Daily Comment (August 17, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment will cover three key themes: what the latest FOMC meeting minutes could mean for monetary policy going forward, an update on the latest complaints regarding artificial intelligence, and why the upcoming Argentine election in October has investors on edge.

Is the Fed Done? The hawkish Fed minutes weighed on market sentiment as investors pulled back on bets of a Fed pause.

- The minutes of the Federal Open Market Committee’s (FOMC) July 25-26 meeting revealed that most members believed that there was a significant upside risk to inflation, which could warrant additional rate hikes. This hawkish tone suggests that, despite the progress made in bringing down inflation, policymakers are not yet confident that inflation has peaked and are willing to take a more aggressive approach in tightening monetary policy. However, there were also a few more optimistic members of the FOMC. Two officials favored leaving rates unchanged or “could have supported such a proposal.” Although there were no dissenting votes, it is clear that not all policymakers are on the same page.

- Investor sentiment soured following the release of the FOMC minutes, as the market could not rule out the possibility of a hard landing. The S&P 500 closed yesterday down nearly 0.8%, while the U.S. Dollar Index (DXY) rallied. Despite the disappointing news, investors did not severely change their rate expectations. The yield on the 10-year Treasury rose a paltry 5 basis points, and the CME FedWatch Tool’s expectation of a September hike increased only modestly from 10% to 12.5%. This suggests that investors still believe that the Fed is near the end of its hiking cycle.

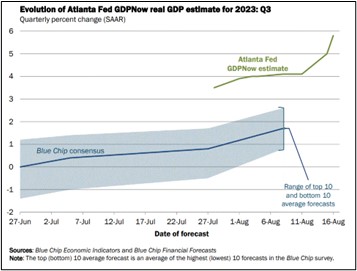

- Despite the market’s reaction, it is too soon to rule out another rate hike this year. As the chart above shows, the economy is projected to accelerate in the third quarter, making it difficult for the Fed to justify easing policy any time soon. This may explain why investors sold off after the report, as they may have wanted to lock in their gains from earlier this year. However, we will be paying close attention to Fed Chair Jerome Powell’s speech at Jackson Hole next week for any hints as to how the Fed is leaning. Our expectation is that Powell will likely keep his options open.

AI Presence Expanding: Generative artificial intelligence (AI) is receiving flak after author Jane Friedman found books generated by the technology that were claimed to have been written by her.

- The rise of AI-generated content has sparked controversy with some people concerned that it will displace human workers. This is because AI models are trained on massive datasets of text and code, including the work of authors. Without proper attribution, this can lead to accusations of plagiarism and copyright infringement. A survey by the Authors Guild found that 90% of writers believe they should be compensated for their work used to train AI models. Others argue that the rising popularity of AI-generated content threatens to crowd out quality work from human writers.

- Generative AI content-generating applications are at the heart of the Hollywood writers’ and actors’ strikes, and their concerns could easily spread to other industries. The strike has gone on for over 100 days, and it appears that studios have already made some concessions, such as crediting writers for work used by the models and using more human-generated content. However, it remains to be seen whether these concessions will be enough to satisfy the picketers. Regardless of the outcome of the strikes, it is clear that AI is here to stay in Hollywood. A recent survey found that over 96% of media executives plan to increase their spending on AI technology.

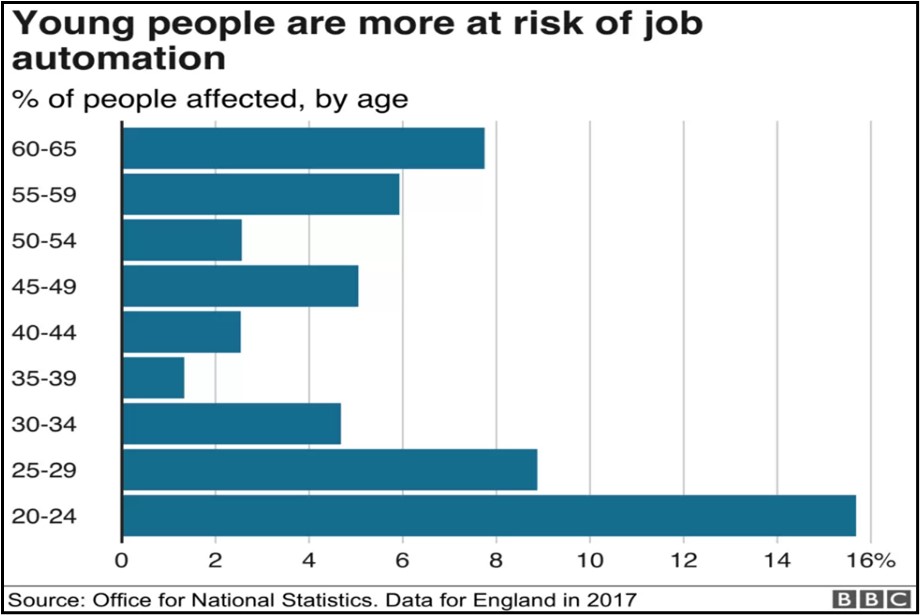

- The ongoing dispute between Hollywood writers and actors is an example of how workers are concerned about the potential for technology to displace low-skill and middle-skill white-collar workers, particularly among young people. Without adequate regulations in place, the growing ubiquity of AI could lead to a knowledge gap and inequality in the workforce. As a result, we suspect that the technology will likely face increased scrutiny in the coming months as concerns about its disruptive potential enter the national conversation. Investors should be aware of the uncertain regulatory landscape for the technology and how this may impact company earnings in the future.

Argentina in the Spotlight: The presidential front-runner in Argentina unveiled controversial proposals to overhaul the Argentine economy that have left many investors worried.

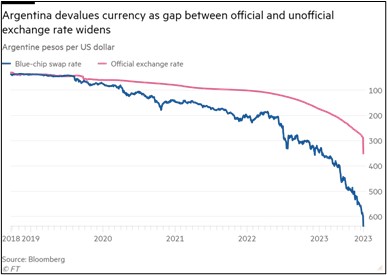

- Libertarian presidential candidate Javier Milei has proposed a sweeping set of free-market policies to jumpstart the Argentine economy. In a two-hour interview, he promised to slash government spending by at least 13% of GDP by 2025, shutter the country’s central bank, and replace the national currency with the U.S. dollar. These policies are designed to help rebrand Argentina as a stable and attractive destination for investment, following years of economic turmoil. Argentina narrowly avoided default earlier this year after it was able to restructure nearly $22 billion of domestic debt, extending the maturity into 2024 and 2025. The event led S&P to slash Argentina’s national rating to SD from raCCC+.

- In addition to radically reforming the economy, the new leader vowed to distance Argentina from socialist countries, including its two largest trading partners: Brazil and China. According to the Observatory of Economic Complexity, these two countries imported more than $17 billion worth of Argentine goods in 2021, which is more than the next three countries combined. Milei’s remarks are likely to be a major shift in the country’s trade policy as it has often relied on China for exports and debt relief. Growing uncertainty regarding the impact of his policies led to a steep decline in the Argentine peso (ARS).

- The rise of Javier Milei is a reminder of how volatile Latin American politics can be. The region has typically swung between left-wing and right-wing governments, each promising to bring about a better future. However, as the world moves towards regional blocs, we see the same volatility in foreign and trade policy. For example, Brazil’s relationship with China was very contentious before Lula took over the presidency, since former President Jair Bolsonaro had blamed China for the pandemic. As a result, investors should keep in mind that these blocs will be fluid, especially as the world moves away from globalization.