90.99), ruling against the Federal Trade Commission’s contention that the merger would hurt competition. The FTC may continue a separate administrative effort to block the acquisition, and regulators in the U.K. are looking at the deal as well. Nevertheless, the judge’s decision shows how the Biden administration’s effort to tighten big-tech antitrust regulation has had only spotty success so far.

U.S. Labor Market: Officials from Ford (F, $15.23), General Motors (GM, $39.97), and Stellantis are meeting with the United Auto Workers union this week to work on a new labor contract to replace the one that expires September 14. By all accounts, the new leadership at the UAW is intent on winning back the cost-of-living adjustments its workers lost following the Great Financial Crisis and protecting jobs as the automakers shift toward producing less-labor-intensive electric vehicles.

- Ahead of the elections in 2024, the pro-union Biden administration is also likely to put outside political pressure on the negotiators to strike a deal favorable to workers, despite concerns that high wage growth is boosting consumer price inflation.

- In any case, there is a considerable chance that the negotiators will fail to strike a deal and the UAW’s 400,000 could go out on strike, as they did at the last contract expiration in 2019.