Daily Comment (October 2, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a recap of the U.S. Congress’s last-minute deal on Saturday to avert a partial government shutdown. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including news on the Chinese economy, prospects for tighter monetary policy in Japan, and falling steel prices in the U.S. as the United Auto Workers continue their strike against the country’s top auto manufacturers.

U.S. Fiscal Policy: With just minutes to spare before the federal government would have run out of funding on Saturday night, the House and Senate approved a stopgap bill that will provide for spending at current levels to mid-November, giving Democrats and Republicans more time to negotiate over full-year appropriations. The breakthrough came as Republican House Speaker McCarthy shifted gears and put forward a stopgap bill that Democrats could accept, and that the Senate was unwilling to reject.

- The stopgap spending bill has prevented a partial shutdown of the federal government, but perhaps only temporarily. If lawmakers can’t agree by mid-November on a budget for the fiscal year that started Sunday, a disruptive shutdown is still possible.

- Meanwhile, hard-right Republicans in the House have vowed to launch a vote to oust McCarthy for failing to implement their cherished spending cuts and other conservative goals. It is not yet clear whether they will be successful in that effort.

China-Taiwan: People who monitor aircraft tracking sites say a Chinese military plane recently performed an unusual maneuver in which it closely followed and then dove beneath a civilian airliner as it flew close to Taiwanese waters. By flying directly beneath the civilian aircraft, the military plane temporarily dropped off ground-based tracking radar, suggesting the Chinese were practicing the maneuver as a way to keep their military aircraft from being tracked by Taiwanese radar in the event of a conflict.

China: In a win for President Xi’s program to clean up the country’s semiconductor industry, the former head of the state-backed computer chip giant Tsinghua Unigroup (600100.SS, CNY, 7.27) has plead guilty to corruption charges. The executive, Zhao Weiguo, apparently misappropriated state-owned assets valued at more than $60 million through shady real estate deals and similar crimes. Besides showing how Xi has made the semiconductor industry a new target of his anticorruption program, the case also illustrates how corruption has been one factor keeping the industry from catching up to its rivals in the West.

- Separately, the official purchasing managers’ index for manufacturing rose to a seasonally adjusted 50.2 in September, compared with 49.7 in August. The official PMI for the nonmanufacturing industries rose to 51.7 from 51.0. Both gauges are now above the 50.0 level that signals expanding activity. The PMI figures suggest the Chinese economy may have gotten through its recent rough patch and is growing again.

- All the same, that doesn’t necessarily mean the economy is growing rapidly. Growth is still sluggish because of problems such as weak consumer demand, high debt levels, poor demographics, and “de-risking” moves by foreign companies.

- Indeed, the World Bank today released new forecasts showing it expects Chinese gross domestic product to increase just 4.4% in 2024, after stripping out price changes. That’s down from the institution’s forecast of 4.8% in April.

- With weaker growth in China, the World Bank said it cut its growth forecast for the broader East Asia and Pacific regions to 4.5% in 2024, versus expected growth of 5.0% in 2023. Such poor growth rates would be among the region’s worst in the last five decades.

Japan: In the minutes of the Bank of Japan’s policy meeting last month, several officials said they were seeing progress on bringing consumer price inflation up to target in a sustainable way and indicated they should start planning to end their ultra-easy monetary policy. The minutes have intensified speculation that the BOJ will soon tighten monetary policy by eliminating its negative short-term interest rate and loosening up its control over longer-term bond yields.

United Kingdom: The Conservative Party has opened its annual conference, with some participating officials warning that Prime Minister Sunak will have to do more to retain power at the next elections and others clearly jostling for position to potentially unseat him in the future. For example, some officials are clamoring for tax cuts. On the eve of the meetings, Home Secretary Suella Braverman and Business Secretary Kemi Badenoch both floated the idea that the U.K. pulling out of the United Nations Convention on Human Rights was so the country could have a freer hand in blocking and deporting refugees.

Slovakia: In parliamentary elections over the weekend, former Prime Minister Robert Fico and his Russia-friendly, populist Smer Party won about 23% of the vote, comfortably ahead of the Ukraine-friendly, liberal Progressive Slovakia Party and its 18%. However, an even more Russia-friendly, far-right party that likely would have allied with Smer failed to win any seats in parliament, so Fico could have an uphill battle to form a governing coalition.

Serbia-Kosovo: U.S. officials have warned that Serbia is massing tanks, artillery, and other military equipment on the border with the breakaway province of Kosovo, in a move that points to a possible new Balkan war. Serbian President Aleksandar Vučić has denied that he intends to send Serbian troops into Kosovo but given the worsening of tensions between Serbia and Kosovo over the last few years, we cannot discount the possibility of a destabilizing new war in the Balkans.

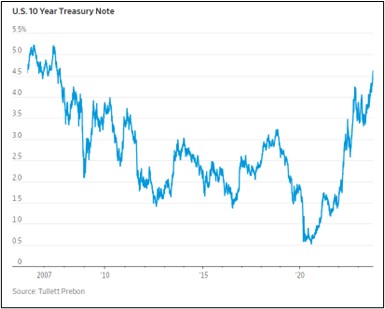

U.S. Bond Market: The Wall Street Journal today carries a useful article with multiple charts explaining the recent surge in bond yields. As we had been warning, bond yields prior to late summer had seemed much lower than they should have been. Now that investors have focused on factors like the economy’s relatively good economic growth (for now), its persistent price pressures, and the Fed’s intention to keep interest rates higher for longer, it should be no surprise that bond yields have surged. As of this morning, the yield on the benchmark 10-year Treasury note has risen to 4.637%, its highest level since 2007, while the 2-year note has risen to 5.117%.

U.S. Steel Market: New reporting shows the United Auto Workers’ strike against the country’s top three automakers has slammed the demand for steel, contributing to a 40% drop in its price over the last several months. Of course, steel demand is also likely waning as overall economic growth slows and the economy looks set to fall into recession in the coming months.