Daily Comment (December 14, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Risk assets surge as investors shake off recent jitters, while Giannis Antetokounmpo lit up the court with a 60-point performance. Today’s Comment navigates the key questions on the minds of many: Will central banks pivot soon? Are investors finally ready for risk? And how is the world’s shift away from globalization shaping government priorities? As always, our comprehensive report encompasses the latest domestic and international data releases.

Higher for How Long? While the market exuberantly celebrated the end of the hiking cycle and a potential pivot, we are increasingly worried that some investors may have gotten ahead of their skis.

- Despite maintaining its hold on the target federal funds rate at 5.25%-5.50%, the Federal Open Market Committee (FOMC) issued dovish whispers, suggesting a potential pivot by the end of 2024, with the range possibly falling to 4.50%-4.75%. Fed Chair Jerome Powell’s acknowledgment of committee discussions on the timing of rate cuts intensified chatter about a shift, further fueling market speculation. Ten-year yields plunged nearly 20 basis points, while the S&P 500 soared 1.4% on the day as investors strategically repositioned their portfolios for a potential shift toward lower rates.

- The European Central Bank hinted that its aggressive rate hikes might be nearing an end, but President Christine Lagarde underscored the bank’s unwavering commitment to bringing inflation back to target. Despite keeping rates steady, she warned of future tightening if fiscal measures remain uncontrolled, highlighting concerns about domestic price pressures. Lagarde’s veiled threat underscores the precarious balance the ECB faces—while its hawkish stance aims to tame inflation, it risks exacerbating the Eurozone’s fiscal tensions, particularly as member states grapple with returning to pre-pandemic deficit rules.

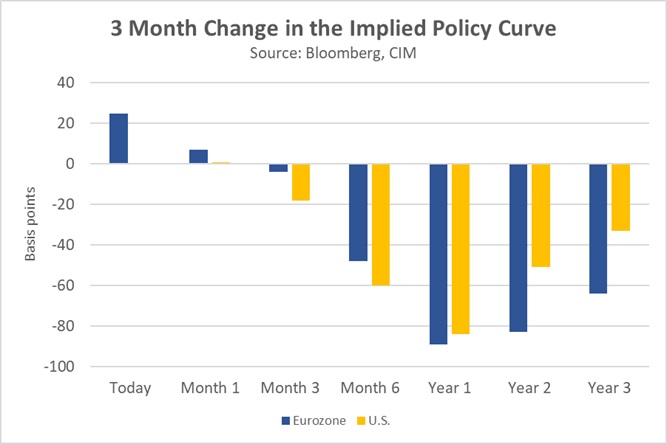

- Although policy easing may be inching closer, the pace and magnitude are unlikely to meet the aggressive expectations of many investors. The CME Fedwatch Tool predicts a potential cut of 150 bps or more in March 2024, while swap rates hint at even deeper cuts from the ECB. However, such optimism may be misplaced, ignoring lingering inflation concerns and underestimating policymakers’ commitment to price stability. A significant economic downturn in the U.S., necessitated by persistent regional inflation, would be the only scenario justifying such aggressive easing. Should our assessment hold, the current market euphoria could be short-lived as policymakers may decide to rein in expectations with hawkish rhetoric.

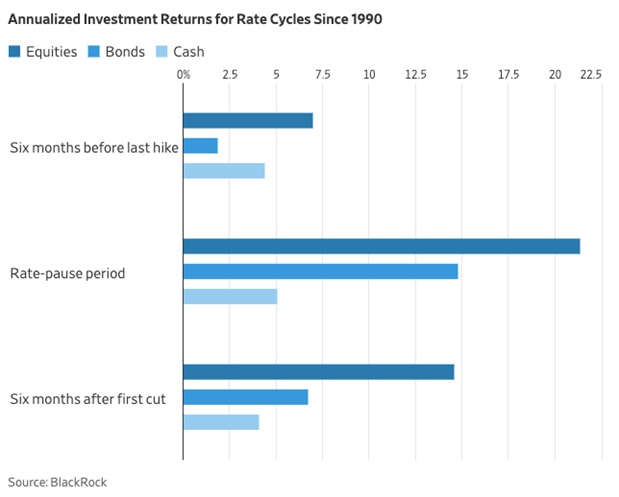

Where Will It Go? While money market funds were all the rage during the historic rate hikes of the last two years, a potential reversal could see investors fleeing for greener pastures.

