Daily Comment (December 8, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Risk assets are down following stronger-than-expected jobs data. Meanwhile, the Los Angeles Lakers and Indiana Pacers have secured their spots in the NBA In-Season Tournament championship game. Today’s Comment kicks off with our insights on the latest craze in artificial intelligence followed by an analysis of why investors suspect the Bank of Japan may soon abandon negative interest rates and a discussion on Saudi Arabia, which continues to work with both the U.S. and Russia to achieve its aims. As always, our comprehensive report encompasses the latest domestic and international data releases.

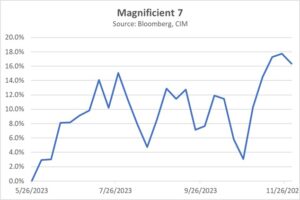

AI’s Last Hoorah: Fear of missing out has led investors to pile into tech companies after each new development, but there are doubts about how long this can last.

- Alphabet subsidiary Google (GOOGL, $138.10) unveiled its highly anticipated answer to OpenAI’s technology on Wednesday. The company’s new artificial intelligence, dubbed Gemini, boasts capabilities exceeding anything currently available. Gemini can process information from audio, video, and text, which should expand the customer’s use. Additionally, it is believed to possess advanced reasoning and understanding abilities and was able to outperform the latest OpenAI on a range of industry benchmarks. So far, Gemini has been released in limited markets as Google would like to test the technology before releasing it early next year.

- Google’s answer to OpenAI is a reflection of the ongoing turf war for dominance in the AI space, which has also expanded to the chip market. Advanced Micro Devices Inc. (AMD, $127.69) unveiled its new MI300 accelerator chip, a direct challenge to Nvidia’s (NVDA, $464.22) dominance in the semiconductor market. This powerful new graphics processor boasts greater memory bandwidth and capacity compared to Nvidia’s H100 chip, positioning it as a compelling and potentially cheaper alternative. Major tech players, including Meta (META, $327.06), OpenAI, and Microsoft (MSFT, $370.75), have already expressed interest in acquiring the newly developed chip, indicating its potential to disrupt the current market landscape.

- While the excitement surrounding AI technology continues, its path to widespread adoption faces significant challenges in 2024. Intense competition within the space threatens to squeeze profitability as companies engage in price wars, potentially hindering their ability to meet ambitious earnings targets and justify their high valuations. Furthermore, lingering regulatory uncertainty surrounding AI, fueled by concerns about privacy and societal risks expressed by policymakers, poses a further obstacle. As a result, investors should exercise caution and recognize that today’s industry leaders may not remain so in the future. Focusing on undervalued companies outside the AI sector may offer greater potential for long-term returns.

BOJ Regime Shift: The Japanese yen (JPY) has jumped following speculation that the Bank of Japan will move away from its ultra-accommodative monetary policy.

- BOJ Governor Kazuo Ueda hinted at potential policy adjustments in remarks to Japanese lawmakers on Thursday, stating that the central bank has “several options” available once short-term interest rates rise above zero. These comments followed Deputy Governor Ryozo Himino’s remarks the previous day, which suggested that a measured transition toward a more restrictive monetary policy could benefit the overall economy. The combined statements fueled speculation among traders that a significant policy announcement might be imminent at the BOJ’s upcoming meeting on December 18. This speculation contributed to a surge in the Japanese yen, reaching a peak of 4% appreciation against the dollar (141.71 yen per dollar) on Thursday, reflecting a decline in bearish sentiment toward the currency.

- The recent surge in price increases, driven by a departure from traditional corporate pricing and compensation strategies, suggests a significant shift in Japanese business culture. This has propelled inflation above the central bank’s 2% target for 19 consecutive months, boosting the BOJ’s confidence that deflation may be fading. However, a seamless transition to a hawkish monetary policy remains elusive. The latest GDP figures reveal a contraction of 2.9% in the third quarter of 2023 and a 2.5% decline in household spending since October 2022, suggesting the central bank’s tightening might not be as swift as investors anticipate.

- Higher yields on Japanese government bonds (JGBs) may entice foreign investors, reversing the country’s sizable net outflows and transforming them into inflows. This could lead to capital appreciation for foreign investors with exposure to Japan, driven by a strengthening JPY. Additionally, global bond yields may rise as Japanese buyers, incentivized to hold more domestic debt, exert less downward pressure on international yields. However, the change could also lead to an increase in servicing costs for traders who profited from the yen carry trade. It shouldn’t be a problem as long as those traders are able to make payments on their loans. However, if they are unable to do so, it could lead to another financial crisis.

Saudi Arabia Weighs Its Options: The ongoing conflict between Israel and Hamas highlights Riyadh’s cautious approach to picking sides between regional rivals.

- Washington continues its efforts to facilitate the normalization of relations between Saudi Arabia and Israel. U.S. officials remain cautiously optimistic that both parties are receptive to restarting negotiations, which were paused following the escalation of violence between Israel and Hamas. While Saudi Arabia has not explicitly called for renewed talks, its recent appeals to the U.S. to exercise restraint in response to Houthi rebel attacks on ships in the Red Sea suggest a broader regional commitment to peace. Currently, there are no plans for the countries to engage in discussions while conflicts persist in Gaza.

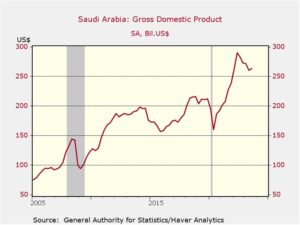

- On a separate note, Saudi Arabia’s Crown Prince Mohammed bin Salman hosted Russian President Vladimir Putin in Riyadh for talks centered on oil production cuts. This meeting served as a stark reminder that Moscow retains significant influence in the Middle East, despite Western efforts to isolate it following the invasion of Ukraine. Putin, facing a looming re-election campaign and a struggling Russian economy heavily reliant on energy revenue, prioritized the meeting, demonstrating his deep concern about the impact of low oil prices. Following their discussion, both leaders called on other OPEC members to strictly adhere to the production targets set at the previous meeting. Notably, Iran, with whom Putin met on Thursday, remains the biggest holdout.

- Despite being the world’s largest exporter of crude oil, Saudi Arabia is currently struggling to diversify its economy. Its attempts to branch out into different fields beyond energy have yielded weak results so far. On Thursday, the Kingdom announced a delay in its ambitious 2030 Vision due to concerns over growing budget deficits. The recent drop in oil prices, which has slowed down the global economy, has likely exacerbated these problems. To attract foreign investment, Saudi Arabia has announced a 30-year tax exemption for any company willing to relocate its headquarters to the country.

In Other News: The European Union is considering challenging U.S. steel tariffs with the World Trade Organization. The move highlights growing concerns that the Western alliance may be weakened following the next presidential election.