Daily Comment (November 15, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with new impediments to U.S. investments in China. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the latest on the Israel-Hamas conflict, new signs of economic weakness and falling inflation pressure in Europe, and House passage of a new stopgap funding bill for the U.S. government.

United States-China: The U.S.-China Economic and Security Review Commission, an advisory panel on China policy, issued a recommendation yesterday that Congress pass a law forcing U.S. publicly traded companies to disclose how their investors are exposed to risks related to China. For example, the commissioners recommended that the companies disclose the percentage of their total assets in China, their joint ventures with Chinese firms, the amount and nature of research and development they undertake in China, and the influence of any employee associated with the Chinese Communist Party in corporate decision-making.

- If passed, the disclosure requirement would be yet another impediment to U.S.-China capital flows.

- Separately, the Federal Retirement Thrift Investment Board, which oversees approximately $771 billion of retirement savings for federal workers, said today that it will change the benchmark index for its international fund to avoid exposure to stocks listed in China or Hong Kong, citing increased U.S.-China geopolitical tensions.

- Finally, we note that President Biden and President Xi plan to meet for four hours today at the Asia-Pacific Economic Cooperation summit in San Francisco. At the end of the meeting, Biden and Xi are expected to announce a number of smaller-scale agreements. More broadly, the summit may help slow the current downward spiral in U.S.-China relations.

Taiwan: The country’s top two opposition parties, the China-friendly Kuomintang and the Taiwan People’s Party, have struck a deal to field a joint ticket in January’s presidential election. The deal aims to help the opposition compete better against Vice President Lai Ching-te, the leading candidate of the ruling Democratic Progressive Party, which has forged tighter ties with the U.S. and is currently leading in the polls.

Israel-Hamas Conflict: Hours after the U.S. officially backed Israeli assertions that the Hamas government in Gaza places military command posts in hospitals, the Israel Defense Forces said they launched a targeted strike against Hamas personnel in the territory’s besieged Al-Shifa Hospital. The IDF says the raid turned up weapons and other “concrete evidence” that the facility was being used as a Hamas command post. The IDF says that evidence will be shared publicly in the near future.

- Meanwhile, Hamas authorities say Israel’s airstrikes and other attacks on Gaza during the conflict have now killed about 11,000 people, many of them noncombatant women and children. If that figure is accurate at all, it is certainly brutal and horrifying, and it reflects an apparent policy decision by the Israeli government to defang Hamas no matter what the cost to civilians or to Israel’s own reputation and political support.

- Still, given that Gaza had a population of about 2.0 million at the start of the conflict, 11,000 dead (and perhaps tens of thousands injured) seems low enough to suggest that the IDF really is taking some care to avoid hurting civilians. Besides, other reports suggest that up to 50% of all the structures in Gaza have been destroyed or severely damaged by Israel’s attacks. If that translates to 11,000 structures hit, it suggests “only” one death and perhaps several other injuries for each structure targeted.

European Union: In a new sign that the European economy is failing to keep up with activity in the U.S., the European Commission today cut its 2023 growth forecasts for both the broad EU and the eurozone. In each region, the commission now forecasts that gross domestic product this year will expand just 0.6%, compared with a forecast of 0.8% in September. The faltering growth reflects a range of problems, from high inflation and interest rates to weaker global demand for European exports.

United Kingdom: In another sign that inflation pressures are easing worldwide, the U.K.’s October consumer price index was up just 4.6% from the same month one year earlier, less than expected and much less than the 6.7% increase in the year to September. Excluding food, energy, and other volatile categories, the October core CPI was up an annual 5.7%, versus 6.1% in the year to September. Signs of cooling inflation have boosted hopes that the Bank of England can forego further interest-rate hikes and may even start to cut rates in 2024.

Russia-Ukraine War: The Ukrainian government has struck a deal with major insurers to provide war-risk coverage for ships carrying grain and other foodstuffs out of Ukrainian ports. After Russia withdrew from a safe-passage deal with Ukraine over the summer, Kyiv has managed to get several ships moving out of its ports, but the new deal could further boost the country’s agricultural shipments, bolstering global supplies and helping hold down prices.

