Daily Comment (September 11, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with news about Chinese domestic politics and the country’s currency, the renminbi. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including news of a cut in the European Union’s economic growth forecast and increased concerns about a potential federal government shutdown in the U.S.

Chinese Domestic Politics: According to insider reports, influential Communist Party officials unexpectedly warned President Xi at their annual Beidaihe leadership retreat that if China’s political, economic, and social turmoil continues without any effective countermeasures being taken, the party could lose public support, posing a threat to its rule. The reports say Xi was stunned by the reprimand and bitterly complained about it to his confidential advisors afterward.

- The reports could help explain why Xi failed to attend the Group of 20 (G20) summit in India over the weekend, why he missed a key speech at the recent BRICS summit, and why he appears to be backing away from a visit to the U.S. later this month.

- Rather than expressing his disdain for U.S.-founded international organizations, as pundits have suggested, Xi might be pulling back from such meetings to avoid being pressed on Chinese security and economic policies. In other words, Xi may have pulled back from these venues not for deliberate strategic reasons, but because of domestic political challenges.

- The reports serve as a reminder that Xi must still contend with domestic political pushback against his policies, even if he has done a good job solidifying his power. Going forward, that may force him to temper some of his policies and provide more stimulus to the economy despite his aim to rein in debt and control the private sector.

- All the same, other reporting suggests he is doubling down on at least some of his initiatives. In several recent speeches, for example, he has urged government officials to prepare for “worst case scenarios” and “extreme circumstances,” which some outsiders have interpreted to mean he is preparing for war with the U.S.

Chinese Economy: The People’s Bank of China today issued a warning against speculating against the renminbi (CNY), saying PBOC officials “are capable of and feel confident in . . . keeping the renminbi exchange rate at a reasonably stable level.” In response, the currency has rallied as much as 1.0% to 7.2698 per dollar ($0.1376). Nevertheless, the renminbi is still trading close to a 16-year low as investors fret over China’s ongoing economic slowdown and worsening tensions with the West.

India: As foreign investors sour on the Chinese economy, India is reportedly ramping up its infrastructure investment to increase its attractiveness as a place to do business. For example, the country now has approximately 90,000 miles of national freeways, almost double the mileage one decade earlier. The expansion and upgrading of India’s infrastructure will probably encourage even more foreign direct investment and portfolio investment.

Japan: Another Asian country that appears to be benefiting from China’s malaise is Japan. The Wall Street Journal today carries a useful examination of what’s been driving the Japanese stock market higher after many years in the doldrums. Besides investors’ shift in focus away from China, the article cites positive developments such as improved corporate governance in the country, recent investments by Warren Buffett, and low valuations.

European Union: The European Commission today cut its forecast for EU economic growth this year, saying it now expects gross domestic product to grow 0.8% in 2023, rather than the 1.0% it expected in May. The Commission also said GDP will grow just 1.4% in 2024, down from 1.7% previously.

- The revised forecasts reflect headwinds such as high consumer price inflation and a big slowdown in German industrial output.

- Importantly, the new forecasts could help convince the European Central Bank’s policymakers to hold interest rates steady at their meeting on Thursday, rather than hiking them further in their continued fight against inflation.

United Kingdom-China: In a bilateral meeting between British Prime Minister Sunak and Chinese Premier Li Qiang at the weekend’s G20 summit, Sunak said he personally expressed his “very strong concerns” to Li about China’s interference in the U.K.’s parliamentary democracy. Sunak’s announcement followed news that British authorities in March arrested two men on charges related to spying for China. One of those arrested was a long-time researcher in the U.K. parliament who had close contacts with Conservative Party politicians.

United States-Vietnam: At their weekend summit, President Biden and Vietnamese leader Nguyễn Phú Trọng signed an agreement elevating their countries’ relationship to that of a “comprehensive strategic partnership.” The agreement lays the groundwork for increased defense cooperation between the countries and establishes a joint semiconductor supply program to boost Vietnamese computer chip manufacturing in support of U.S. businesses.

- Previously, Vietnam had signed such strategic partnership agreements with only four other countries: China, Russia, India, and South Korea.

- The deal shows that China’s geopolitical aggressiveness in the South China Sea is pushing Vietnam into Washington’s embrace, just as it has done to the Philippines, and as it is likely to do to other countries in the Indo-Pacific region.

- Based on our objective methodology for assigning countries to the world’s evolving geopolitical and economic blocs, we currently assess Vietnam to be in the “Neutral” bloc. For example, note that even as Vietnam tiptoes into a closer relationship with the U.S., it is also continuing to seek weapon imports from Russia to build its defense capability against China. However, if Washington and Hanoi continue to cooperate more closely, Vietnam could eventually shift to the “Leaning U.S.” camp, or even to the “U.S.-led bloc.”

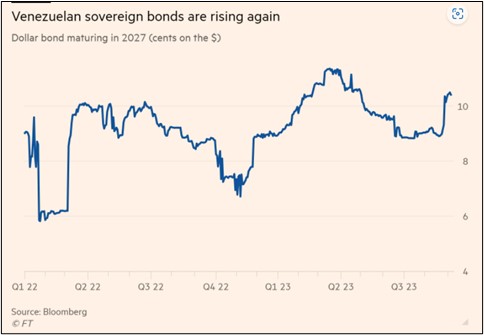

United States-Venezuela: Rumors that secret talks between Washington and Caracas will lead to détente and reduced economic restrictions have given a boost to Venezuelan bonds recently. Although the debt still trades at a tiny fraction of its face value, the hope of renewed cross-border investment has pushed the value of the benchmark 2027 bond up above 10 cents on the dollar.

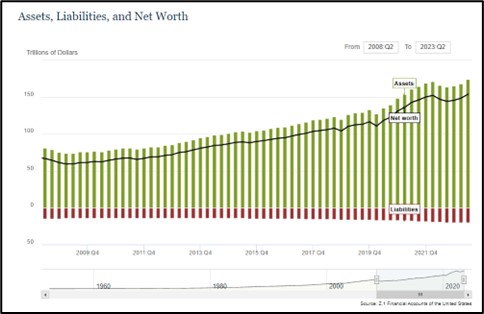

U.S. Household Wealth: Data from the Federal Reserve shows the net worth of U.S. households and nonprofits rose to a record $154.3 trillion in the second quarter, driven about equally by the rebound in stock prices and rising real estate values. The rise in net worth comes despite moderating economic growth and concerns about an impending recession.

U.S. Labor Market: The United Auto Workers union continues to negotiate for a new labor contract with the top three U.S. automakers—Ford (F, $12.30), General Motors (GM, $32.95), and Stellantis NV (STLA, $18.23)—with the current contract expiring Thursday night at midnight. In simplistic terms, the auto manufacturers want to channel much of their recent profits into new electric vehicles, but the union, with new leverage because of labor shortages, wants them to share their proceeds with employees to make up for significant concessions they granted over the last decade.

U.S. Policymaking: The House of Representatives is back in session this week after its summer recess, and all eyes are on the increasing frictions between Speaker McCarthy and the right wing of his Republican Party. The increasing acrimony has raised concerns about a destabilizing leadership battle and the possibility of a partial shutdown of the federal government. Such a shutdown could happen if the right-wing of McCarthy’s party prevents passage of the appropriations bills needed to fund the government once the current fiscal year ends on September 30. Coming just as more pandemic stimulus programs are set to end (including the moratorium on student loan payments and subsidies for childcare centers), a government shutdown could help to finally push the economy into the long-expected recession.