Daily Comment (August 16, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a brief remark on the importance of linking geopolitics to investment strategy. We next review a range of international and U.S. developments with the potential to affect the financial markets today, including another instance in which U.S.-China tensions have apparently scuttled an international transaction and ominous signs of a potential autoworkers’ strike in the U.S.

Geopolitics and Investment Strategy: The Financial Times today carries an interesting opinion piece by Saker Nusseibeh, CEO of asset manager Federated Hermes (FHI, $32.77), in which he argues that de-globalization and the fracturing of the world into blocs requires asset managers to pay closer attention to geopolitics. According to Nusseibeh, asset managers today need to have a deep understanding of how geopolitics can affect asset values and prospects, and they need to actively develop the skill sets and human capital applicable to understanding those linkages. As our regular readers know, we are longtime practitioners of geopolitical analysis and take great pride in our ability to walk from an understanding of the world’s political, security, and economic trends to the setting of investment strategy. Reading Nusseibeh’s article today, our response is: We couldn’t have said it better ourselves!

China-United States: As one great example of how geopolitics can directly affect company operations and prospects, semiconductor giant Intel (INTC, $34.77) and Israeli computer-chip maker Tower Semiconductor (TSEM, $33.78) today said they will abandon their planned merger after failing to get timely approval from China’s State Administration for Market Regulation. Beijing’s failure to approve the deal is being widely interpreted as further retaliation against the West for its clampdown on advanced technology flows to China. As we have argued many times before, the increasing geopolitical rivalry between the U.S. bloc and the China/Russia bloc presents risks for any investor who has a position in Chinese assets or in assets dependent on the Chinese market and/or Chinese regulators.

China-Vietnam: New commercial imagery shows China has suddenly started building an airstrip on one of the disputed Paracel Islands in the South China Sea. At present, it appears the airstrip is too small to host larger military jets. Nevertheless, its location on Triton Island, which is the Paracel Island closest to Vietnam, will likely be disconcerting to Hanoi. While it’s become commonplace to note Beijing’s mistakes in economic management, this could be another instance of it over-playing its geopolitical and military hand, since construction of the airstrip could push Vietnamese officials even closer to the U.S.

Russia-United Kingdom: British police said that in February they arrested five people, including three Bulgarians, on charges of working under non-official cover for the Russian intelligence services. The arrests are only the latest in a series of arrests of Russian intelligence operatives posing as common citizens in Western countries, rather than as diplomats and other officials. That likely reflects the damage done to Russian intelligence when Western countries expelled hundreds of official-cover spies immediately after Russia’s invasion of Ukraine last year. To compensate, the Russians have activated their deep-cover operatives, raising their profiles and putting them at greater risk of arrest.

Russia: After the central bank’s big interest-rate hike yesterday failed to stem the ruble’s (RUB) steep depreciation, President Putin today is holding an emergency meeting with his top economic officials to discuss ramping up currency controls. The measures being considered include requiring exporters to convert 80% of their foreign-currency revenue to RUB, banning foreign loans and dividend payments, and cancelling import subsidies. In New York trading yesterday, the RUB closed at 98.001 per dollar ($0.0102), down 1.0%.

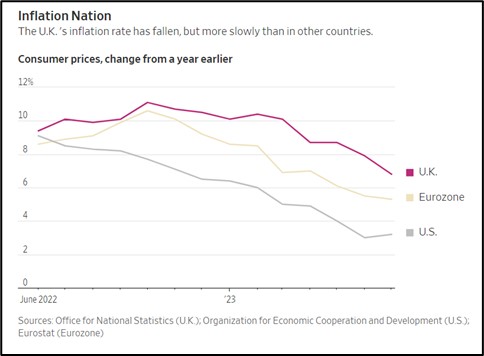

United Kingdom: Just a day after a report of surging wage rates sparked renewed concerns about inflation, the Office for National Statistics today said the July consumer price index was up 6.8% from the same month one year earlier, considerably better than the 7.9% rise in the year to June and the lowest headline inflation reading since February 2022. However, after excluding the volatile food and energy components, the July “core” CPI was 6.9%, matching the core inflation rate in June and coming in above expectations. On balance, the reports suggest the Bank of England will have to continue hiking interest rates to get a handle on the U.K.’s sticky inflation problem.

Japan: Now that the country is seeing sustained inflation again and longer-term interest rates are moving up, Japanese banks are starting to realize that their bond traders may not have the skill set to deal with higher yields and greater volatility. Some bankers are therefore actively seeking to hire older traders with experience extending back to the 1980s. At least one banker has likened the situation to this year’s Top Gun: Maverick movie, in which an aging pilot with specialized skills is called back into service.

Argentina: Even though the government implemented a sudden currency devaluation and interest-rate hike immediately after radical right-wing economist Javier Milei won the weekend’s presidential primary election, the peso (ARS) has remained under pressure on concerns about Milei’s proposed austerity and currency policies. The markets increasingly suggest the government will have to devalue the currency further in the coming days, which would only add to Argentina’s sky-high price inflation. The chaos also puts at risk the International Monetary Fund’s final approval for the latest $7.5-billion installment of its $44-billion bailout package.

U.S. Labor Market: The United Autoworkers Union said new contract negotiations with the top U.S. automakers have been going too slowly, so it will hold a strike vote next week. If at least two-thirds of the union members vote to authorize the strike, union leaders would be able to formally call the walk-out as the September 14 expiration of the current contract draws closer. Based on the recent militant comments by union leaders and the fact that they have made such aggressive requests in the negotiations, the probability of a costly, disruptive strike is elevated.