Asset Allocation Bi-Weekly – Fiscal Tightening Looms (September 11, 2023)

by the Asset Allocation Committee | PDF

To understand the state of the U.S. economy and gauge near-term financial prospects, investors over the last couple of years have focused on issues like the Federal Reserve’s monetary policy, consumer price inflation, labor market indicators, and retail sales. They seemed to pay much less attention to fiscal policy, except perhaps amid this spring’s Congressional standoff over the federal debt limit. Our recent work suggests fiscal policy could become a much more important focus in the coming months. In part, that’s because of the potential for a stalemate in Congress over the budget for the new fiscal year starting October 1. More generally, it’s also because of the fast-growing budget deficit and looming changes in the government’s income and outlays.

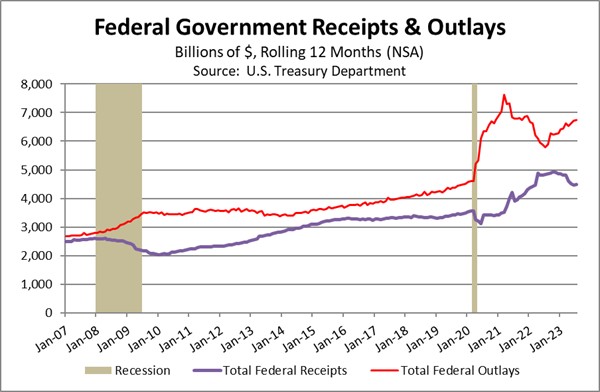

To start out, let’s look at the broad contours of today’s federal budget situation. In the 12 months ended in July, federal receipts totaled $4.480 trillion, but outlays rose to $6.743 trillion. The deficit stood at $2.263 trillion. That shortfall was nowhere near the enormous deficits at the height of the coronavirus pandemic, but it was still much worse than in the prior 12 months. As shown in the chart below, the expansion in the deficit over the last year reflected both declining receipts and rising outlays.

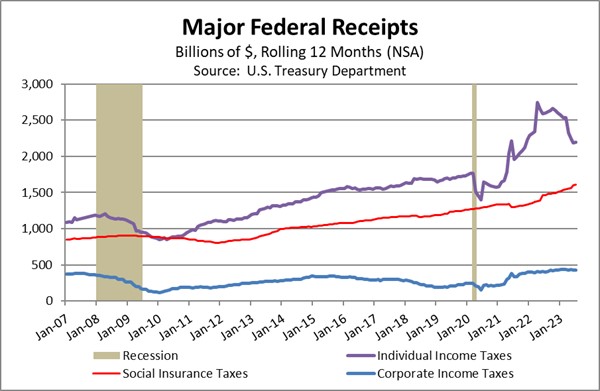

To understand what’s going on here, let’s first dive deeper into federal revenues. During the year ended in July 2023, they were down $352.4 billion from the year ended in July 2022, for a decline of 7.3%. Our analysis shows the decline can be explained entirely by a $408.3-billion drop in individual income taxes, most likely because of lower capital gains taxes after the stock market’s long slide last year, lower wage income as more Baby Boomers and other workers dropped out of the labor force, and an upward adjustment to federal tax brackets because of the price inflation in 2022. The drop in individual income taxes was partially offset by a modest rise in other receipts, such as Social Security taxes, Medicare taxes, corporate income taxes, and customs duties.

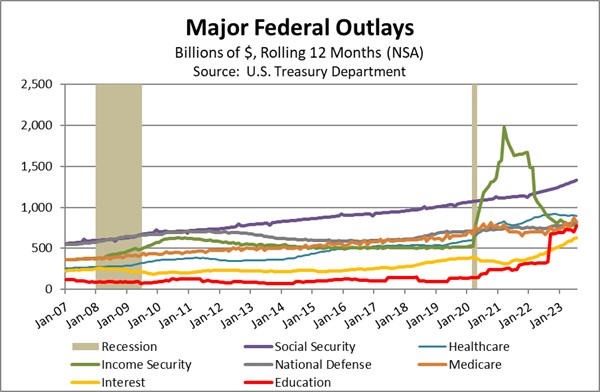

The bigger change came on the spending side of the ledger. In the year ended July, federal outlays were a whopping $951.8 billion more than in the preceding year, for a rise of 16.4%. A couple of major outlays fell. For example, Income Security and Healthcare spending declined modestly. On the other hand, several big spending types grew sharply. Because of population aging, a boom in new retirees, and a big cost-of-living increase in Social Security benefits, outlays for Social Security and Medicare grew by a collective $279.6 billion. In addition, interest outlays were up $182.9 billion from the prior 12 months as outstanding debt grew and interest rates rose. Most dramatic of all, education outlays ballooned by $453.2 billion compared with the previous 12 months, mostly reflecting the pandemic-era moratorium on student loan repayments and interest. That moratorium was declared back in March 2020, but final costs of $449.3 billion were recognized only in September 2022, making it look like there was a sudden, temporary spike in education expenditures during that one month (see chart below).

The spike in recognized education expenditures may drop out of the 12-month rolling average beginning with the Treasury report for September 2023, which could then show a drop in spending. More broadly, as the student loan pause and other big pandemic relief programs come to an end in the coming months, the drop in overall fiscal stimulus could have a noticeable negative impact on demand. Not only will college graduates lose their student loan subsidies and have to start paying principal and interest again, but daycare centers will lose their operating subsidies, prompting some to close and forcing many, mostly women, out of the workforce. Of course, the administration’s big, new programs to subsidize infrastructure rebuilding and factory construction will soon begin to pump more money into the economy, but that probably won’t offset all the expiring pandemic outlays.

Without substantial growth in fiscal stimulus in the coming year, a major pillar that has prevented the economy from entering recession will be removed. Although the tight labor markets from the loss of Baby Boomers and the consequent higher incomes remain as does rising interest income, the drop in fiscal stimulus raises the odds of a downturn in the coming quarters. Thus, investors need to remain vigilant about a recession, even though the current consensus is calling for continued growth.