- Separately, EU officials are looking for new ways to clamp down on Russian oil revenues following recent reports that Moscow is largely circumventing the West’s $60-per-barrel cap on its exports.

- One proposal would have Denmark stop, inspect, and potentially impound tankers carrying Russian oil through Danish waters without Western insurance, under laws permitting states to check vessels they fear pose environmental threats.

- If implemented, the plan would naturally be high risk, potentially producing serious naval tensions in the Baltic region.

U.S. Fiscal Policy: The House of Representatives yesterday passed Speaker Johnson’s two-step stopgap funding measure to keep some federal departments operating until mid-January and others until early February. Since many of Johnson’s own Republican Party voted against the bill because it lacked spending cuts and other positions favored by the far right, passage of the measure required the votes of many Democrats.

- The “continuing resolution” now moves to the Senate, where prospects appear to be good that it will pass and be sent to President Biden to be signed into law.

- Nevertheless, even if the bill passes and averts a partial government shutdown this weekend, there will still be the chance of a fresh impasse and potential shutdown when the new bill expires early in 2024.

U.S. Labor Market: Despite the national sigh of relief when the United Auto Workers and the major U.S. automakers struck a tentative deal on a new labor contract, workers at several plants run by General Motors (GM, $28.20) have voted to reject the deal. That puts the GM tally to date at about 50%, with voting set to continue for another week or two. In contrast, the proposed deals at Ford (F, $9.86) and Stellantis (STLA, $20.25) are on track to be approved by comfortable margins. The neck-and-neck voting at GM is a further reflection of just how empowered workers feel in the midst of today’s labor shortages.

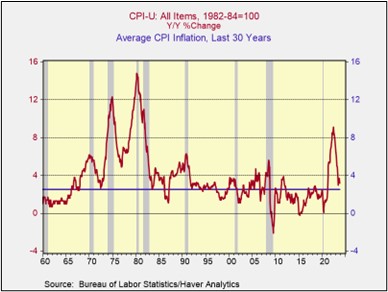

U.S. Consumer Price Inflation: In the interest of acknowledging contrarian viewpoints, we note that the Wall Street Journal today carries an interview with Cathy Wood, the founder of ARK Investment Management and a major technology-stock cheerleader, in which she argues that new technologies and falling commodity prices will lead to a future of deflation rather than inflation. Of course, this could simply be an instance of Wood “talking her book,” since lower inflation implies lower interest rates and higher valuations for long-duration stocks like technology start-ups. We continue to believe that consumer price inflation in the coming decades will be higher and more volatile than in the post-Cold War period of relative peace and globalization over the last three decades.

- It’s difficult to forecast inflation rates over such a long period, but we would not be surprised if they average between 3.0% and 4.0% between now and mid-century, versus the average of 2.5% over the last 30 years (see chart below).

- While technology advancements will help bring down some costs, we think that will be offset by factors such as:

- The global economy’s fracturing into relatively separate blocs;

- The shift to less efficient global supply chains;

- The relocation of production back to relatively expensive countries in the West;

- Increased corporate and government investment spending to support those shifts;

- Higher commodity prices because of recent under-investment and the expected weaponization of supplies by the China/Russia bloc;

- Population aging and its associated labor shortages; and

- Potential increases in consumer spending as lower-skilled workers gain a bigger part of national income.

U.S. Financial Markets: After driving stock and bond prices sharply higher yesterday, the euphoria over yesterday’s report of falling inflation as measured by the consumer price index appears set to continue today. After the S&P 500 stock price index surged 1.7% yesterday, it and all the other main U.S. equity indexes are pointing to a higher open at the moment. Precious metals are also a bit firmer today, but longer-maturity bonds have given back some of yesterday’s rally, pushing yields up modestly so far this morning.