Daily Comment (September 28, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! The S&P 500 is off to a decent start, 10-year Treasury yields are up, and Republican contenders failed to make a spark at last night’s debate. Today’s Comment will cover the rising dollar, several unions’ fights against AI, and Russia’s waning influence over neighboring regions.

Fed Lifting the Dollar: The U.S. dollar has hit a 10-month high against its peers as investors accept the Fed’s “restrictive for longer” narrative.

- Bolstered by stronger-than-expected economic growth and hawkish monetary policy from the Federal Reserve, the dollar index is poised for its eleventh consecutive week of gains, outperforming its G-10 peers. Meanwhile, Fed policymakers have shown a greater willingness to tighten policy than their counterparts at the ECB and BOJ who have both maintained a preference for keeping rates at their current levels at least for the rest of 2023. Earlier this month, Fed Governor Michelle Bowman and Boston Fed President Susan Collins called for further tightening to address rising inflation. However, Minneapolis Fed President Neel Kashkari has cautioned that economic disruptions, such as a government shutdown or union strikes, could lead FOMC members to hold off on another rate increase.

- The USD is likely to remain strong in the near term due to expectations of higher interest rates and faster economic growth in the U.S. than in other major economies. Interest rate swaps suggest that U.S. policy rates will rise faster than most other advanced economies in the coming three months. At the same time, GDP growth is expected to accelerate in the U.S. from an annual rate of 2.2% to 4.9% in the third quarter. In contrast, nowcasts show that the eurozone economy will contract an annualized 0.9% from July to September, and Canada’s economy will expand by a scant annual rate of 1.2% in the same period.

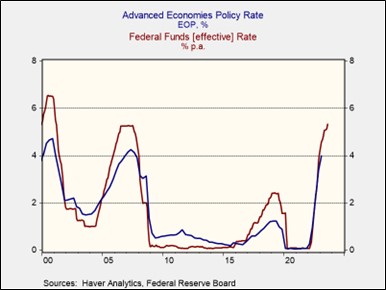

- Despite its current strength, the dollar is likely to face some headwinds in 2024. This is because Fed officials expect to cut interest rates at least once next year, while other central banks may keep rates steady or even tighten. As this chart above shows, U.S. policy rates generally rise and fall faster when compared to other advanced economies. The divergence in monetary policy could lead to a period in which other currencies start to gain on the dollar. This may make foreign stocks more attractive, especially as countries start to exit the trough phase of the business cycle.

Unions Against AI: The new labor contract for screenwriters may provide a roadmap of how labor unions can protect themselves against AI.

- Hollywood screenwriters have ended their five-month strike against studios and are expected to return to work this week. Under the new agreement, studios are required to disclose whether material given to them has been sourced from AI, either partially or in full. AI cannot receive a writer’s credit, and AI cannot be used to rewrite scripts. These new rules are the first time that guardrails have been established for this burgeoning technology, and similar agreements are expected to follow. Not long after the agreement, Hollywood video game actors announced their own strike, seeking further limits on AI.

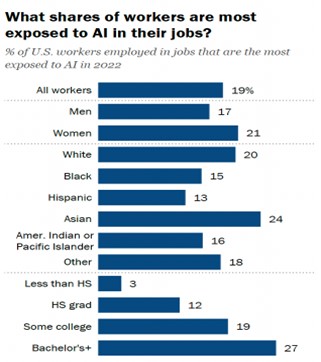

- The movement to combat the threat of AI is likely to spread to other industries, as workers across the globe become concerned about its potential to displace them. A recent study from Goldman Sachs suggests that over 300 million jobs may be at risk, and a Pew Research study found that 27% of jobs that require a bachelor’s degrees may also be vulnerable. This rising fear has led to increased political scrutiny, as governments seek to understand and mitigate the potentially negative impacts of AI. In order to alleviate concerns, President Biden is expected to release an executive order on AI in the coming weeks.

(Source: Pew Research Center)

- Despite its growing significance, the labor struggles against AI have, so far, flown under the radar. During Wednesday’s Republican debate, there were few references to the new technology. This is likely to change during the election season, as candidates will be forced to discuss how they plan to mitigate the impact of AI on the job market, while still incentivizing firms to innovate as the U.S. looks to maintain its lead on China in that area. Although AI is likely to offer a lot of productivity gains and make firms more profitable, regulatory uncertainty still makes investment in the space relatively difficult, especially at current valuations.

Russia’s Waning Influence: An ally of Moscow was forced to cede territory to a rival after a tumultuous conflict.

- The self-governing Nagorno-Karabakh, an Armenian enclave within a territory internationally recognized as part of Azerbaijan, surrendered to Azerbaijan following a military clash last week, and announced it will dissolve on January 1, 2024. Many Armenian residents were allowed to leave, but some were forced to stay, including billionaire Ruben Vardanyan, who has close ties to the Kremlin. The region, which many believed was under Russian protection, now faces accusations of ethnic cleansing, as locals fear retaliation from their Azerbaijani captors. This situation reflects Russia’s inability to enforce the ceasefire that it brokered with Azerbaijan in 2020.

- Russia’s reluctance to get involved in conflicts outside of Ukraine may be due to budget constraints. As a result of Western isolation and sanctions, the Kremlin has had trouble funding its expenditures and has been working to reduce its debt burden. The government has been able to lower its debt by around $128 billion since the start of the war, as it adapts to a changing environment. The recent rebound in oil prices has offered the country some relief, but domestic shortages have forced the country to ban exports of certain fuels.

- Russia’s waning influence in the Caucasus and Central Asia could create a power vacuum that could be exploited by other actors and potentially lead to increased conflict. Countries such as Georgia and Kazakhstan are likely vulnerable to heightened tensions given the lack of a Russian counterweight. At this time, it appear that China and the U.S. are looking to fill the void left by Moscow, but it isn’t clear whether either side can offer the same level of security commitments. An outbreak of violence, particularly in the countries surrounding the Caspian Sea, could further exacerbate commodity uncertainty and drive up oil prices, as the region supplies over 20% of global oil and 26% of global gas supplies. Investors should pay close attention to tensions in this part of the world.

Other stories that made us think:

- Why Hasn’t the Gold Price Fallen Further?– Bloomberg

- Oil Prices Are Rising. Shale Isn’t Coming to the Rescue– Wall Street Journal

- Rising headwinds threaten US economy’s resilience– Financial Times