Weekly Energy Update (September 8, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices have clearly broken out of their trading range, with Brent crude oil moving above $90 per barrel. Prices are being supported by the Russian and Saudi extension of production restraint.

(Source: Barchart.com)

(Source: Barchart.com)

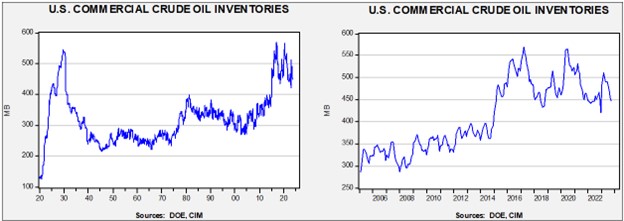

Commercial crude oil inventories fell 6.3 mb, much lower than the 1.8 mb draw forecast. The SPR rose 0.8 mb which puts the net draw at 5.5 mb.

In the details, U.S. crude oil production was steady at 12.8 mbpd. Exports rose 0.4 mbpd, while imports rose 0.2 mbpd. Refining activity fell 0.2% to 93.1% of capacity.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

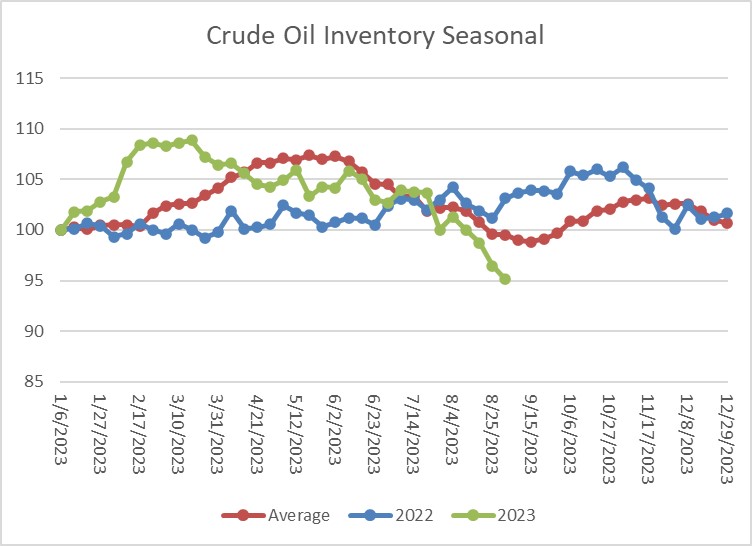

The above chart shows the seasonal pattern for crude oil inventories. Last week, the continued decline in inventories put stocks well below seasonal norms. We are nearing the seasonal trough, and if stockpiles continue to decline, it would be a bullish factor for oil prices.

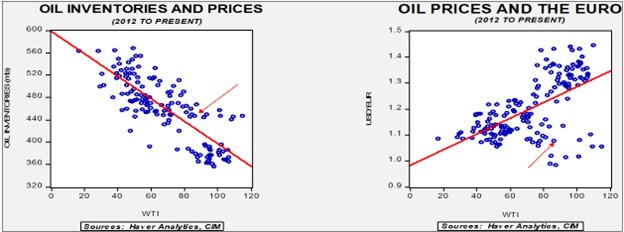

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $74.53. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

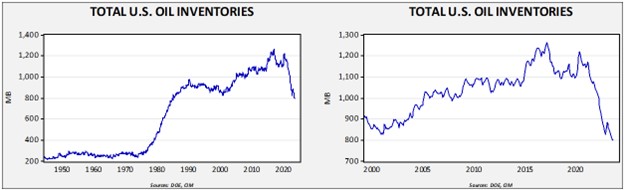

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1985. Using total stocks since 2015, fair value is $95.32.

Market News:

- The Kingdom of Saudi Arabia (KSA) and Russia announced that they will keep their production restrictions in place until the end of the year. This news boosted oil prices and the restrictions should buoy prices. Falling KSA production is leading to a decline in Saudi oil exports. As these producers constrain output, there is some evidence that Iran is taking market share. The U.S. is likely facilitating Iranian oil flows.

- Rising oil prices are a danger to the global economy. China itself is at risk.

- The Biden administration has rescinded some Alaskan drilling permits issued during the Trump administration. However, the Willow project remains in place. The administration is continually trying to weave a path between supporting the economy through lower oil prices and placating the environmental wing of the Democratic party. For the most part, Biden is managing to disappoint both goals. Although the decision was welcomed by environmentalists and panned by the fossil fuel industry, in reality, the White House is not going full bore toward either side. This decision details the difficulty of being in power. There are costs to engaging in a policy and sometimes those costs make a president unpopular.

- It should be noted that oil companies are were not rushing to expand the projects in Alaska.

- A new DOE report shows the LNG market is broadening. As this market broadens, it’s a supportive factor for U.S. natural gas producers. This broadening is also helping Russian gas producers as well. While EU piped gas imports have plummeted, Europe is importing record volumes of Russian LNG. EU leaders have taken notice of these imports and argue that they should be curtailed.

