Daily Comment (August 29, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with concerns about a new El Niño event that could further boost global food prices and other global data showing a decline in alternative investments. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a renewed commitment by the European Union to expand by 2030 and an analysis suggesting the U.S. labor force participation rate is now being held down mostly by demographics rather than the impact of the coronavirus pandemic.

Global Agriculture Markets: An expected warming of waters in the Pacific Ocean, known as El Niño, has officials and investors bracing for weather disruptions such as increased heat in Central America and increased rain in the Andes. Importantly, an El Niño event typically distorts crop cycles and could exacerbate today’s existing food supply issues, such as Ukraine’s grain export challenges because of Russia’s invasion and India’s ban on exports after heavy rains damaged its rice crop. The results could include higher food prices around the world, boosting overall consumer price inflation and interest rates, and might also lead to political unrest in poorer countries.

Global Alternative Investment Market: Data from Preqin shows that alternative investment funds—which invest in assets ranging from private equity and hedge funds to real estate and private credit—have raised just $740 billion since the start of this year, down 27% from the $1.02 trillion raised in same period last year. The drop in fundraising reflects the impact of higher global interest rates, weak stock markets late last year, and a tepid market for initial public offerings.

European Union: European Council President Charles Michel said in a speech that the EU should be ready to admit Ukraine, various Balkan states, and other countries into the bloc by 2030. Michel argued that setting a specific target date would force current EU members to grapple with the changes needed to admit new members while also galvanizing reforms in aspirant countries.

Germany: Average wages in the second quarter were up a record 6.6% from the same period one year earlier, slightly beating the consumer price inflation of 6.5% over the same timeframe and accelerating from a wage rise of 5.6% in the year ended in the first quarter. Amid Germany’s broader, structural economic challenges, the figures suggest that German workers are at least no longer facing a decline in their real purchasing power. Nonetheless, the figures also bolster concerns about on-going price pressures and the potential for further monetary tightening by the European Central Bank.

Brazil: Leftist President Luiz Inácio Lula da Silva is reportedly close to striking a deal with two right-wing parties formerly allied with his defeated rival, Former President Jair Bolsonaro, in a move aimed at overcoming Congressional opposition to his initiatives to hike public spending and pass greater protections for workers, minorities, and the environment. The deal would cede cabinet posts and potentially other roles in return for support in Congress, where the coalition led by Lula and his Workers’ Party does not command a majority.

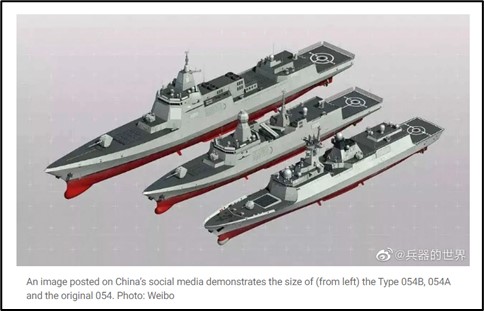

China: Photographs on social media show that the Chinese navy has finally launched the first of its Type 054B frigates, which sport an advanced phased-radar system, a stealth mast aimed at allowing it to sail undetected through the seas along China’s coast, an integrated electric propulsion system that will allow it to power a wider range of weapons, and an active towed-sonar system designed to identify U.S. and allied submarines. The ship is also the largest Type 054 variant, with an estimated length of 482 feet and a width of almost 60 feet.

- As we have mentioned before, China now has the world’s largest navy, with a combat force of approximately 350 ships. The U.S. Navy is now a distant second, with about 295 ships.

- Importantly, as this report illustrates, China also continues to make steady progress in increasing the size and capabilities of its vessels.

United States-China: Commerce Secretary Raimondo today tried to counterbalance her Monday statements that the U.S. would prioritize national security and protect its workers, saying the country was nevertheless not intending to “decouple” from China. The reporting on the second day also indicates that U.S. and Chinese officials have agreed to regular information-sharing meetings designed to ease economic tensions.

- While certain members of the Biden administration have taken a tough stance against the geopolitical and economic threat from China, the administration has recently tried to use bilateral meetings to ease tensions. At least in part, that probably reflects pressure from foreign allies and the left wing of the domestic political system.

- Nevertheless, we suspect that bilateral meetings, information-sharing sessions, and the like can only go so far in easing tensions. China’s economic imperatives probably still include steps to boost its trade and investment activity around the world, often at the expense of established Western companies and their workers. More important, we think China’s increasingly aggressive military activity and the continued build-up in its conventional and nuclear arsenal (see above) will ultimately spoil any benefit from eased economic tensions.

U.S. Industrial Sector: The Wall Street Journal’s “Heard on the Street” column has recently run at least few stories extolling U.S. industrial and basic materials firms as likely beneficiaries of the re-industrialization and factory building boom that we’ve been writing about. Last week, the column featured industrial machine maker Rockwell Automation (ROK, $309.05), and today it features steelmaker U.S. Steel (X, $29.92). We don’t necessarily endorse the specific analyses or recommendations regarding those stocks. All the same, we do think the articles illustrate how the investor class is swinging around to our view that the industrial sector is attractive as the world fractures into relatively separate geopolitical and economic blocs, and as more production is shifted out of China and back to the U.S. or to U.S. allies.

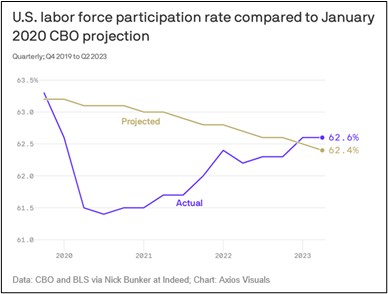

U.S. Labor Market: Analysis from Axios shows the labor force participation rate has recently been exceeding the Congressional Budget Office’s early-2022 forecast for this period. The LFPR (the share of adult, non-institutionalized civilians who are working or seeking work) has stood at 62.6% for several months, versus a CBO forecast of 62.4%. The coronavirus pandemic certainly drove the LFPR way below forecast for almost three years, sparking big labor shortages across the economy. Nevertheless, the new analysis suggests that today’s labor shortages are largely the result of long-standing trends in population aging and high levels of retirement.

- Today’s labor shortages, strong wage growth, and high consumer price pressures, therefore, look to remain in place for the foreseeable future.

- Of course, that will also tend to make today’s high consumer price inflation “sticky” and encourage the Federal Reserve to keep interest rates high for an extended period.