Daily Comment (August 22, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment opens with a curtain-raiser for the BRICS summit starting today in South Africa. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including news of growing trade ties between China and Russia, a vote for a new prime minister in Thailand, and the latest developments in the U.S. labor market.

Brazil-Russia-India-China-South Africa: The latest summit of the BRICS countries will start today in Johannesburg, with appearances by top leaders ranging from Chinese President Xi to Indian Prime Minister Modi. Leaders from a number of other emerging markets will also be attending, although Russian President Putin will not.

- One key agenda item is Xi’s push to expand the group to countries such as Indonesia and Iran. However, Modi and Brazilian President Luiz Inácio Lula da Silva are resisting that move out of fear it would give Xi too much power and dilute their influence.

- The leaders reportedly also plan to discuss how the countries can reduce their reliance on the U.S. dollar, especially after seeing how Washington and its allies were able to freeze hundreds of billions of dollars of Russia’s foreign reserves following its invasion of Ukraine.

- Some observers think the summit will also discuss the creation of a new BRICS currency to replace the dollar, sparking fears of a sudden weakening in the greenback. However, other reporting suggests an alternative currency will not formally be on the agenda.

- In any case, even though the greenback’s dominance in international trade and foreign reserves has been falling gradually for years, we and other observers doubt the renminbi (CNY) or any other proposed alternative could suddenly and sharply displace it. At least for now, we think there are big political, economic, financial, and technical hurdles that would likely preclude the BRICS countries from a wholesale abandonment of the dollar.

China-Russia: New data shows that total trade between China and Russia in the first seven months of 2023 jumped to $134 billion, up 36% from the same period one year earlier, putting Russia just behind Australia and Taiwan in the list of China’s largest trading partners. The figures illustrate how Russia’s invasion of Ukraine and the resulting Western sanctions have pushed China and Russia closer together economically, helping coalesce the evolving China/Russia geopolitical bloc. We think the continued war and the continued common interest of the two countries will lead to a further coalescing of the bloc in the coming years, making it even more difficult for U.S. investors wanting to invest in the members of the bloc.

- While China’s overall exports from January through July were down 5% on the year, its exports to Russia were up 73%. That means China now accounts for almost half of all Russian imports. Importantly, China appears to be sending Russia many products with dual military/civilian uses that could help support Moscow’s invasion Ukraine, such as semiconductors and heavy equipment.

- Russia’s exports to China in the same period were up 17% on the year, boosting Russia’s share of China’s imports to 4.8%

China-United States: For the second time this month, the Chinese Ministry of State Security reported that it has arrested a Chinese citizen on charges of spying for the Central Intelligence Agency. The announcement came just a month after CIA Director William Burns said his agency was making progress in rebuilding its spy network in China. That suggests the MSS statements may be as much public relations as anything else.

- In any case, the CIA evidently recruited both spies while they were studying abroad, one in Japan and the other in Italy.

- To do so, it appears that the CIA borrowed the very same techniques the MSS has used to recruit U.S. citizens to spy for China, i.e., it buttered them up with compliments, dinners, gifts, and offers to pay for written “research.” (We think that’s hilarious.)

Japan: The government stated today that on Thursday it will start releasing tritium-laced water from the Fukushima No. 1 nuclear power plant that is being decommissioned following its inundation and nuclear accident due to a tsunami in 2011. Release of the stored radioactive water is opposed not only by local residents and fishers, but also by a number of neighboring countries. Importantly, some countries have threatened to ban imports of Japanese seafood because of concerns about radioactivity.

Thailand: Today, parliament picked real-estate tycoon Srettha Thavisin as the country’s next prime minister, marking a modest democratic advance after almost a decade of military rule. Even though Thavisin had to rely on military-backed parties to be elected, the return of civilian rule and the fact that Thavisin is seen as pro-democracy will likely help the U.S. strengthen ties with Thailand again after it had drifted closer to China in recent years.

U.S. Labor Market: Unionized pilots at American Airlines (AAL, $15.16) ratified a new labor contract that will boost wages by more than 40% over its four-year term. The eye-popping wage increase reflects not only today’s general post-pandemic labor shortage, but also a shortfall in the number of available aviators and surging demand for leisure travel. Such lucrative new labor contracts will likely keep investors concerned about continuing inflation pressures and the likelihood that the Federal Reserve will keep interest rates “higher for longer.”

- All the same, other signs point to some cooling in labor demand. For example, new data from ZipRecruiter (ZIP, $16.66) shows that most of the postings for some 20,000 different job titles on its site are offering less pay than just one year ago.

- The biggest drops have been in technology, transportation, and other sectors that had hiring frenzies in 2021 and early 2022.

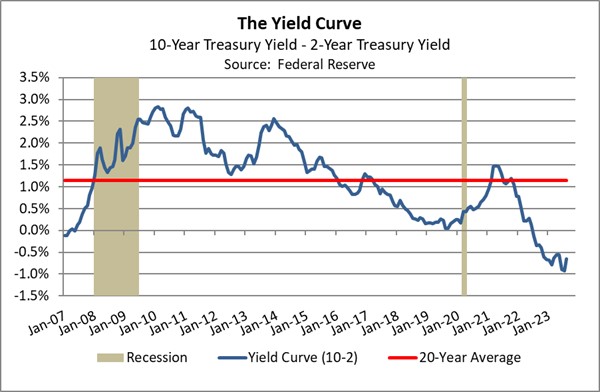

U.S. Bond Market: The rare “bear steepening” in the Treasury yield curve has continued this week, with the yield on the 10-year Treasury note rising yesterday to a 16-year high of 4.339% while the yield on the two-year obligation rose to 4.990%. The difference between the two has now narrowed to just 65 basis points, compared with 93 basis points as recently as the end of July. We believe the rise in longer-term yields primarily reflects a realization that the Fed is not likely to cut interest rates in the near term. Since the yield curve’s inversion remains quite large, we think there is plenty of room for longer-term yields to keep rising.

- Meanwhile, new data shows that the average interest rate on a 30-year, fixed-rate mortgage has jumped to 7.48%, reaching its highest level since November 2000.

- That will likely continue to discourage current homeowners with ultralow mortgage interest rates from putting their homes on the market. That could make the supply of existing homes even tighter and push their prices higher, while also creating further incentives for new home construction.