Daily Comment (November 1, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with new examples of how the Chinese Communist Party and government are intruding ever-more strongly into the economy. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the latest on the Israel-Hamas conflict, its implications for other countries, and a word or two about the Federal Reserve’s latest decision on interest rates, which is due today.

Chinese International Data Regulation: The Ministry of State Security yesterday said it has discovered and “dealt with” hundreds of foreign-run meteorological installations across the country that have been illegally transmitting weather data overseas in real time. The MSS announcement is the latest example of how China is clamping down on even seemingly innocuous information flows out of the country. Some of the weather monitoring equipment discovered and shut down simply appeared to serve foreign weather services and crop monitoring companies.

- More broadly, the clampdown on information flows is part-and-parcel of the global fracturing we have been writing about. As the world fractures into relatively separate geopolitical and economic blocs, we are seeing increased impediments to inter-bloc trade, investment, technology, data, and travel flows.

- As we have been arguing, new impediments to the international flow of merchandise, services, money, information, and people will likely lead to higher and more volatile inflation, interest rates, and production costs worldwide.

Chinese Financial Industry Regulation: With the completion of its quadrennial policy conference on the financial industry, the government yesterday stressed the need to tighten regulation over the sector and “adhere to the centralized and unified leadership of the Communist Party in financial work.”

- Along with the clampdown on sending weather data abroad, the statement on financial regulation helps clarify that China’s economy isn’t just being held back by the “Four Ds” that we’ve discussed previously, i.e., weak consumer demand, high debt levels, poor demographics, and foreign decoupling.

- Now, we would add another “D” to the list of problems, i.e., disincentives arising from government and party interference in company activities.

India: Apple (AAPL, $170.77) has reportedly notified several opposition lawmakers, journalists, and think tank leaders in India that “state-sponsored attackers” are trying to compromise their iPhones. Although Apple didn’t identify what country was sponsoring the attempted hacking, the news has rekindled concern that Prime Minister Modi’s government is trying to spy on its opponents.

- Modi is being increasingly dogged by concerns that he has developed an authoritarian, anti-democratic governing style. For example, his Hindu nationalist program has included a sharp crackdown on Muslims in the northern territory of Kashmir, a ban on foreign donations to a Christian charity founded by Mother Teresa, and a block on the social media accounts of opposition leader Rahul Ghandi.

- Along with accusations that Indian government agents recently killed a Sikh separatist leader living in Canada, these accusations could slow the U.S.’s effort to cozy up to Modi and enlist his help in countering China’s increased geopolitical aggressiveness.

Israel-Hamas Conflict: The Israel Defense Force yesterday said it launched airstrikes against a residential area in the northern Gaza Strip that killed a Hamas commander and many other fighters affiliated with the terrorist group. In a measure of the relative death tolls involved in the fighting, medical officials in Gaza said dozens of civilians died in that one attack, while the IDF said two Israeli soldiers were killed in fighting around the compound. The continued high civilian death toll relative to the number of Hamas fighters killed could further erode foreign political support for Israel as it continues its campaign in Gaza. Separately, attacks on Israeli interests by Islamists in the West Bank, Lebanon, Syria, and Yemen—along with Israeli retaliatory strikes—continue to raise the risk of a broader regional conflict.

- In the U.S., Federal Bureau of Investigation director Christopher Wray yesterday warned that the Hamas attack on Israel last month has raised the risk of a copycat attack on the U.S. “to a whole other level.”

- In France, police on high alert for Islamist terrorism yesterday shot an unarmed woman in a burka at a Paris train station after passengers reported that she was acting in a threatening manner.

United Kingdom: Just as the Israeli-Hamas conflict has exposed sharp divisions within the Democratic Party in the U.S., the leader of the Labor Party in the U.K., Keir Starmer, is dealing with sharp divisions in his party. Some Labor officials are furious at Starmer for his focus on Israel’s right to self-defense. They want him to show more sympathy for the Palestinians and call for a ceasefire. However, Starmer is resisting that pressure so far as he tries to steer his party back toward the political center. The row threatens to erode Labor’s big advantage in recent opinion polls.

Canada: A monthly measure of gross domestic product shows it was essentially flat in both July and August, while other data points to another soft month in September. The figures imply that Canadian GDP may have fallen at an annualized rate of 0.1% in the third quarter, after declining at a rate of 0.2% in the second quarter.

- Not only would that imply a mild technical recession, but it would suggest that Canada, like Europe, is now growing much more slowly than the U.S. As a reminder, an initial estimate of U.S. GDP indicates it rose at a robust 4.9% clip in July through September.

- Higher economic growth and higher interest rates in the U.S. versus Canada implied continued weakness in the Canadian dollar (CAD). Over the last three months, the currency has steadily weakened to the point where it now takes 1.3866 loonies to buy one U.S. dollar.

U.S. Monetary Policy: The Fed wraps up its latest policy meeting today, with the decision due to be released at 3:00 PM EDT. Investors are nearly unanimous in thinking the policymakers will hold the benchmark short-term interest rate unchanged at 5.25% to 5.50%. The focus will therefore be on any guidance regarding future rate changes in the committee’s statement or in Chair Powell’s post-meeting press conference.

- No new economic projections are due to be released at this meeting.

- Nevertheless, the statement and Powell’s discussion could well express a bias toward further tightening, consistent with Powell’s “higher for longer” mantra.

- We think it makes sense to take Powell at his word. Even though we think U.S. interest rates are probably near their peak, we continue to believe the Fed will try to hold them at elevated levels for an extended period to wring inflation out of the economy.

U.S. Residential Real Estate Market: A federal jury yesterday found the National Association of Realtors and several top real estate brokers guilty of illegal collusion to inflate commissions on real estate transactions. If upheld on appeal, the decision in the class-action lawsuit could scuttle the longstanding practice in which home sellers pay a 6% commission to their agents, which in turn is shared with the buyer’s agent without the buyer knowing how much their agent is going to make on the transaction.

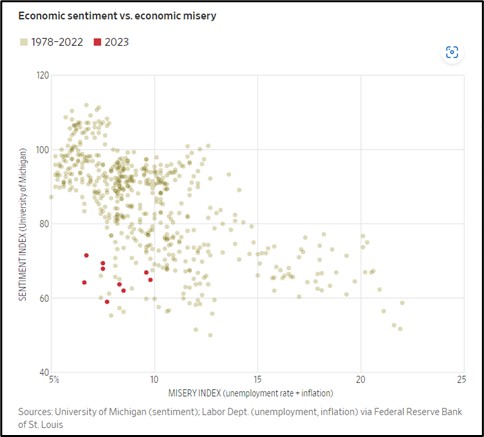

U.S. Consumer Sentiment: Wall Street Journal columnist Greg Ip today has an interesting article exploring why consumer optimism is so low when economic growth is humming along, unemployment is low, and wage gains are outpacing price inflation again. Ip’s graph below shows just how low the University of Michigan’s consumer sentiment index is now compared with its past relationship to the “misery index” (the unemployment rate plus the inflation rate as measured by the consumer price index). Ip posits that today’s low consumer optimism may in part reflect dissatisfaction with broader national issues, such as political polarization.