Daily Comment (August 31, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment has three main themes: 1) Why markets are rethinking expectations that the U.S. was in recovery; 2) How regulators are looking to rein in banks with new regulations; and 3) How El Niño may be a problem for the rest of the world but could lead to lower energy costs in the U.S.

Optimism Fading: Data continues to show a mixed picture of the current state of the economy.

- Revision to the gross domestic product (GDP) and a release of private payroll information suggest that the economic activity is slowing. According to the Bureau of Economic Analysis, the economy expanded at an annual rate of 2.1% in Q2 2023, slower than the 2.4% in the previous report. On the same day, ADP private payrolls showed that the economy added 177k jobs in August, significantly lower than the previous month’s revised reading of 371k. The disappointing data has challenged the assumption that the worst is behind us and has raised hopes that the Federal Reserve will pause in September.

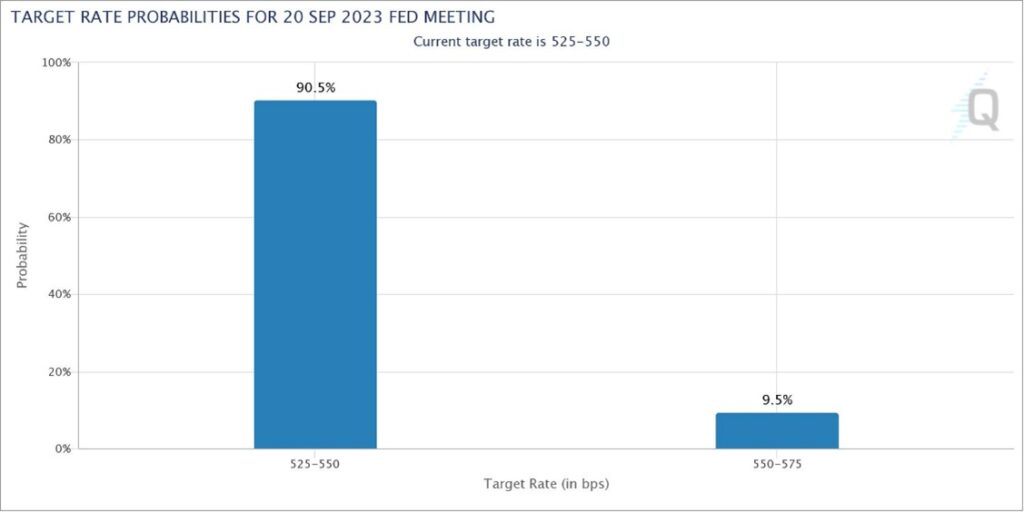

- Investors welcomed the report, with many dreaming of a possible end to the rate-hiking cycle. The S&P 500 closed higher on Wednesday, while the yield on the 10-year Treasury fell to a three-week low. This shift in sentiment comes a day ahead of the release of the BLS payrolls report. If the report shows another setback in job growth, it will likely strengthen expectations that the Federal Reserve is done raising rates. The latest CME FedWatch Tool suggests that the FOMC is 90% likely to hold rates in September, and there is a nearly 60% chance of rates rising before the end of the year.

(Source: CME Group)

(Source: CME Group)

- The economic outlook is becoming increasingly uncertain and complex. While it was widely expected that rapidly rising interest rates would hinder GDP growth, the fiscal and monetary response has altered this dynamic. Stimulus checks helped households pay down debt, while easy monetary policy allowed consumers to extend maturities and improve balance sheets. President Biden’s Inflation Reduction Act and infrastructure bills are also likely to mitigate the economic impact of tighter monetary policy. As a result, we are becoming more optimistic that the economy may be able to narrowly avoid a recession in 2023. This may also mean that the Fed may be persuaded to maintain tighter policy for longer.

Policing Banks: Lawmakers and regulators are tightening regulations on banks in an effort to mitigate the risk of future economic disruptions.

- The Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) unveiled plans to force banks with $100 million in assets to set up living wills and to issue enough long-term debt to cover capital losses in times of severe stress. The proposal is designed to make it easier for banks to dissolve during a potential collapse. Regulators have wasted little time ensuring that banks fall into compliance with these new rules. Several regional banks, including Citizens Financial Group Inc. (CFG, $27.99), Fifth Third Bancorp (FITB, $26.16), and M&T Bank Corp (MTB, $126.43) have received warnings about failing to meet requirements. This increase in oversight is likely to add to the woes of a banking system still recovering from the March turmoil.

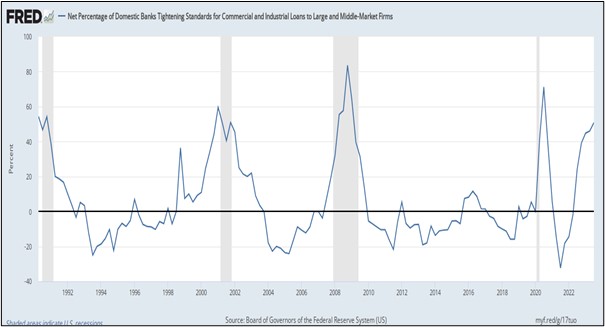

- These new regulations are being implemented at a time when banks are paying higher interest rates on deposits and are tightening their lending standards. S&P Global Market Intelligence reported that net interest margins contracted in the second quarter of 2023, as funding costs rose at a faster pace than earning asset yields. The median taxable equivalent net interest margin of the banking industry fell to 3.40%, down 20 basis points from its peak in Q4 2022. Additionally, lending standards for the banking industry have risen to the highest level since the pandemic recession.

- Major banks also face increased scrutiny from politicians over plans to increase credit card swipe fees. The fee increases, scheduled to take effect in October and April, have been criticized for their potential to increase inflation and hurt small businesses. Lawmakers have used the planned fee hike to promote their Credit Card Competition Act, which will force large banks to offer alternatives to Visa (V, $247.18) and Mastercard (MA, $415.10) for networks to process transactions. The legislation, if passed, could hurt revenue for both credit card providers and banks. A Nilson report, an industry publication, showed merchants paid $160.70 on average last year, while research from a merchant consulting company showed the new fees could cost retailers another $500.00 a year.

Weather Worries: El Niño could cause disruptions in some parts of the world, but its impact on the U.S. may be less severe.

- El Niño conditions in the central and eastern Pacific Ocean are increasing the likelihood of more extreme weather events, such as droughts, floods, and wildfires. We are already seeing the early signs of this impact, with Hong Kong preparing for its strongest typhoon in five years, Greece battling the largest wildfire in EU history, and droughts in Southeast Asia threatening harvests. The impact of El Niño has already cost many countries billions of dollars, and the effects are expected to strengthen until it peaks sometime between December and February.

- El Niño is expected to exacerbate the upward pressure on commodity prices in the coming months. Food prices have already been hurt by India’s export ban on non-basmati rice and Russia’s decision to pull out of the grain deal. This is likely to be felt by developing countries the most, as they rely on food imports. The pessimistic outlook on food prices has led to concerns that central banks in other countries may not be able to cut rates as prices may be on the rise. Despite making progress in the first six months of the year, emerging markets have seen a reacceleration in inflation.

- In the U.S., El Niño conditions in the summer are typically weak, but it can cause wetter and warmer conditions in the South and drier conditions in the North. As El Niño strengthens, it is possible that these effects could become more pronounced. The prospect of a stronger El Niño has so far led to lower gas prices, as households are likely to use less energy as a result. This could weigh on inflation in the U.S. and could lead the Fed to follow through on its pause in interest rate hikes.