Daily Comment (December 5, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a downgrade in the outlook for Chinese sovereign debt. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including reports of suspicious short-selling in Israeli stocks ahead of Hamas’s October 7 attacks on the country and new data on educational achievement for the future U.S. workforce.

China: Moody’s (MCO, $373.94) today maintained its middling investment-grade rating of “A1” on China’s long-term sovereign debt, but in a surprise decision, the firm cut its outlook on the debt from “stable” to “negative.” According to Moody’s, the cut in the outlook reflects a likelihood that Beijing will eventually need to bail out many of its highly indebted provincial and local governments. It also cited China’s slowing economic growth in its reasoning.

- For comparison, rating firms Standard & Poor’s and Fitch both currently rate Chinese debt as A+, with a stable outlook.

- While China’s central government debt only amounts to about 21% of gross domestic product, total provincial and local government debt (including off-budget obligations) is estimated to be several times higher than that. Provincial and local governments are also highly dependent on land sales and other off-budget funds, which now are drying up because of Beijing’s clampdown on excessive property development.

- In sum, China continues to face economic headwinds from what we call the Five Ds: Weak consumer demand, high corporate and local government debt, poor demographics, economic disincentives from the Communist Party’s increasing intrusion into the economy, and decoupling as foreign countries shift their trade, investment, and technology flows away from China.

Japan: As the country returns to consistent price inflation and the Bank of Japan prepares to let interest rates rise further, commercial banks are finding that decades of deflation and ultra-low interest rates have left their staffs unprepared for the new environment. Major banks are having to retrain their staff to help them understand how to operate in an environment that is normal for most other countries!

Israel-Hamas Conflict: A draft paper by law professors at NYU and Columbia flags suspicious short-selling in Israeli stocks right before the October 7 attacks by Hamas. The professors posit that a trader or traders were informed about the planned attacks and sold Israeli stocks short in anticipation that they would decline sharply. While that seems plausible enough, it also seems to contradict the narrative that the Hamas attacks were originally meant to be relatively small scale incursion but ended up being more much extensive and successful than anticipated.

- Meanwhile, reports today say the Israel Defense Forces’ retaliatory attack on Hamas in the Gaza Strip is close to encircling the last major group of Hamas fighters around the city of Khan Younis.

- Destroying that group could nearly end Hamas’s conventional military capability, but it wouldn’t necessarily lead to a quick end to all fighting in Gaza. Therefore, there is still a risk that the conflict could spread more broadly throughout the region.

Russia-Ukraine-NATO: In another sign of how militarized Russia is becoming, President Putin has signed an order boosting the country’s total military personnel to 2.20 million, including 1.32 million troops. That’s up from a total of 2.03 million, including 1.15 million troops, in the increase that was announced in August 2022. The troop levels cited appear to encompass only active-duty troops, not reservists, so the figures imply that Russia will soon have 1.98% of its military-aged population (those aged 16 to 49) under arms.

- For comparison, active-duty troops only constitute about 0.90% of the U.S. military-aged population.

- Separately, the Stockholm International Peace Research Institute has estimated that revenue from military goods and services at the 100 global defense contractors it tracks actually fell by 3.5% in 2022, despite Western countries’ rush to rebuild their defenses following Russia’s invasion of Ukraine. Sales at the 42 U.S. defense firms tracked by SIPRI fell 7.9%.

- According to SIPRI, the drop in revenues reflects problems ranging from labor shortages and soaring costs to supply chain disruptions.

- The think tank believes Western defense firms will only see significant production, sales, and revenue increases in two or three years.

- We continue to believe defense firms will see big, sustained increases in sales and profits over the coming decade or more as the U.S. and its allies work to rebuild their defenses, but we agree that those increases may not arrive for another couple of years.

European Union-United States: The CEO of Airbus (EADSY, $37.18) warned that the company’s multi-billion euro program for replacing its aging A320 family of jets could require “some support” from European governments. The CEO may be trying to capitalize on Western governments’ recent openness to using taxpayer funds to support domestic manufacturers. However, any new European support for Airbus would likely spark pushback from Boeing (BA, $234.87) and rekindle trade tensions with the U.S.

European Union-Mercosur: The Brazilian government has informed EU officials that the Mercosur trade group — Brazil, Argentina, Uruguay, and Paraguay — won’t be able to sign a proposed free trade deal with the EU this week as previously planned. According to the Brazilians, the Argentines don’t want to move forward until the inauguration of their newly elected President Javier Milei, who has criticized Mercosur. Coupled with resistance from France, the long-debated EU-Mercosur trade pact now looks like it could be postponed indefinitely.

United States-Cuba: Victor Manuel Rocha, a former senior U.S. diplomat who served in U.S. embassies across Latin America, was arrested by the FBI yesterday on charges of spying for Cuba over the course of decades. As bad as the case is, it likely pales in comparison to the enormous, highly aggressive espionage efforts that China continues to run against the U.S. and its allies.

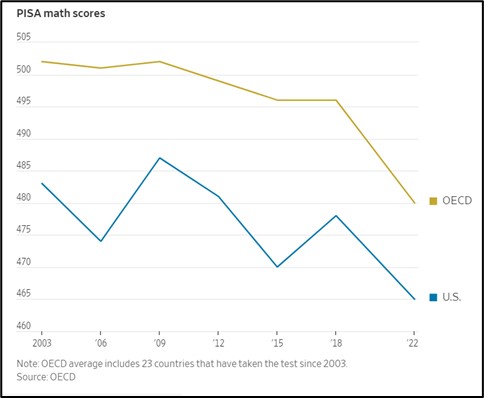

U.S. Education System: In a mixed message for the future labor force, the Organization for Economic Cooperation and Development said 15-year-olds in the U.S. lost less learning during the pandemic than most of the other OECD countries. Based on tests administered under the organization’s Program for International Student Assessment, U.S. students’ average reading and science scores were essentially unchanged between 2018 and 2022. As shown in the chart below, U.S. students’ average math score fell 13 points, versus an average decline of 15 points in the other countries tested. Unfortunately, U.S. math scores remained far weaker than in other countries.