Daily Comment (October 17, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a discussion of how difficult it is for countries to abandon the U.S. dollar for international trade. We next review a range of other international and U.S. news with the potential to affect the financial markets today, including new geopolitical tensions between China and Canada and a survey showing economists now see less risk of a near-term recession in the U.S.

Russia-India-U.S. Dollar: As India’s state-owned refiners continue to gorge on cheap Russian crude oil, New Delhi has reportedly clamped down on their use of Chinese renminbi (CNY) to pay for some shipments that otherwise would be subject to Western sanctions. Although China and other members of its geopolitical bloc are trying to reduce their use of the U.S. dollar, prompting some Western observers to predict a massive depreciation in the greenback, the Indian clampdown on CNY payments illustrates several hurdles to replacing the dollar:

- While Indian buyers initially paid for some shipments in rupees (INR), Russian sellers pushed back on the practice after realizing there was little they could buy with their growing rupee stockpiles.

- Russian sellers and Indian buyers have experimented with a number of different currencies for payment, including Emirati dirhams (AED), but the market hasn’t been able to agree on a dollar alternative.

- Although New Delhi has implied that its clampdown on CNY payments is related to their extra cost, the reality is that India probably wants to avoid anything that would buttress Chinese financial power and influence.

China-Canada: Ottawa has issued a protest saying Chinese fighter jets harassed a Canadian surveillance plane that was flying in international airspace to help enforce UN sanctions against North Korea. One of the Chinese jets reportedly came within five meters of the Canadian aircraft. The incident serves as a reminder that the Chinese military is becoming more aggressive, not only against U.S. forces, but also the forces of its allies.

Israel-Hamas: Ahead of a summit tomorrow involving President Biden and Middle Eastern leaders, Jordan’s King Abdullah warned that the region is at the edge of an “abyss” because of the conflict between Israel and the Gaza-based terrorist group Hamas. Abdullah called for humanitarian aid to the civilian population in Gaza, which Israel is besieging, but he insisted Jordan and Egypt would not accept waves of Palestinian refugees who might never leave. By emphasizing the way massive refugee waves could destabilize Jordan and Egypt, the king’s statement helps clarify the many ways the conflict could spread and cause problems throughout the Middle East.

Russia-Ukraine: While the world has been focused on the Israel-Hamas conflict over the last week, Russian forces have launched a large-scale attack to seize the small city of Avdiivka in eastern Ukraine. The Russian forces have made some minimal gains in the area, but the latest reports suggest they’ve done so at a high cost in both equipment and personnel. If the attack aimed to swing momentum of the war back to Russia, it appears to have failed. In the near term, at least, that suggests the Russians will fall back on their previous stance of defending territory and sending waves of missiles, drones, and artillery against the Ukrainian power grid over the winter.

United Kingdom: New data shows average total pay in the three months ended in August was up 8.1% from the same period one year earlier, decelerating modestly from the 8.5% gain in the three months ended in July. Excluding bonuses, the annual pay gain in the three months to August slowed to 7.8% from 7.9% in the previous period.

- The annual gains remain close to record highs, but their deceleration could point to lower price pressures in the coming months and a lesser need for the Bank of England to keep raising interest rates.

- In response, British stock values are up about 0.4% so far today, while the pound (GBP) has fallen 0.6% to $1.2147.

Italy: The right-wing government of Prime Minister Giorgia Meloni said its budget for 2024 will include 24 billion EUR ($25.3 billion) in tax cuts and public-sector pay hikes to spur consumption and boost economic growth, despite investors’ concerns about Italy’s fiscal balance.

- The announcement follows the government’s decision last month to allow the fiscal deficit to rise to 4.3% of gross domestic product, versus its April target of 3.7% and the eurozone’s standard of 3.0%.

- The spread between Italian government bond yields and German yields widened slightly on the news to 4.77%.

Poland: Final figures from Sunday’s elections confirm that the business-friendly, pro-EU former Prime Minister Donald Tusk and his Civic Platform and allied parties will have 248 of the 460 seats in the next parliament. Since the ruling right-wing Law and Justice Party won the most votes in the election, it will get first crack at forming a government. However, the seat count for Tusk’s coalition makes it clear that he will regain power.

- Tusk’s return to power in Poland will likely mark a return to more orthodox economic and social policies and better relations with EU leaders in Brussels.

- That will help accelerate an important but little-noticed shift in the EU, i.e., the growing power and influence of countries in the eastern part of the EU.

United States-Venezuela: U.S. and Venezuelan officials have reportedly struck a deal in which Caracas will allow more competitive, monitored elections in return for the U.S. partially lifting its sanctions on the authoritarian country’s oil industry. The deal illustrates how the Biden administration is looking for any way it can to boost global oil supplies and hold down energy costs. However, it’s important to note that even with a fuller lifting of sanctions, the Venezuelans probably can’t boost their oil output significantly in the near term.

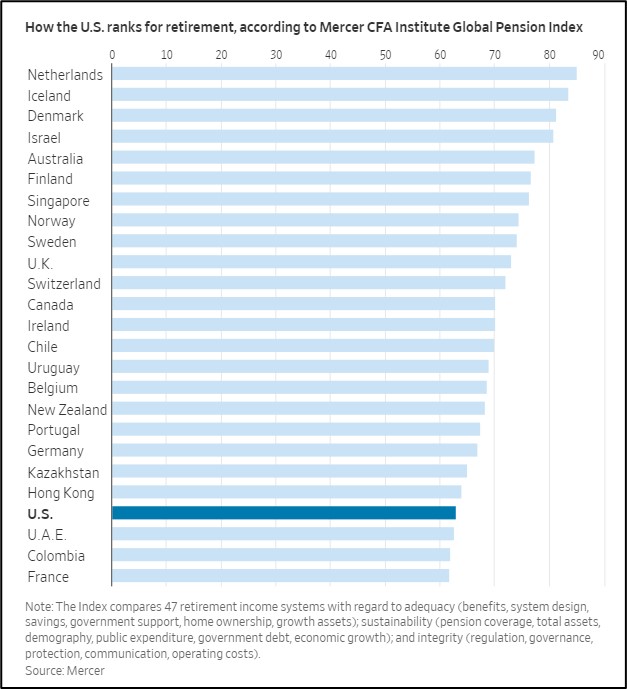

U.S. Retirement System: The latest Global Pension Index from Mercer and the CFA Institute ranks the quality of the U.S. retirement system just 22nd out of the 47 countries studied. The study ranks the U.S. system just below those of Kazakhstan and Hong Kong, and just above those of the United Arab Emirates and Colombia. The study finds that the U.S. system—based on corporate pensions, 401(k) accounts, and individual retirement accounts—provides uneven coverage and is subject to insolvency problems. (Of course, one way that individuals can try to overcome those challenges is simply to save and invest more.)

U.S. Economic Growth: The latest survey of economists in the Wall Street Journal showed the average probability of a recession within the next year has fallen to 48%, down from 54% in July. On average, the surveyed economists now also believe that the Federal Reserve is done raising interest rates, and that consumer price inflation will continue to cool.

- We also believe that the risk of recession has fallen to some extent, that the Fed is at least close to ending its rate-hiking campaign, and that inflation will moderate further in the near term.

- However, even if the economy doesn’t fall into an outright contraction, growth is cooling noticeably, creating a “slow bicycle economy” in which the momentum is so weak that an unexpected crisis could tip it into a downturn.