Daily Comment (September 29, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment will begin with a discussion of the potential for a soft landing, Europe’s budget problems, and an update on government shutdown talks. As usual, our report also provides an overview of the latest domestic and international data releases.

New Economic Fears: As investors embrace the possibility of a soft landing, there are growing signs that economic expansion is losing steam.

- The pandemic did not distort the economy as much as many had feared, according to a benchmark revision. Average U.S. economic activity growth between 2017 and 2022 was revised upwards from 2.1% to 2.2%. This slight upward revision suggests that the reporting during that period was relatively accurate. However, the underlying details show that there were still some noticeable changes. Household savings levels were revised downwards by about $1.1 trillion, although much of this update happened in the years prior to the pandemic. Meanwhile, the personal consumption price index showed that inflation rose 4.1% in 2022, above the previously reported 3.7%.

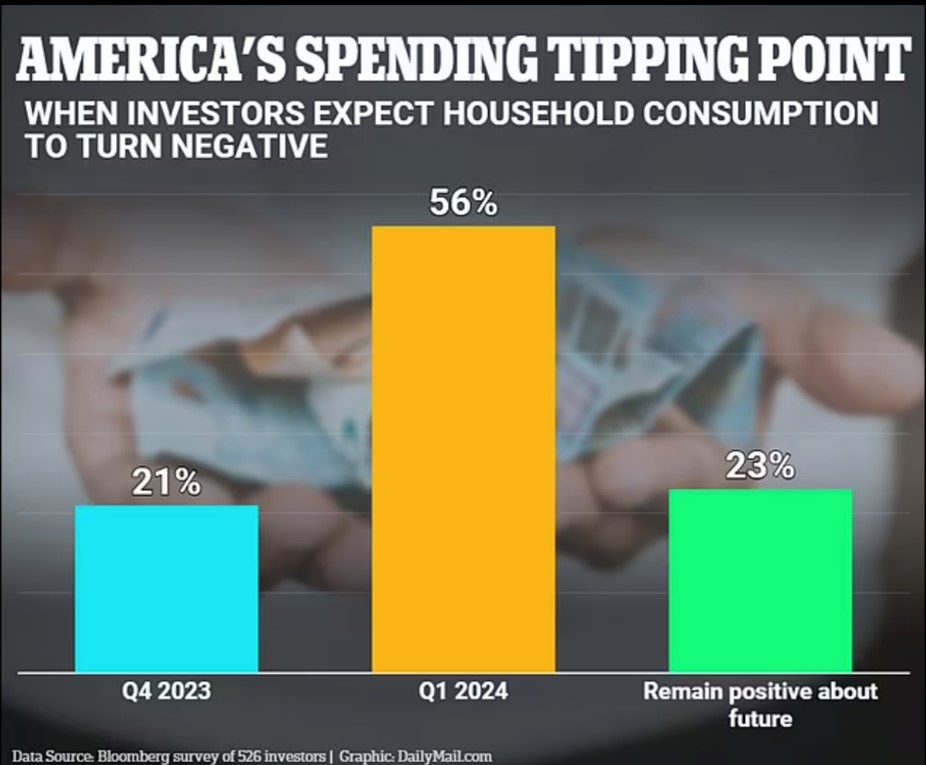

- Despite the slight change in GDP figures which reaffirmed economists’ beliefs that the economy has been more resilient since leaving the pandemic, the future remains less clear. Consumption has remained stable throughout 2023 but has decelerated in four of the five previous quarters. This shift in purchases reflects households switching from expensive durable goods to cheaper services. As a result, over 56% of the economists surveyed believe that consumption will decline in the first quarter of 2024, while 21% believe that the contractions could start as soon as the final quarter of 2023. Since it accounts for a little over a third of GDP, a significant drop in consumer spending may push the economy into a downturn.

