Daily Comment (July 28, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with a discussion about the Bank of Japan’s latest policy decision. Next, we will provide an in-depth analysis of the GDP report, including why we believe that the warm weather may hurt economic growth in the third quarter. Finally, we end with our thoughts about the underlying tensions within the Western bloc.

New Day for BOJ: The Bank of Japan has left its policy rate unchanged but made a tweak to its yield control

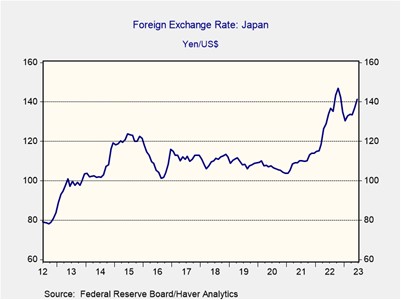

- The Bank of Japan (BOJ) has made a surprise move to relax its yield curve control policy, allowing 10-year Japanese government bond yields to rise to 1.0%. The BOJ had previously capped yields at 0.5%, but it now says that the limit will no longer be rigid but rather a reference rate. This signals that the BOJ is planning to get less involved in anchoring the yield curve. The move comes after reports showed that consumer prices excluding fresh food rose 3% in Tokyo in June, well above the BOJ’s 2% target.

- Traders viewed the Bank of Japan’s (BOJ) decision to relax its yield curve control policy as a sign that the central bank was moving away from its ultra-accommodative monetary policy. Yesterday’s reports that the BOJ was considering such a move led to a drop in all major indexes in the U.S., with the S&P 500 falling 0.62%, the NASDAQ slipping 0.64%, and the Dow Jones Industrial Average dropping 0.67%. The dollar also slipped against the yen (JPY), from 144 per dollar to 139. The move is a sign that the BOJ is preparing to normalize monetary policy.

- The BOJ’s decision to relax its yield curve control policy marks a significant shift in financial markets, particularly in the yen carry trade. The trading strategy involves borrowing JPY at low-interest rates and investing in assets that offer higher yields. Low rates and a weak currency have made the JPY an attractive funding currency for this strategy. However, if interest rates in Japan rise, the yen carry trade will become less profitable and hurt traders who will have to repay loans with a stronger currency. Additionally, the move will cause investors to reassess their risk appetite, especially as the global economy shows signs of slowing.

Keep on Surprising: Strong GDP growth in the second quarter of 2023 has bolstered hopes that the U.S. economy may be able to skirt a recession, but we have doubts.

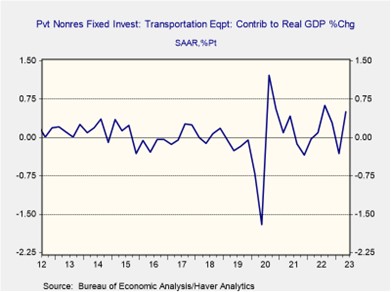

- The American economy expanded at a faster-than-expected pace in the second quarter of 2023, according to the Bureau of Economic Analysis (BEA). GDP grew at an annualized pace of 2.4% from April to June, up from a revised 2.0% in the first quarter. The figure was also above the consensus estimate of 1.8%. A rebound in investment spending boosted the growth, as it offset deceleration in both government spending and consumption. Although it is unclear whether we are out of the woods, the report does provide reassurances that the economy is more resilient than many suspected.

- A deeper dive into the investment GDP numbers shows that much of the increase came from private investment, particularly in transportation. Purchases of transportation equipment accounted for more than half of the growth in fixed investment and more than a fifth of the rise in overall growth. Although it is unclear where the rise has come from, there is speculation that it may have something to do with the government infrastructure bill passed in 2021. Additionally, steps made toward reshoring manufacturing may have also played a role. If this is true, it suggests that investment may be able to support a longer expansion.

- That said, hotter-than-normal temperatures and El Niño conditions could lead to an unexpected drop in growth in the third quarter. These factors could make it harder for workers to perform outside jobs and deter consumers from engaging in outdoor activities. There are signs that the heat is leading to a decline in consumer spending and business investment. On Thursday, President Biden instructed the Department of Labor to ramp up enforcement of on-the-job heat hazards. At the same time, theme parks such as Disney World have experienced a sharp decline in attendance. The extent of the economic impact of high temperatures on economic activity is unclear, but it is likely to weigh on GDP.

Let’s Be Friends: NATO allies are vying for support in the Oceania region as geopolitical tensions in the Indo-Pacific heat up.

- As geopolitical tensions rise in the Indo-Pacific, Western leaders have traveled to Oceania to build ties with countries in the region. French President Emmanuel Macron is currently on a week-long tour of the Polynesian islands, where he warned of a “new imperialism” threatening the sovereignty of numerous states in the South Pacific. On the same day, U.S. Defense Secretary Lloyd Austin gave a speech in Papua New Guinea, reassuring government officials that the U.S. was not planning to set up a permanent base in the country, and the U.S. Secretary of State Antony Blinken invited New Zealand to join AUKUS.

- Western overtures in Oceania are part of a strategic pivot toward Asia to counter China’s growing influence in the region. In April 2022, the Solomon Islands authorized the Chinese navy to make routine port visits, raising concerns that Beijing could establish a permanent military base in the region. In response, the United States and European countries have increased their engagement with Oceania. This year, the U.S. has signed defense agreements and reopened embassies after decades of closure. France has also sought to improve ties with Australia and position itself as an alternative to China and the United States in the Oceania region.

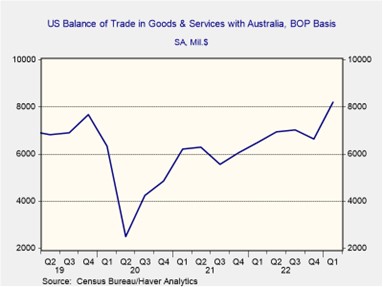

- Along with security agreements, the U.S. is also looking to increase trade ties with Australia

- While the West agrees on the need to stand up to China in the Indo-Pacific, there are signs that the two sides are not completely aligned. Europe’s focus on strategic autonomy is one example of this, as it suggests that the bloc is seeking to avoid putting all of its eggs in the U.S. basket. France has been particularly vocal in this regard, with President Macron stating that he wants to maintain a “constructive relationship” with China, despite U.S. calls for de-risking. Although we do not expect the Western allies to have a major fallout over this dispute, we do foresee a less cooperative relationship, especially if the war in Ukraine ends.