Weekly Energy Update (July 20, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

On Monday, oil prices spiked on reports that the Kingdom of Saudi Arabia (KSA) was going to extend its voluntary production cuts until year’s end. The report was incorrect but does show the power that the news has on the oil markets.

(Source: Barchart.com)

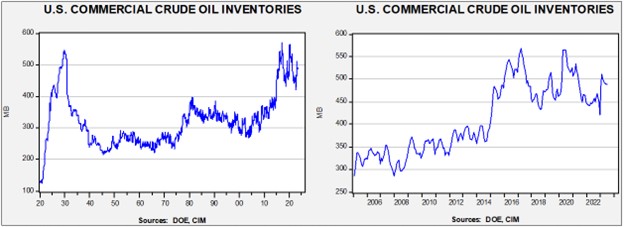

Commercial crude oil inventories fell 0.7 mb, less than the 2.5 mb draw forecast. The SPR was unchanged.

In the details, U.S. crude oil production was steady at 12.3 mbpd. Exports rose 1.7 mbpd, while imports increased 1.3 mbpd. Refining activity rose 0.6% to 94.3% of capacity.

(Sources: DOE, CIM)

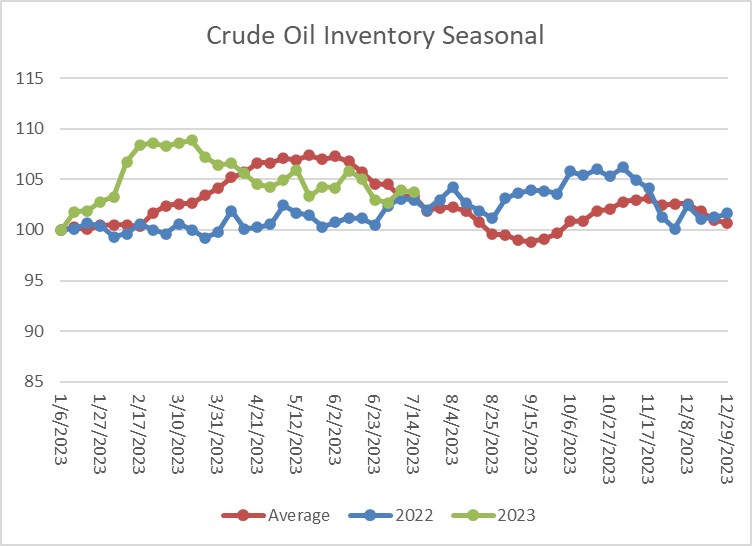

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace in the first quarter, stockpiles have moved into a pattern consistent with the seasonal. Current inventories are in line with seasonal levels.

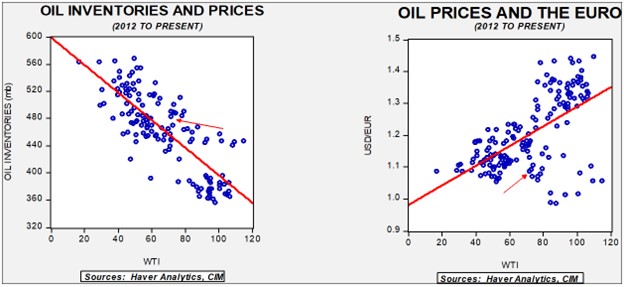

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $59.94. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

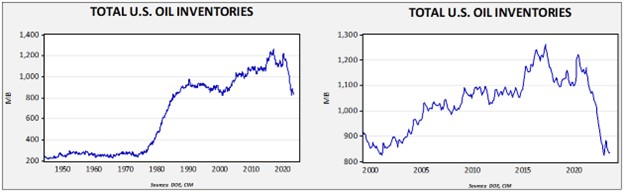

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2002. Using total stocks since 2015, fair value is $92.96.

About the Heat: We have been commenting on the unusually warm temperatures currently in the Northern hemisphere. Europe, unaccustomed to such heat, is having a very difficult time adjusting. In the U.S. the southern tier of states has experienced extreme heat, especially in the Southwest. China is seeing hot weather as well. Temperature reporting is now front and center in the media. Although climate change is being blamed for much of it, our experience with climate is that it’s complicated. There are two complications that are important to mention:

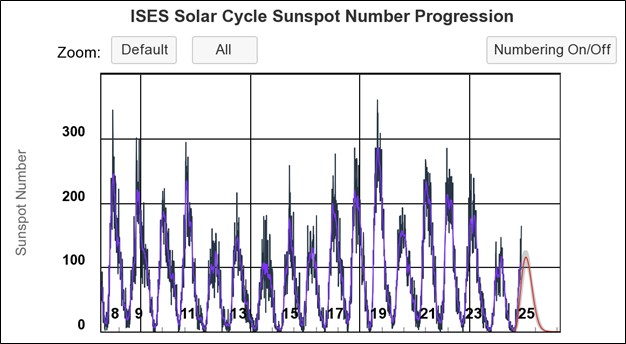

- Sunspot cycles: The sun plays a major role in the earth’s climate. Sunspots are the result of magnetic activity on the sun that causes flares and ejections from the sun’s surface. The scientific community is divided on the impact of sunspots on climate. Some argue that it is an important factor, others dismiss the activity as negligible. We are not climate scientists but interested observers. Our take is that the cycles likely amplify the normal variation. That means that sunspot cycles probably don’t drive climate by themselves but do play a role.

