Daily Comment (November 10, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Gold has retreated on Powell’s monetary policy comments, and the National Women’s Soccer League has signed major TV deals. Today’s Comment begins with our thoughts on declining demand for U.S. government bonds. We then discuss the impact of geopolitical competition on the semiconductor industry, and the political ramifications of Senator Joe Manchin’s (D-WV) decision not to run for re-election. As always, our report includes a summary of the latest domestic and international data releases.

Auction Flop: A Treasury bond auction drew weaker-than-expected demand, raising concerns about the path of interest rates.

- Thursday’s auction of 30-year government bonds yielded 4.769%, 5 basis points higher than the start of pre-auction trading, reflecting investors’ reluctance to buy long-duration debt. Wednesday’s Treasury auction also underwhelmed expectations. This poor performance has raised concerns that the bond market may be struggling to absorb new U.S. debt issuance. Following the auction, the S&P 500 sank 0.8% and the NASDAQ fell 0.9%, ending the duo’s longest winning streaks in almost two decades. The market reaction suggests that investors are concerned about the Federal deficit and the lack of participation from the Federal Reserve in the bond market.

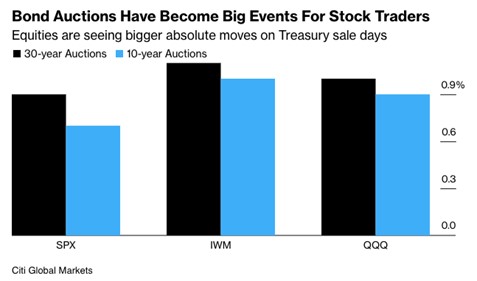

- Treasury auctions have become more important than employment data in recent months, according to research from Citi Global Markets. After analyzing 22 Treasury auctions, the bank found that equity sales have fluctuated more after Treasury auctions than on the day the jobs data is released. This may explain why the stock market rallied earlier this month after the Treasury announced that it would sell $112 billion in fixed-income securities, less than the $114 billion primary dealers had expected. The growing importance of Treasury sales underscores concerns that bondholders’ appetite for U.S. debt is waning.

- The scarcity of bond buyers is likely to push up interest rates and tighten financial conditions, as investors demand higher yields to compensate for the liquidity risk. This trend will persist unless policymakers take steps to control the federal deficit, or the Fed expands its balance sheet. Policy rate cuts may also relieve some of this pressure on long-duration securities by discouraging investors from purchasing shorter-duration bonds. Uncertainty about high interest rates will likely lead to increased scrutiny of risky assets, as investors assess the potential impact of higher borrowing costs on corporate earnings. However, the lack of demand for Treasury issuance reduces the chance of another rate hike from the Federal Reserve.

Semiconductor Slump: Despite a strong start to the year fueled by excitement about AI, chipmakers’ profits have slipped due to weak demand and a growing supply of semiconductors.

- The PHLX Semiconductor Sector Index has plummeted 11% from its peak in August 2023, drastically outpacing the 3% decline in the S&P 500 from the same period. This is driven by a pessimistic outlook after last year’s chip shortage turned into a glut. However, recent earnings reports from Samsung Electronics Co.(005930.KS, KRW, 70,500) and Taiwan Semiconductor Manufacturing Co.(TSM, $91.62) have offered a glimmer of hope for a reversal, as both companies suspect that the market is inching closer to balancing. Meanwhile, Chinese chipmaker Semiconductor Manufacturing International Corp. (SMIC) has voiced concerns that growing geopolitical competition within the space could lead to overcapacity.

- SMIC’s concerns appear to be a veiled criticism of U.S. efforts to stifle China’s advancement in chipmaking. The Biden administration has imposed export controls that make it more difficult for China to develop chips for military technology. Additionally, the U.S. has allocated resources to build its own domestic chip fabs to reduce its reliance on Taiwan, a major chipmaking hub. China has responded by increasing its spending on semiconductor production. This increased competition has led to a surge in investment in semiconductor production, as both countries seek to insulate themselves from possible supply chain disruptions.

- The easing of tensions between the United States and China is unlikely to improve the outlook for the semiconductor industry, as both sides are seeking to reduce their reliance on the other. As a result, chipmakers are likely to face increased competition, as the massive investments in semiconductors should lead to a battle for market share. This could make technology more affordable in the long term, as firms struggle to maintain market power in an environment where new entrants are likely to emerge. However, the lack of market dominance could also make it difficult for firms to maintain healthy profit margins.

Senate Majority in Danger? West Virginia Senator Joe Manchin’s decision not to seek reelection in 2024 gives Republicans a prime opportunity to flip a Senate seat.