- Higher rates gave life to money market funds and savings accounts, offering investors a viable alternative to riskier assets with their suddenly competitive returns. The Crane 100 Index shows that the seven-day annualized yield currently sits at 5.19%, which surpasses the returns for a third of the S&P 500 sectors. Additionally, the funds have been a magnet for capital as they drew in more than $651 billion worth of assets in the second quarter compared to the year prior. Assuming that rates fall next year, this trend is likely to see a shift in favor of riskier assets.

- Large cap tech stocks took investors on a wild ride in 2023, driven by FOMO surrounding AI and communication giants. But with their sky-high valuations, the “Magnificent 7” may have already priced in much of their future growth potential. This presents a golden opportunity for investors seeking diversification and hidden gems. Small and mid-cap stocks, boasting lower P/E ratios, have already attracted early birds. Since money market funds reached their peak in November, the S&P 400 and 600 indexes have skyrocketed 13.6% and 16.1%, respectively, compared to the S&P 500’s 11.1% gain.

- Although the shift away from large caps might be tempting, it hinges on the U.S. maintaining its resilience, especially with inflation potentially lurking. However, worrying signs are emerging. Atlanta GDP Nowcast points to a significant slowdown in economic output compared to the previous quarter. Simultaneously, ADP data suggests small businesses, the engine of job creation, have cut back on hiring for three months straight. Adding to concerns is the looming “debt maturity wall” next year, where a massive chunk of loans come due under much tighter financial conditions than when they were issued. As a result, investors should still exercise caution and due diligence before preemptively looking to price in rate cuts.

A Smaller Peace Dividend? As the tide of globalization recedes, governments are increasingly turning their attention inward, prioritizing domestic security concerns over international cooperation.

- Western support for Ukraine faces mounting hurdles as domestic concerns and internal fissures within the bloc complicate additional aid. In the U.S., Senate wrangling centers on attaching border security measures to Ukraine funding, while within the EU, Hungary’s Viktor Orban threatens to block further assistance due to concerns about alleged discrimination against Hungarians in Kyiv and his own desire for unfrozen EU funds. The persistent bickering among the countries adds pressure on Ukraine to either win decisively or be forced to compromise with Russia.

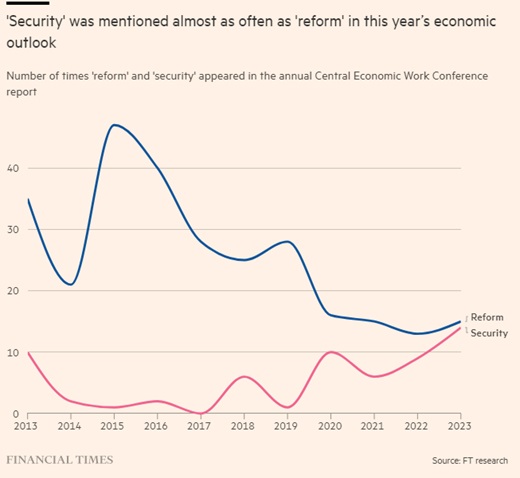

- Tensions with the West have prompted both Russia and China to flex their muscles. A recent breakdown of China’s outlook for the country showed that Chinese leaders have placed more emphasis on “security” and less on “reforms” over the last three years. Meanwhile, Putin’s renewed calls for “denazifying and demilitarizing” Ukraine underscore his desire to neutralize a Western ally on his doorstep. These developments suggest that neither Moscow nor Beijing is inclined to simply accept the pre-existing order dictated by the West. Consequently, their cooperation, driven by a shared desire to level the playing field with the U.S., is likely to endure for the foreseeable future.

- The potential unraveling of globalization is unlikely to be smooth or swift as countries aim to mitigate sudden shocks that could erode investor and consumer confidence. China’s recent re-engagement with the U.S., despite ongoing tensions, exemplifies this cautious approach to managing risk. Further reinforcing this view was Thursday’s report that the top defense leaders from both countries met for the first time following an ongoing row over spying.

In Other News: The Senate passed a defense policy bill without much pushback. Passage of the bill highlights the ways in which the government is on the same page regarding maintaining defense spending.