- Sunspot cycles run 22 years, from trough to trough. The current cycle will peak in 2025. In general, increased activity tends to lead to higher temperatures. Thus, we are in the part of the cycle that should lift global temperatures. The current cycle isn’t unusually amplified, but its current readings exceed the peaks observed in the last cycle.

(Source: NOAA)

- ENSO cycles: The ENSO cycle has three phases—El Niño, La Niña, and neutral. In recent years, we had experienced a set of La Niña events. We are currently in an El Niño event, and current projections suggest it will be moderate to strong. El Niño events often lead to hot North American summers, especially across the south. It has also coincided with mild winters.

The combination of elevated sunspot activity and an El Niño ENSO cycle indicates that hot weather will continue. In the developed world, this climate condition tends to be bullish for summertime natural gas prices, as it boosts air conditioning demand and consequently, electricity consumption. So far, U.S. natural gas production has been robust enough to keep injections on par with seasonal norms. This factor has kept natural gas prices low. If winters are mild, it could be bearish for natural gas prices going forward. There have been other effects as well:

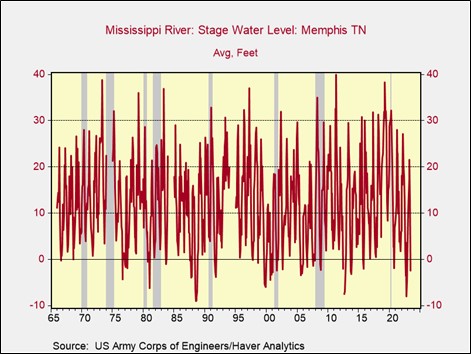

- Hot, dry weather in parts of Europe have caused the water levels of the Rhine River to decline, forcing shippers to lighten barges by shipping less product. Mississippi River water levels are also low.

- High river temperatures are limiting nuclear power production in France.

- Hot weather in Spain has sent (olive) oil prices soaring.

- Temperature and rainfall changes have created situations where it is hard to find any part of the U.S. that is unaffected.

Market News:

- The IEA’s oil market report increased oil demand by 2.4 mbpd to 102.3 mbpd, a new record. Most of the demand will be met by non-OPEC+ suppliers. Meanwhile, we note that the KSA is losing its spot as top oil producer within OPEC+. In the early 1980s, something similar occurred which led the Saudis to aggressively retake market share, tanking oil prices in the mid-1980s.

- As the KSA reduces output, Kuwait is aggressively lifting productive capacity. We doubt that the Saudis will tolerate this absorption of market share indefinitely.

- The global natural gas market is experiencing a generational adjustment in the wake of the war in Ukraine. The IEA’s recent global natural gas report details how the world market for gas has changed.

- The recovery in oil prices has lifted the Russian Urals price to the G-7 cap of $60 per barrel. The breach will begin triggering financial sanctions for traders and the financiers of these oil purchases. We will be watching to see if Russian oil sales are affected.

- The Biden administration is planning modest injections into the SPR, but in no way is this going to replace all the oil that was sold.

- California, once a major oil producer and still the 7th largest oil producing state, has essentially stopped new oil well approvals.

- Turkey has suspended oil flows from Iraq over a dispute over payments. So far, there has been little progress in freeing up these flows.

- One of the surprises of the past year has been the rather modest increase in U.S. oil production despite elevated prices. As we have noted in the past few months, higher costs for drilling and financing issues have stifled output. Now, there are reports that drilling rig counts are fading, suggesting that production may decline in the coming months.

Geopolitical News:

- India has been a major buyer of Russian crude oil, but the two nations have struggled to establish payments. India has been paying in INR, but the Russians have discovered that the usefulness of INR is limited due to the lack of deep Indian financial markets and capital controls. And so, to facilitate further sales and avoid USD transactions, Russia and India have agreed to transact in CNY. It’s unclear how much is being done in the Chinese currency and what India’s CNY reserve status is at the moment. However, if this continues, then at some point India will need to run a trade surplus with China to acquire CNY. We doubt China will support that outcome.