- Manchin’s decision not to seek reelection in 2024 jeopardizes the Democratic Party’s control of the U.S. Senate. The party will struggle to find a replacement for the moderate Manchin, as there is no apparent frontrunner in the race. West Virginia has a long history of favoring Republican candidates, and former President Donald Trump won the state by a nearly 40% margin in 2020. If the Democrats lose Manchin’s seat, the Senate will likely fall into Republican hands. The seat is favored to switch to Conservative West Virginia Governor Jim Justice, and it isn’t clear whether the Democrats will look to save it.

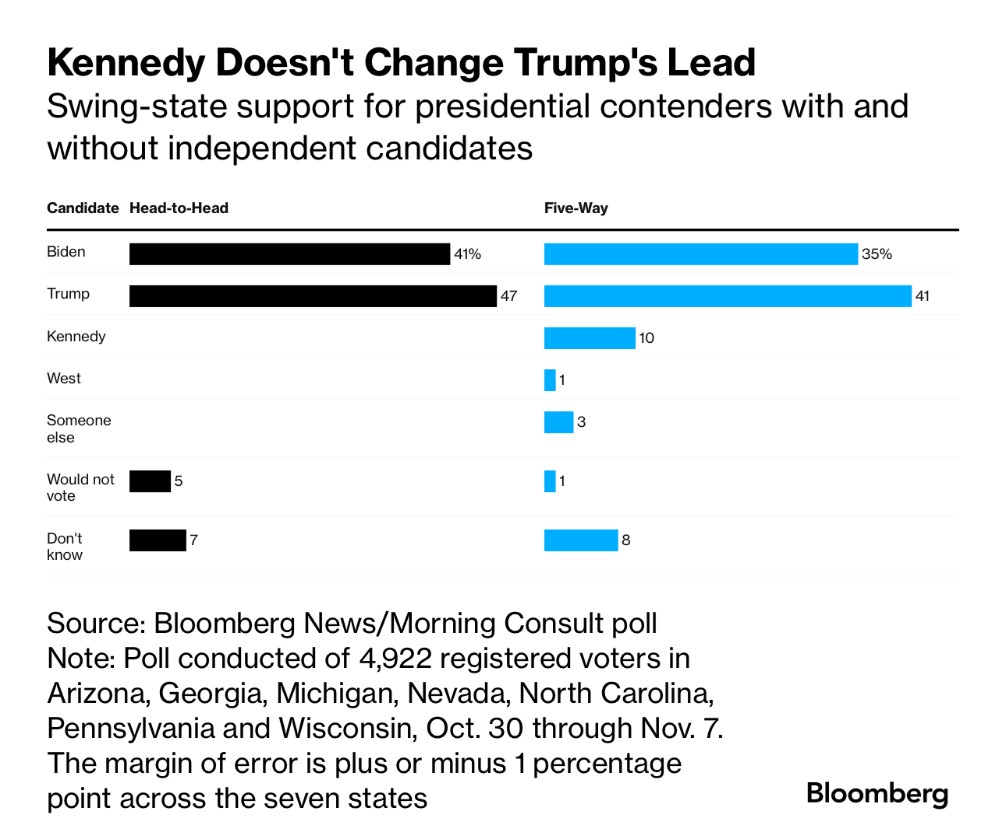

- Senator Manchin’s decision not to run for re-election may be related to the growing demand for a third-party challenger in the 2024 presidential election. He has long been associated with the bipartisan No Labels political party, and in his announcement, he mentioned a desire to test the level of support for a candidate who could bring the middle together. So far, several challengers have thrown their hats in the ring, including Harvard Professor Cornel West, environmentalist Jill Stein, and environmental lawyer Robert Kennedy. While third-party candidates are often seen as spoilers, it is unclear whether any of these candidates can swing the election.

- The entrance of third-party candidates increases the likelihood of a contingent election, in which no candidate wins the 270 electoral votes required to win the presidency outright, which has not occurred since 1877. In this case, the Constitution requires the House of Representatives to choose from the top three candidates who received the most electoral votes. Each state gets one delegate, and a candidate needs to receive at least 26 delegates to secure the nomination. The last time this happened, the Democratic and Republican candidates agreed to give the presidency to Republican Rutherford B. Hayes in exchange for the end of Reconstruction in the South. Markets would likely react poorly to this outcome, as it would call the legitimacy of the government into question.

Other News: China is investigating a ransomware attack on the U.S. unit of the Industrial and Commercial Bank of China. The attack on U.S. Treasuries disrupted trading and reflects the ongoing battle to develop the cyber infrastructure needed to prevent hackers from accessing sensitive information. Israel is concerned over a possible war with Hezbollah, in another example of the risk of a spreading Middle East conflict. Cleveland Fed President Lorretta Mester is set to resign in 2024, and she will likely be replaced by another policy hawk. Fed Chair Jerome Powell has warned that Fed officials may look beyond data when determining whether inflation is improving.