- Brazil’s oil and gas production hit a new record in July.

- Guyana is currently producing 0.4 mbpd, but by 2028, it is expected to be producing 1.2 mbpd, making the country an increasingly important supplier to the oil market.

- Canada is near completion of its Trans-Mountain pipeline. Once open, it will shift Canadian oil flows to the Pacific, increasing oil exports to the Far East, and reducing Canadian flows into the U.S. We would expect the Canadian/U.S. differentials to narrow compared to their history.

- For reasons that are not exactly clear, the difference in electricity consumption between the weekends and weekdays is steadily falling. Most of the time, electricity consumption during the week had been higher than the weekends. However, in recent years, the difference has been shrinking. The most likely reason is probably coming from the industrial sector. It’s possible that industrial firms are running full out and, thus, don’t slow down on the weekends, or industrial firms have become more energy efficient, narrowing the difference. In any case, if this pattern continues, it will make it easier to manage the grid. Energy firms have to maintain capacity to meet peak demand. If that peak declines (essentially smoothing out demand), utilities should then need lower peak capacity.

Geopolitical News:

- We have documented the U.S. efforts to see the KSA and Israel normalize their relations. Key participants to this goal are the Palestinians. The Palestinians are formulating their demands to support normalization, but what is unclear is just how concerned Riyadh is about meeting those demands. Although such a deal would be a blockbuster, there are numerous impediments to getting a deal done.

- Brett McGurk, a senior administration Middle East advisor, is traveling to Riyadh this week to meet with KSA and Palestinian representatives.

- Beijing and Riyadh are steadily improving relations. The Bank of China (BACHF, $0.35) has opened its first branch in the kingdom providing evidence of deeper financial cooperation. Creating banking relationships will facilitate trade in local currencies.

- Russia is facing internal fuel shortages that appear to be worsening. There is concern that the lack of fuel could adversely affect the grain harvest.

- The U.S Navy has indicated it intends to keep warships around the Strait of Hormuz to address Iranian attacks. The IRGC has seized a ship it claims was carrying smuggled fuel.

- The G-7 is quietly shelving the Russian oil price cap; as prices have increased, there is less incentive to curtail Russian supplies.

- Although Iran has expanded its inventory of near-weapons grade uranium, there are some hints it is slowing its stockpile accumulation, perhaps as a confidence-building At the same time, the U.N. watchdog IAEA is still not able to fully monitor Iran’s nuclear program.

- Iran is holding an EU official from Sweden. Johan Floderus has been in captivity for over a year.

- Swedish oil executives are on trial for war crimes due to their drilling activity in South Sudan. The executives are accused of aiding government and paramilitary groups who engaged in war crimes to secure areas for drilling activities.

Alternative Energy/Policy News:

- The Danish wind energy firm Ørsted (DNNGY, $21.17) warned that supply chain issues and complications surrounding tax credits hurt earnings. Shares of the company fell sharply on the news. Wind energy has been hitting some snags recently for a myriad of reasons.

- Four metals are critical to the energy transition: lithium, nickel, copper, and cobalt. Chile dominates copper and lithium reserves, the Congo holds the majority of cobalt reserves, and nickel resides in Australia and Indonesia.

- The KSA is investing heavily in the U.S. lithium battery industry.

- Due to the probable lack of supplies of these metals to meet anticipated demand, the importance of recycling is increasing.

- Although controversial, nuclear power remains the most stable carbon-free electricity source. China, with 21 reactors under construction, is moving to dominate this industry.

- As EV production grows in the U.S., much of the build-out is occurring in the rural South, offering both opportunities and disruption to local communities.

- China’s EV industry is rapidly expanding and is increasingly becoming a growth engine for the economy. China’s EV industry is threatening European and U.S. automakers. We suspect that the EU producers will accommodate China, whereas the U.S. will protect American automakers.

- China’s aggressive expansion of battery production is raising fears it is creating a supply glut that could depress prices.

- Chinese EV battery producers are focusing on Hungary for battery production in Europe. The government is considered more friendly to Beijing and has offered subsidies.

- Range is one of the most important issues for the transition from internal combustion engines to EVs. Since batteries take longer to charge and charging stations are not as readily available as gasoline stations, drivers deciding on which to buy are concerned about this issue. Car makers are working to develop solid state batteries that could charge much faster, but perhaps more importantly, could have ranges of up to 1000 miles.

- China has a dominant position in solar panels, but since the Chinese economy is driven more by government goals rather than profitability, the industry continues to invest even in the face of weaker prices.

- Russia continues to benefit by exporting nuclear fuel to the world’s nuclear power industry. Weaning off of Russian supplies will take years, although as we noted in recent reports, the U.S. is starting the process.

- Geoengineering is a controversial method of addressing carbon reduction and temperature control. The oceans remove carbon from the atmosphere, and there are efforts underway to enhance the ocean’s capacity to absorb carbon. There are numerous other carbon capture projects underway as well. Corporate America seems to be getting behind these efforts.

- Governments are expanding their investment into fusion power.