(Source: DailyMail)

(Source: DailyMail)

- Persistent strikes, rising oil prices, and delays in the impact of interest rates raise the risk of a hard landing. These headwinds are likely to exacerbate an already vulnerable economy. However, barring an outlier event, such as a war or a government default on its debt, the next recession may not be as bad as the previous two. The pandemic drop in the labor force suggests that workers who are laid off will have an easier time finding work than in typical downturns, and business investment will likely receive a boost from manufacturing. As a result, we are optimistic that equities are unlikely to be severely affected by a slowdown in economic activity.

What Deficit? The euro bloc may face challenges in getting its members to comply with budget limits by its desired deadline.

- The eurozone is expected to reinstate its 3% deficit target in early 2024, but two major economies, Italy and France, are not ready. Italy’s deficit is projected to be 4.4% of GDP, and France’s is projected to be around 4.3%. These shortfalls come as the eurozone prepares to return to rules that were put on hold due to the pandemic. French President Emmanuel Macron has struggled to pass a budget due to his party lacking a majority. Meanwhile, Italian Prime Minister Giorgia Meloni’s right-wing party still plans to follow through on its tax cut promises. It is not clear how strictly the bloc will enforce the rules, but it is likely to lead to significant friction between members.

- Concerns over rising deficits in the eurozone have led to a jump in European bond yields. The spread between the Italian and German 10-year government bonds, a gauge of financial stress, has climbed to a six-month high. The sharp increase in interest rates is due to concerns that the European Central Bank (ECB) will have to keep rates higher for longer to fight inflation, as well as the potential for an oil price shock. The rise in borrowing will likely exacerbate concerns that the region is headed for recession over the next coming months.

- Though a downturn is widely anticipated, governments have limited options to soften the blow. Policymakers at the ECB are hesitant to pivot from their hawkish stance, as inflation shows signs of returning. Government budget constraints will likely prevent another round of fiscal stimulus. The outlook for Europe over the next three months is bleak, and any improvement will depend on member states’ willingness to compromise on deficits or a complete reversal in monetary policy. Such uncertainty will likely weigh on the euro as investors try to gauge what is next for the bloc.

Shutdown Politics: The U.S. government is on the verge of paralysis as lawmakers continue to play political brinkmanship with the nation’s finances.

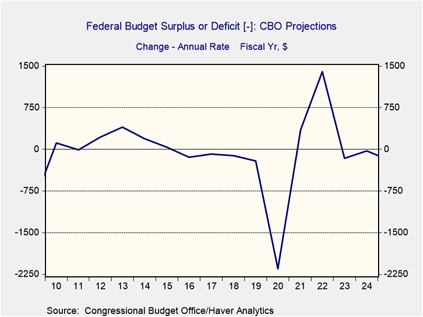

- Congress has until Saturday to pass a bill to keep the government open. The House of Representatives has passed three appropriations bills that largely maintain defense-related expenditures. However, the House still has eight remaining appropriations bills to pass to keep the government fully funded. The political standoff in Congress, which is split in both houses, is making it difficult to reach an agreement. Grandstanding from members of the GOP Freedom Caucus, in particular, is hindering progress. The Senate has already passed a short-term spending bill, but the House is not expected to call it to a vote. The standoff may not last longer than a week, but it is unclear what is needed to get the ball rolling.

- The row over government debt continues to unnerve investors, highlighting government dysfunction. Moody’s, the last of the big three credit rating agencies to give the U.S. its highest rank, has warned that the wrangling could jeopardize its stance on U.S. government debt. At the same time, Federal Reserve Chair Jerome Powell has warned that a delay in releasing data could complicate policymakers’ ability to judge the economy’s state, especially the heavily watched job employment numbers, which could lead to market volatility.

- Legislative gridlock is likely to persist over the next few years, as neither Republicans nor Democrats have been able to create a unified message for the country. This growing partisanship suggests that neither side will be able to make major changes to the economic system without the help of the court system, which typically favors conservatives. Therefore, it is unlikely that the government will be able to reach a long-term resolution on its burgeoning debt burden. While this may make investors less likely to hold U.S. Treasury securities, we do not believe that these concerns will outweigh other issues, such as inflation and economic growth.