- Israel is working to improve relations with Azerbaijan. The Israeli defense minister has visited the country recently. At the same time, Azerbaijan is working to improve relations with Iran as well.

- Russia recently suggested that the UAE had the rightful claim to the Greater and Lesser Tunbs and Abu Musa, three islands in the Persian Gulf that are controlled by Iran. The Iranians were not pleased. Although Iran and Russia have seen relations improve recently, there have been notable differences over the years that still affect the relationship.

- As part of the thaw in Saudi/Iranian relations, the KSA, Kuwait, and Iran may be working to jointly develop offshore natural gas in the Persian Gulf.

- In response to Iran’s interdiction of Persian Gulf shipping, the U.S. is increasing its deployment of F-16s to the region. The U.S. has also moved F-35s and a destroyer to protect shipping. There is also talk of boosting air defense systems in Iraqi Kurdistan as Iran has also been threatening that region.

- The morality police in Iran were sidelined during last year’s headscarf protests. The police have apparently returned, along with a crackdown on women not wearing the hijab.

- Although sanctions on Russian energy sales have affected global oil supply, they haven’t really prevented Russian oil from entering the market. The sanctions have reduced the Russian revenues from oil sales (evading sanctions costs money), but the Russian economy continues to muddle through, although there is increasing evidence that economic conditions are deteriorating. Essentially, Western nations really didn’t want to shut off the flow of Russian oil, but they just didn’t want to pay high prices due to sanctions. The real goal was to reduce Russian revenue, and in those terms, sanctions have been generally effective.

- Saudi Arabia is increasing its imports of Russian petroleum products. We suspect these are for reexport. Exporting product to friendly nations is one way Russia is evading sanctions.

- Sanctions on Russian oil have benefited Venezuela and Iran, who have both seen sanctions on their respective nations ease. Dubai has benefited by becoming the place where Russian oil deals are consummated. The role of busting sanctions used to belong to Switzerland; that has changed.

- Interestingly enough, the U.S. has also benefited from sanctions. The shift from coal to oil disadvantaged Europe, which had plenty of coal but lacked oil. The U.S. has attempted to use oil as a diplomatic tool to gain European compliance to American policy goals. Europe, obviously wanting to avoid this pressure, and against American opposition, bought Russian oil. The U.S. was open to Europe buying oil from the Middle East as well, but Europe’s goal was diversity of sources. The war in Ukraine has exposed the risks of being dependent on Russia, which has led to a boom in U.S. oil and gas sales to Europe.

- Schlumberger (SLB, $56.41) has finally ended sales to Russia.

- Relations between the UAE and the KSA leaders have deteriorated recently. Mostly, it appears to be driven by the goal of both leaders to project power in the region.

Alternative Energy/Policy News:

- Solid state EV batteries could be the technology that moves transportation to electricity. The batteries promise not only to recharge in a time frame similar to filling a car with gasoline, but also to have a range that may exceed 700 miles per charge. Nio (NIO, $10.48) announced it will start using these batteries. The current technology is still emerging, but the more the industry moves to solid state, the quicker the transition is likely to be.

- We continue to monitor the progress in not just solid state batteries, but cheaper materials to make batteries. Lithium prices have soared as EV production rises, so replacing such metals with cheaper alternatives would be another form of progress.

- The European heatwave, noted above, is boosting solar power output.

- The EU is trying to use trade policy to secure critical EV metals. Mercosur and the EU have been in trade negotiations for some time, but now the EV buildout is increasing European’s interest in getting a deal done. However, for the Mercosur nations, the echoes of colonialism continue, prompting resource nationalism.

- The U.S. Senate has approved a tax treaty with Chile, which could support lithium imports.

- The Economist magazine notes that the process of energy conversion may not be possible without buying such products from China.

- Chinese GDP data was disappointing, but two bright spots are EVs and solar panels. China is aggressively building out battery storage which is critical to the expansion of solar power.

- According to reports, China is aggressively hacking the U.S. energy grid and could use cyberattacks on the grid in case of a war.

- One of the paradoxes of the energy transition is that environmental concerns about mining key metals is hampering the expansion of supplies needed to replace fossil fuels.

- As the world scrambles for critical EV minerals, mining the deep sea is being considered. Concerns about environmental damage are being raised.

- Maine has deposits of lithium, but the state prohibits commercial mining of the resource.

- Clean hydrogen offers the promise of clean energy using the existing infrastructure. However, it isn’t clear if that promise will ever materialize.

- A new deal to build and deploy small modular nuclear reactors in the Northwest shows the steady growth and interest in this new technology.

- The CFTC is drafting guidance for the eventual creation of a carbon market. Economists hold that the fastest way to address carbon reduction is to properly price it. Having this trading done on exchanges is one way to create a market for carbon credits.