Asset Allocation Bi-Weekly – Are Higher Interest Rates Bearish for Risk Assets? (July 17, 2023)

by the Asset Allocation Committee | PDF

Orthodox finance and economics rests on the idea that higher interest rates reduce economic activity and lower the attractiveness of risk assets. We have no real quarrel with the part about reducing economic activity as higher borrowing costs will tend to slow investment and consumer durable spending. The effect on risk assets seems rather straightforward as well. Higher rates should divert funds to fixed income and away from equities and commodities.

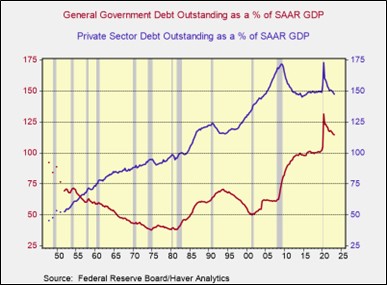

However, when debt levels are elevated, rising interest rates could increase interest income. Current debt levels are high.

This chart shows private sector debt (household plus non-financial business sector) scaled to GDP along with general government debt. Although the total is down from the pandemic peak of 304.1%, it is still 262.0% of GDP. Combine that debt level with rapid policy tightening, and interest income would be expected to rise. In fact, in raw terms, it is.

Interest income is about 8% of total personal income, which is lower than the peak of 18% in 1984. Thus, in looking at the overall data, there isn’t a strong case that interest income is all that significant yet.

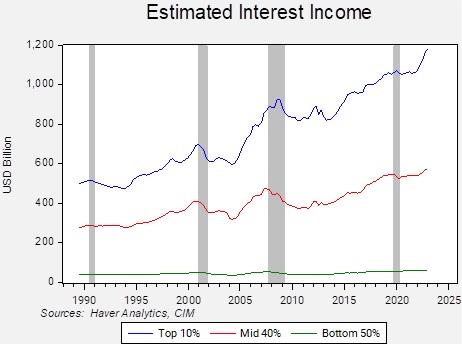

However, there is a distributional factor that may affect risk assets.

In this chart, we estimate the flows of interest income by wealth distribution. As the chart shows, over the past 18 months, interest income to the top 10% of households has increased significantly. The middle 40% has seen modest gains, while the bottom 50% has seen small increases.

In terms of asset allocation, the top 10% hold around 50% to 60% of their wealth in equities. Increased income flows to this wealth bracket, paradoxically, means that more liquidity is available for other purchases. As long as interest rates stay elevated, we would expect fixed income and cash balances to remain high. Although once policy starts to ease, this additional income will likely look for other alternatives; put another way, the bounce to stocks from policy easing could be higher than expected.